Optometry Equipment Market Overview

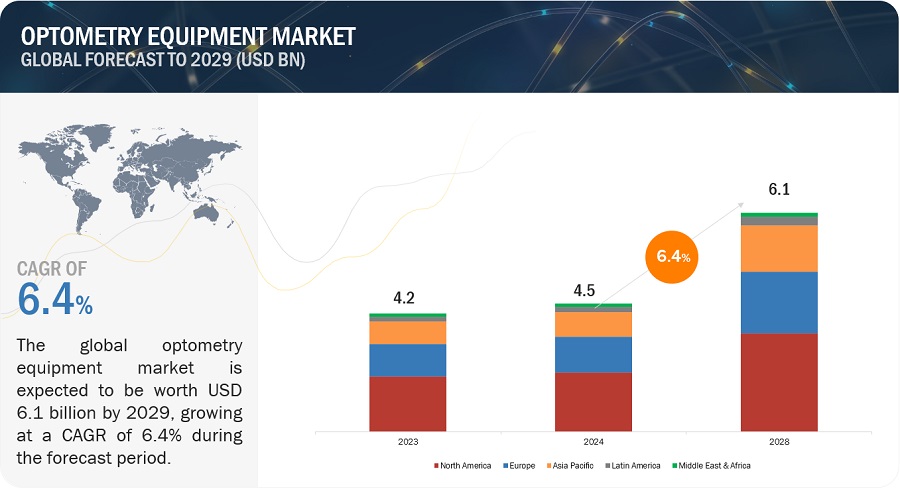

The global optometry equipment market is projected to grow from $4.5 billion in 2024 to $6.1 billion by 2029, reflecting a compound annual growth rate (CAGR) of 6.4%. This market expansion is driven by an aging population, increasing prevalence of eye disorders, and ongoing technological advancements in optometry equipment. The latest research study offers a comprehensive analysis of industry trends, pricing, patents, conferences, key stakeholders, and consumer behavior within the market.

Key Growth Drivers and Challenges in the Optometry Equipment Market

Drivers: Rising Incidence of Eye Disorders

The global rise in eye disorders and vision loss has become a significant public health concern, particularly due to the aging population, governmental initiatives, technological advancements, and escalating healthcare costs. Eye disorders such as cataracts, glaucoma, and age-related macular degeneration are increasingly common, especially in individuals over sixty. This surge necessitates accurate diagnostic testing, which in turn is driving demand for advanced optometry equipment.

Restraints: High Costs and Preference for Refurbished Equipment

One of the primary challenges in the market is the high cost of optometry equipment, which has led to a growing preference for refurbished devices. The substantial investment required for new equipment, including costs related to manpower, training, and maintenance, presents a significant barrier for many ophthalmic practices, especially smaller clinics. This cost factor limits the market’s growth potential.

Opportunities: Emerging Markets

Emerging markets such as South Africa, Brazil, Turkey, Russia, India, and South Korea present significant growth opportunities for market players. Factors such as a high prevalence of eye diseases, a large patient base, improving healthcare infrastructure, rising disposable income, and the growth of medical tourism are driving demand in these regions. Additionally, the Asia Pacific region has become a favorable business environment due to more flexible regulations and data requirements.

Challenges: Low Awareness and Limited Access in Low-Income Countries

In many developing countries, including India, Saudi Arabia, Israel, Kenya, and South Africa, rural populations have limited awareness and understanding of eye diseases. Moreover, access to advanced optometry equipment remains scarce in these regions, due to factors like poor infrastructure, limited access to eye care specialists, and economic disparities between high- and low-income countries.

Market Segmentation

By Product Type:

- Retina and Glaucoma Examination Products: This segment holds the largest market share, driven by technological advancements, increased availability of modern ocular diagnostic tools, and a rising incidence of glaucoma and retinal diseases.

- General Examination Products

- Cornea and Cataract Examination Products

By Application:

- General Examination: This segment leads the market, fueled by increasing cases of diabetes, hypertension, and other infections, as well as a growing awareness of the importance of regular eye examinations, particularly among the aging population.

- Cataract

- Glaucoma

- Age-related Macular Degeneration (AMD)

- Other Applications

By End User:

- Eye Clinics: Eye clinics dominate the market, supported by the high patient volume, the growing number of private clinics in developing nations, and the availability of advanced optometry equipment.

- Hospitals

- Other End Users

By Region:

- North America: In 2023, North America accounted for the largest share of the global optometry equipment market, driven by an aging population, the prevalence of ocular diseases, and access to advanced optometry technologies.

- Europe

- Asia Pacific

- Rest of the World (Latin America, Middle East & Africa, GCC Countries)

Competitive Landscape

The optometry equipment market is moderately consolidated, with key players such as Carl Zeiss Meditec AG (Germany), EssilorLuxottica (France), Alcon (Switzerland), Topcon Corporation (Japan), and Bausch Health Companies Inc. (Canada) leading the industry. These companies maintain their market leadership through extensive product portfolios, global reach, robust research and development capabilities, and strong brand recognition.

Recent Industry Developments

- August 2023: Carl Zeiss launched ZEISS trifocal technology on a glistening-free hydrophobic C-loop platform with a fully preloaded injector.

- March 2022: Topcon Corporation introduced SOLOS, an advanced automatic lens analyzer.

- September 2023: Bausch + Lomb acquired XIIDRA to expand its presence in the prescription dry eyes segment.

- January 2023: Bausch + Lomb acquired AcuFocus, enhancing its cataract surgical portfolio.

Conclusion

The global optometry equipment market is on a steady growth trajectory, driven by technological advancements, increasing eye disorder prevalence, and emerging market opportunities. However, high costs and limited access in developing regions remain significant challenges. The industry’s future will likely be shaped by continued innovation, strategic market expansions, and an increased focus on accessibility and affordability in underserved regions.

Content Source:

https://www.marketsandmarkets.com/PressReleases/optometry-eye-exam-equipment.asp

https://www.marketsandmarkets.com/ResearchInsight/optometry-eye-exam-equipment-market.asp