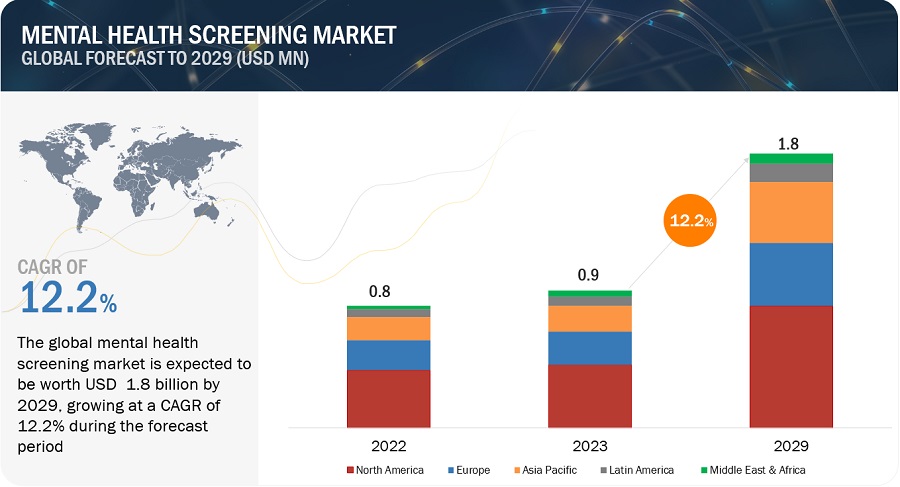

The global mental health screening market was valued at $0.9 billion in 2023 and is projected to reach $1.8 billion by 2029, growing at a compound annual growth rate (CAGR) of 12.2% from 2023 to 2029. This comprehensive analysis delves into industry trends, detailed pricing evaluations, patent reviews, and insights from conferences and webinars. It also identifies key stakeholders and examines market purchasing behaviors.

Market Growth Drivers The expansion of the mental health screening industry is primarily fueled by rising awareness of mental health issues, increased focus on remote monitoring, and technological advancements. Societal shifts toward recognizing the importance of mental health have contributed to the growing adoption of screening tools and solutions.

Key Trends in the Mental Health Screening Market

1. Awareness and Adoption

Growing awareness about mental health issues has significantly driven the adoption of mental health screening tools. Over the past decade, societal attitudes have evolved, with more recognition of mental health’s prevalence and impact. For instance, the World Health Organization (WHO) reported that in 2019, around 970 million people worldwide were living with a mental disorder. Campaigns like “Bell Let’s Talk” in Canada and “Mental Health Awareness Month” in the US have further promoted dialogue and encouraged individuals to seek support.

2. Challenges and Barriers

Despite progress, stigma and limited awareness continue to pose significant barriers to the widespread adoption of mental health screening tools. A 2023 survey by the National Alliance on Mental Illness (NAMI) revealed that 44% of Americans with mental illness experienced discrimination due to their condition. This stigma often deters individuals from seeking help, delaying intervention and exacerbating symptoms.

3. Opportunities through Social Media

Social media’s rise presents a unique opportunity to enhance the adoption of mental health screening tools. Platforms like Facebook, Twitter, and Instagram have become vital in spreading awareness, destigmatizing mental health, and fostering open conversations. According to a 2023 survey by The Trevor Project, 76% of LGBTQ+ youth used social media to access mental health information and support.

4. Accuracy and Validity Concerns

One of the major challenges in the mental health screening industry is ensuring the accuracy and validity of screening tools. A study published in the Journal of the American Medical Association (JAMA) highlighted the variability in accuracy among popular mental health screening apps, with some showing poor sensitivity and specificity.

Mental Health Screening Industry Ecosystem The ecosystem of the mental health screening market includes various stakeholders responsible for the end-to-end process of screening mental health issues:

- Developers & Providers: Companies that design and distribute screening tools such as apps and digital platforms.

- Telehealth & Virtual Care Platforms: These platforms provide remote access to mental health screening and counseling services.

- Health Providers & Institutions: Organizations that integrate screening tools into their care models.

- Health Insurance & Payer Organizations: Companies that cover mental health screening services and offer incentives for using specific tools.

- Research & Academic Institutions: Institutions that contribute to developing and validating screening tools through research.

- Regulatory & Compliance Bodies: Organizations that establish guidelines and standards for the development and use of screening tools.

Market Segmentation

1. By Application:

The market is segmented into software, services, wearables, mobile devices, and various disorders such as psychiatric, behavioral, and cognitive disorders.

2. By Screening Method:

The global market is categorized into self-reported questionnaires, clinical interviews, observation-based assessments, and biomarker testing.

3. By Technology:

Key technologies include self-screening mHealth apps, telehealth solutions, continuous monitoring wearables, AI-based tools, and remote mental health platforms.

4. By Age Group:

The market is divided into children & adolescents, adults, and seniors.

5. By Setting:

Mental health screening is conducted in clinical settings, educational institutions, workplaces, online platforms, and other environments.

6. By Region:

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa represent the regional segmentation of the market.

Recent Developments

- In November 2023, SonderMind (US) acquired Total Brain (US) to expand its offerings in mental wellness and support for therapists.

- In October 2023, Ellipsis Health, Inc. (US) partnered with Augmedix (US) to introduce automated mental health screenings during patient visits.

- In December 2021, Quartet Health, Inc. (US) acquired InnovaTel Telepsychiatry (US), enhancing its capacity to deliver high-quality mental healthcare.

Prominent Players Key companies in the mental health screening market include Proem Behavioral Health, SonderMind Inc., Riverside Community Care, Headspace Health, Quartet Health, Inc., Canary Speech, Inc., Sonde Health, Inc., Koninklijke Philips N.V., Alphabet Inc. (Fitbit), and ResMed.

The mental health screening market is poised for significant growth, driven by technological advancements, increased awareness, and the rising demand for mental health resources. However, challenges such as stigma and concerns about accuracy must be addressed to fully realize the potential of this vital industry.

Content Source:

https://www.marketsandmarkets.com/PressReleases/mental-health-screening.asp

https://www.marketsandmarkets.com/ResearchInsight/mental-health-screening-market.asp