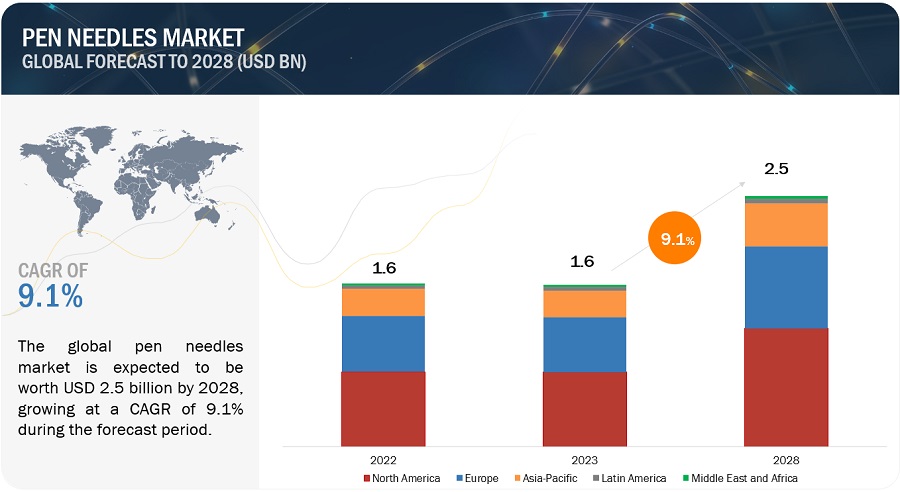

The global pen needles market in terms of revenue was estimated to be worth $1.6 billion in 2023 and is poised to reach $2.5 billion by 2028, growing at a CAGR of 9.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Pen Needles Market Dynamics:

Drivers

- Rising incidence of chronic diseases

- Favorable reimbursements in mature markets

- Growing adoption of self-administration

- Decreasing prices of insulin formulations

Restraints

- Alternative methods of drug delivery

- Poor reimbursements in emerging markets

- Needle anxiety

Opportunities

- Growing preference for biosimilar drugs

- High-growth potential of emerging economies

- Rising healthcare expenditure on diabetes

- Regulatory mandates for safety pen needles

Challenges

- Reuse of pen needles

- Misuse of injection pens

Key Market Players:

- B. Braun Melsungen AG (Germany)

- Embecta Corp. (US)

- Novo Nordik A/S (Germany)

Recent Developments:

- In February 2023, Montmed, Inc. (Canada) announced issuance of a second US Patent for Sitesmart Pen Needles.

- In April 2022, Embecta Corp. (US) completed the spin-off from Becton, Dickinson and Company (US) and started operating globally as a standalone pure-play diabetes care company.

- In February 2021, UltiMed, Inc. (US) launched UltiCare safety pen needles in two sizes, 5mm 30G and 8mm 30 G.

- In January 2021, NHS (UK) chose Owen Mumford (UK) as the sole supplier of safety pen needles. With this partnership, Owen’s pen needles will be used in all NHS Wales hospitals.