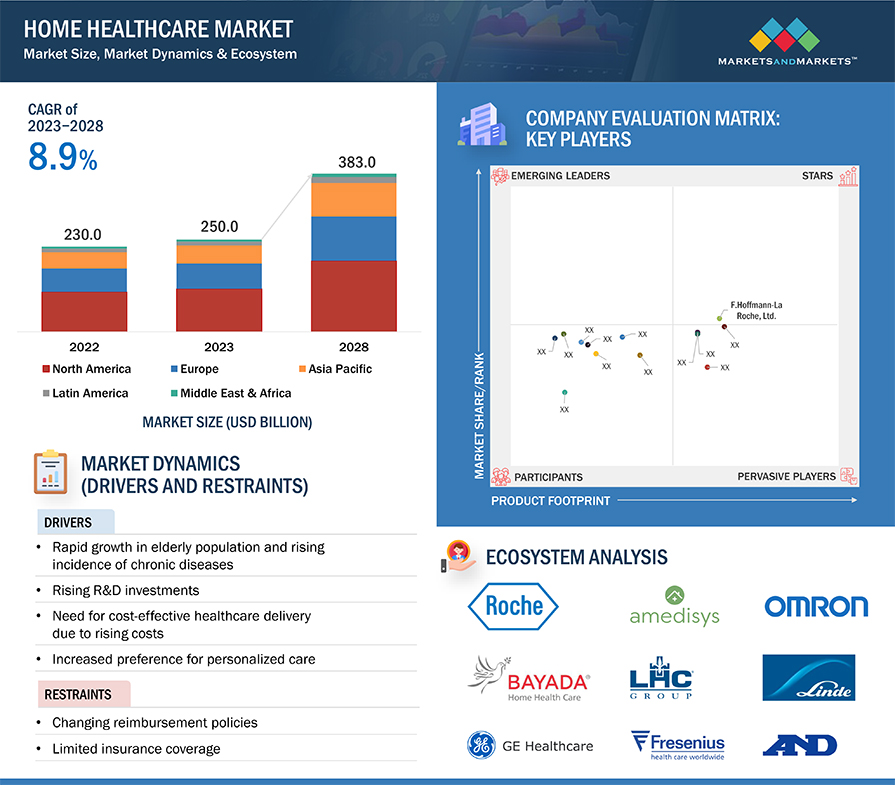

The global home healthcare market was valued at approximately $250.0 billion in 2023 and is projected to grow to $383.0 billion by 2028, representing a compound annual growth rate (CAGR) of 8.9% from 2023 to 2028. This comprehensive analysis includes a detailed exploration of industry trends, pricing strategies, patent reviews, insights from industry events, key stakeholder identification, and a deep dive into market purchasing dynamics.

The market’s growth is driven by factors such as the increasing prevalence of chronic diseases, an aging global population, and the rise of Asian nations as major manufacturers of home healthcare products. These factors present significant opportunities for industry participants.

Home Healthcare Market Dynamics and Ecosystem

Key Drivers

One of the primary drivers of the home healthcare market is the sharp increase in the aging population and the prevalence of chronic illnesses. According to the UN Department of Economic and Social Affairs, the global population aged 65 and over is expected to rise from 771 million in 2022 to 1.6 billion by 2050. Additionally, the population aged 80 and above is projected to triple by 2050 from the current 143 million in 2019. This demographic shift will significantly increase healthcare demand, placing a burden on governments and healthcare systems. Home healthcare, by reducing unnecessary hospital stays, readmissions, and travel time, is positioned to benefit from these trends.

Opportunities

The growing focus on newer technologies, such as telehealth, offers significant opportunities in the home healthcare market. Telehealth enables healthcare providers to monitor patients remotely, ensuring continuous care even when providers are not physically present. This technology facilitates virtual consultations where healthcare professionals can assess a patient’s condition, prescribe treatments, or recommend further medical attention using audio-visual tools. As telehealth adoption increases, patients are experiencing improved care outcomes.

Restraints

Limited insurance coverage poses a challenge to the growth of the home healthcare market. In North America, while many home healthcare services are covered by insurance, this coverage is often restricted to Medicare-certified organizations. Insurance coverage for multi-parameter monitoring, telemetry, rehabilitation, and remote monitoring equipment varies across regions. In Asia, countries like India only provide insurance for post-hospitalization care, leaving elderly and chronically ill patients to bear the costs of in-home healthcare services.

Challenges

The shortage of homecare workers is a significant challenge in the expanding home healthcare industry. The US Bureau of Labor Statistics has projected that between 2021 and 2031, there will be a need for 924,000 personal care and home health aides. The industry must address this workforce gap to meet the growing demand for home healthcare services.

Home Healthcare Market Segmentation & Geographic Spread

Product Segmentation

The home healthcare market is categorized into therapeutic products, testing, screening, and monitoring products, and mobility care products. In 2022, therapeutic products held the largest market share, driven by the increasing prevalence of chronic diseases such as renal conditions, sleep disorders, and respiratory issues.

Service Segmentation

Services within the home healthcare market include skilled nursing, rehabilitation therapy, hospice & palliative care, unskilled care, respiratory therapy, infusion therapy, and pregnancy care. The skilled nursing services segment dominated the market in 2022, fueled by the growing demand for in-home care.

Indication Segmentation

The market is further segmented by indications, including cancer, respiratory diseases, mobility disorders, cardiovascular diseases & hypertension, pregnancy, wound care, diabetes, hearing disorders, and other indications. In 2022, the “other indications” segment, which includes kidney and sleep disorders, held the largest market share.

Geographic Segmentation

Regionally, the home healthcare market is divided into North America, Europe, Asia Pacific, and the Rest of the World. North America was the largest market in 2022, due to its advanced healthcare system and high prevalence of chronic diseases. However, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period, driven by rising healthcare costs and a high prevalence of chronic conditions.

Home Healthcare – Key Market Players

Leading players in the home healthcare market include Fresenius SE & Co. KGaA (Germany), Abbott (US), GE HealthCare (US), Koninklijke Philips NV (Netherlands), and ResMed, Inc. (US). These companies hold significant market share due to their extensive product portfolios, strong global presence, and substantial investments in research and development.

Recent Developments in the Home Healthcare Industry:

- August 2022: Fresenius Medical Care North America (FMCNA) acquired InterWell Health Brand (US) to enhance its expertise in kidney care value-based contracting and performance.

- August 2022: Contessa (US) partnered with Mount Sinai Health System (US) to offer a full continuum of home-based care, including home health, hospitalization at home, rehabilitation at home, and palliative care.

- July 2022: Invacare Corporation (US) launched the Next Generation e-fix eco Power Assist Device, transforming manual wheelchairs with enhanced mobility features.

Conclusion

The home healthcare market is poised for significant growth, driven by demographic shifts, technological advancements, and evolving healthcare needs. While challenges such as workforce shortages and limited insurance coverage exist, the market’s potential remains strong, especially with the increasing adoption of telehealth and other innovative solutions.