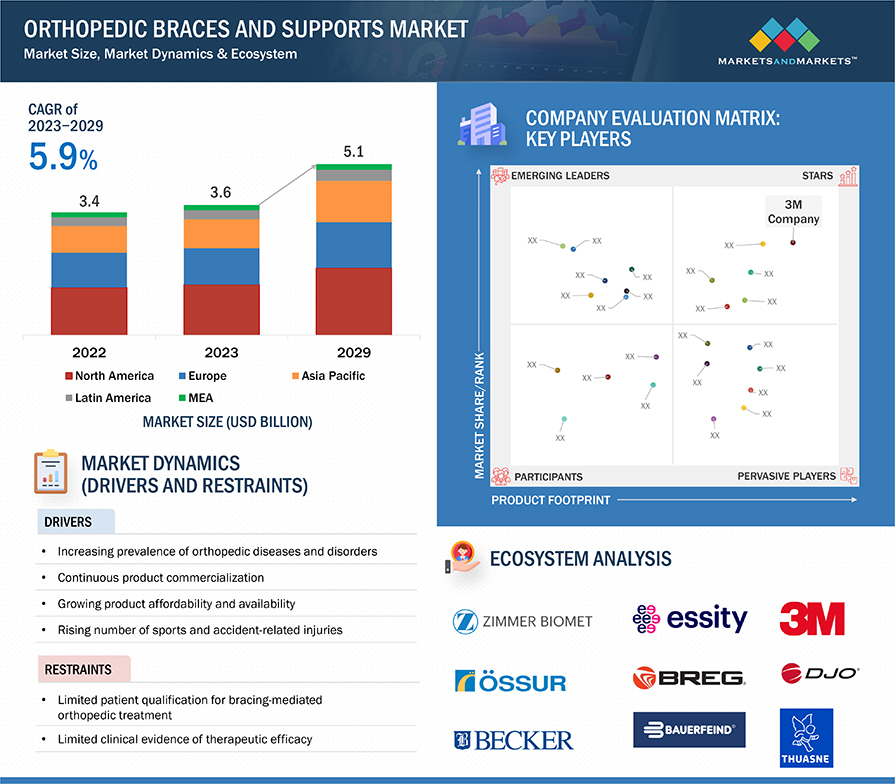

The global orthopedic braces and supports market is projected to reach USD 5.1 billion by 2029, up from USD 3.6 billion in 2023, at a CAGR of 7.2%. We have observed that bracing products are increasingly used in musculoskeletal and soft tissue applications driven by the market availability of lightweight and customizable products and the rising number of sports and other injuries and related orthopedic surgical procedures. These trends are further augmented by the customer shift toward off-the-shelf/OTC products, integration of smart textiles with bracing products (such as glucose or heart rate monitors), and continued reimbursement coverage in prominent markets. Some of the noteworthy start-ups reported in the market include Roam Robotics, Sensoria Health, ActiveOrtho, Orpyx, Myomo, Exos, and Ossur.

Orthopedic braces and supports Market Dynamics

Driver: Increasing prevalence of orthopedic diseases and disorders

Orthopedic braces and supports play a crucial role in providing stability, protection, and assistance to individuals with various musculoskeletal conditions and injuries. These devices are utilized across a spectrum of situations, including post-operative recovery, rehabilitation, injury prevention, and management of chronic conditions such as osteoarthritis. Orthopedic braces can help immobilize injured joints to facilitate healing, provide support to weakened or unstable areas, alleviate pain, and promote proper alignment and function during activities of daily living or sports participation.

Restraint: Limited patient qualification for bracing-mediated orthopedic treatment

Limited patient qualification for bracing-mediated orthopedic treatment arises from various factors including the specificity of conditions amenable to bracing, individual anatomical considerations, and the necessity for proper diagnosis and prescription by qualified healthcare professionals. While orthopedic braces can offer significant benefits in certain cases, such as providing support, stability, and pain relief, they may not be suitable for every patient or orthopedic condition. Patient qualification typically involves careful assessment of factors such as the severity of the injury or condition, the potential for rehabilitation and functional improvement, and the patient’s ability to comply with brace wear and rehabilitation protocols.

Opportunity: Increased sales of off-the-shelf and online products

Convenience plays a significant role, as consumers seek accessible solutions for managing orthopedic conditions without the need for custom fittings or lengthy consultation processes. Online platforms offer a wide selection of products, enabling individuals to browse and purchase braces conveniently from the comfort of their homes, while also providing access to a broader range of brands and options than traditional brick-and-mortar stores. Moreover, the growing awareness of the importance of proactive orthopedic care and injury prevention, coupled with an aging population seeking solutions for musculoskeletal issues, contributes to the rising demand for over-the-counter orthopedic products. Additionally, advancements in materials and design have improved the effectiveness and comfort of off-the-shelf braces, further driving their popularity among consumers seeking affordable and readily available solutions for orthopedic support and rehabilitation needs.

Challenge: Significant adoption of pain medication

The significant adoption of pain medication presents a challenge for the growth of the orthopedic braces market due to its potential to mask symptoms rather than address underlying musculoskeletal issues. While pain medication offers temporary relief, it may not provide long-term solutions for managing orthopedic conditions or injuries. Consequently, individuals may opt for pain medication as a quick fix instead of exploring alternative treatments like orthopedic braces, which offer mechanical support, stability, and aid in rehabilitation. Furthermore, reliance on pain medication alone may delay or deter individuals from seeking appropriate orthopedic interventions, leading to potential exacerbation of their conditions over time. Educating both healthcare providers and consumers about the benefits of orthopedic braces as complementary or primary treatment options alongside pain medication is crucial for overcoming this challenge and promoting holistic orthopedic care.

North America is expected to be the largest market of orthopedic braces & supports industry during the forecast period.

North America, comprising the US and Canada, accounted for the largest share of the orthopedic braces & supports market in 2022. The faster growth of the orthopedic braces and supports imaging market in North America can be attributed to its technological leadership, robust healthcare infrastructure, high market demand driven by prevalent diseases and an aging population, ample financial resources for advanced medical equipment investment, established regulatory frameworks ensuring safety and quality, active research collaboration, insurance coverage for advanced diagnostics, patient expectations for comprehensive care, and a competitive market environment fostering innovation.

Prominent players in the Orthopedic Braces & Supports market include:

- 3M (US)

- Essity (Sweden)

- DJO LLC (US)

- Ossur HF (Iceland)

- Breg, Inc. (US)

- Recent Developments of Orthopedic Braces & Supports Industry:

In January 2022, Össur announced the launch of the ReLeaf Active knee brace, designed to provide pain relief and support for patients with osteoarthritis. The brace features a unique hinge design that mimics the natural movement of the knee, and it is made from lightweight, breathable materials for comfort. - In August 2022, DonJoy announced the launch of the Vizor 120 ankle brace, a lightweight and comfortable brace that provides support and stability for patients with ankle sprains. The brace features a unique air-filled pad that conforms to the shape of the ankle, and it is made from breathable materials to keep the foot cool and dry.