China has one of the world’s largest automotive and electronic manufacturing capacities, also known as “the world’s factory.” These manufacturing facilities in China are major demand generators for collaborative robots (cobots). According to the International Trade Centre, China is the world’s largest exporter and importer of manufactured goods.

The available labor has resulted in the growth of several labor-intensive industries, such as clothing, textiles, footwear, furniture, plastic products, bags, and toys. However, the aging population has created a labor shortage, leading to a wage rise. This is compelling companies to adopt automation and collaborative robots to reduce costs.

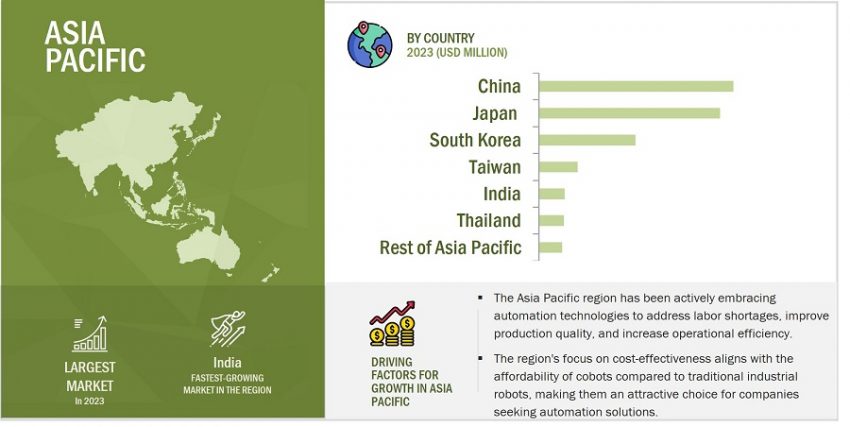

With increasing labor costs, China is expected to increase investments in automation further to maintain its cost advantage in production. As a result, China’s collaborative robot (cobot) market will likely remain dominant during the forecast period. China is moving from labor-intensive simple industries toward manufacturing high-tech goods, such as semiconductors, through its Made in China 2025 policy.

Ask for PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=194541294

Market Size

The global Collaborative Robot market share was valued at USD 1.9 billion in 2024 and is estimated to reach USD 11.8 billion by 2030, registering a CAGR of 35.2% during the forecast period.

According to the International Organization of Motor Vehicle Manufacturers (OICA), China is the largest manufacturer of commercial vehicles. Therefore, the demand for collaborative robots in the electronics and automotive industries is expected to be high in China. According to the Information Technology & Innovation Foundation, China provides higher subsidies for robot adoption than any other nation and is expected to lead the world with the highest number of collaborative robots (cobots) as a share of its industrial workers in the future.

China Collaborative Robot Market in Manufacturing Industry

In China, collaborative robots are expected to help the manufacturing industry stay competitive during economic uncertainties. China is pioneering both the adoption and development of cobots to minimize this risk. Major firms in the electronics industry, such as ZTE (China) and Foxconn (China), are purchasing collaborative robots. China’s significant foreign direct investment (FDI) provides the required infrastructure environment for field testing cobots. SMEs account for most of the business entities in China; their requirement for greater operational flexibility presents a growing opportunity for the deployment of cobots. Major cobot manufacturers in China include AUBO (Beijing) Robotics Technology Co., Ltd (China), Elephant Robotics (China), Han’s Robot (China), and Siasun Robot & Automation Co. Ltd. (South Korea). These companies are expected to dominate the collaborative robot market in the coming years.