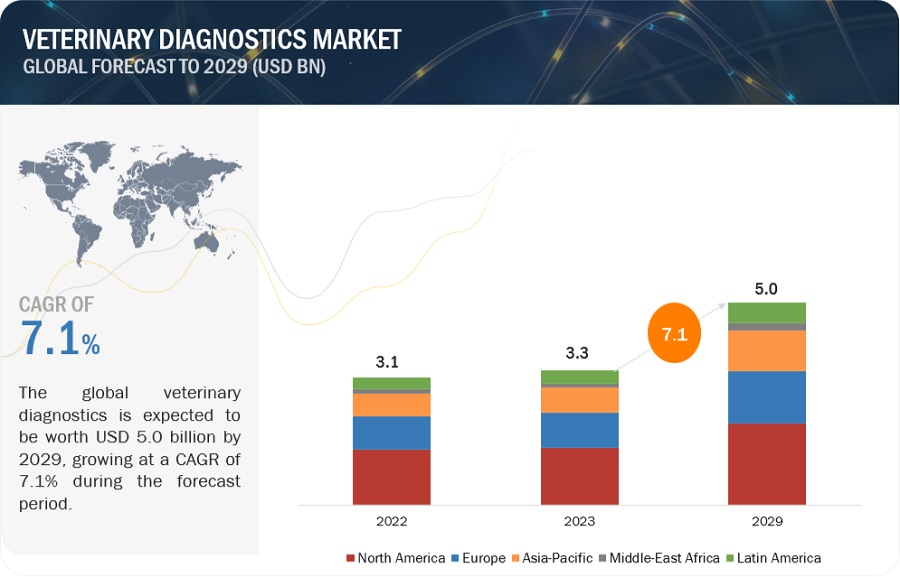

The Veterinary Diagnostic Market size was estimated at $3.3 billion in 2023 and is forecast to grow to $5.0 billion by 2029, at a 7.1% CAGR. This research highlights industry trends, patent reviews, and findings from conferences and webinars. The global surge in the pet population, rising demand for animal-based products, increasing adoption of pet insurance, and greater awareness of animal health in emerging markets are key growth drivers.

Download an Illustrative overview

Browse in-depth TOC on “Veterinary Diagnostic Market”

553 – Tables

65 – Figures

528 – Pages

The companion animal segment holds the largest market share during the forecast period.

The veterinary diagnostics market is divided into companion animals and livestock in the animal type segment. The companion segment was dominated in this market. Increase in the number of households that own a pet like dogs or cats. According to the American Pet Products Association, the number of households owned 86.9 million pets in 2022 and those in Europe owned 90 million in 2022. With the growing population of companion animals, and the increasing ability to spend more on pet health the adoption of advanced diagnostic tests and treatment is expected to increase, in turn, driving the market growth. Some of the major players offering diagnostic modalities for companion animals are IDEXX Laboratories (US), Heska Corporation (US), Zoetis, Inc. (US), Thermo Fisher Scientific (US), NEOGEN Corporation (US), Virbac (France), and INDICAL BIOSCIENCE GmbH (Germany).

The online sales segment is expected to grow at the highest rate during the forecast period.

The distribution channel segment is divided into direct sales, wholesalers and distributors, and online sales. The online sales segment is growing at the highest rate due to the convenience of browsing the product, vast selection of products with comparative pricing options available, competitive pricing with other distributors and players that attract customers for adopting this platform, reading reviews, offers by sellers, and delivery can be tracked only on this platform. Thus, it improved the reliability of the seller and improved brand trust. This is a high growth market and may curb the middleman, i.e., wholesalers or distributors in the supply chain. Companies like Idexx and Zoetis have adopted this model of sales to also enhance their customer base.

In the end-user segment, the point of care or in house testing segment is growing at the fastest rate in the veterinary diagnostics market.

According to end users, point of care/ in house testing is growing at the fastest rate, followed by reference laboratories. Other end users include hospitals/ clinics and veterinary research institutes and universities. POC tests are designed for use in livestock farms outside the physical facilities of clinical laboratories. Since the demand for improved patient care and greater cost control are driving changes in the structure of animal healthcare delivery, the need for POC diagnostic testing is also growing. Technological advancements in veterinary diagnostics are making it possible for a higher number of diagnostic tests to move from clinical laboratories to the near-patient environment.

Currently, new products are being developed in the market that enables pet owners to perform basic tests at home, thereby reducing the cost of tests and enabling greater convenience. Some POC diagnostic testing products for companion animals include diagnostic kits for various diseases and infections, pregnancy test kits, glucose monitors, and portable analyzers.

North America will continue to dominate the adhesion barriers market in 2028.

On the basis of region, the microfluidics market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America has various advantages—a surge in the population of companion pets, willingness to spend high costs on pet care, rise in adoption of dogs and cats, and rise in milk production leading to adoption and care of more livestock. The APPA Biennial Survey of Pet Owners found that 66% of US households, or 86.9 million homes, owned at least one pet in 2022. The rising expenditure on companion animal healthcare is are factor expected to drive the market growth in North America. Presence of all major players like Idexx Laboratories, Zoetis, Inc., and Thermofisher Scientific Inc. are also housed in this region which fuels its market share in the market.

Veterinary Diagnostic Market Dynamics:

Drivers:

- Increasing incidence of transboundary and zoonotic diseases

- Growth in companion animal population

- Rising demand for animal-derived food products

- Rising demand for pet insurance and growing animal health expenditure

- Growing number of veterinary practitioners and rising income levels in developed economies

- Increasing disease control and disease prevention measures

Restraints:

- Rising pet care costs

- High costs of veterinary diagnostic tests

Opportunities:

- Untapped markets of emerging nations

- Increased use of PCR testing panels to rule out COVID-19 virus in animals

Challenge:

- Developing markets are experiencing a reduction in the number of practicing veterinarians

- Lack of animal healthcare awareness in emerging countries

Key Market Players of Veterinary Diagnostic Industry:

The veterinary diagnostics market is a consolidated market with the presence of few dominant multinational market players. Some of the prominent players include IDEXX Laboratories, Inc. (US), Zoetis, Inc. (US), Thermo Fisher Scientific Inc. (US), bioMérieux SA (France), Heska Corporation (US), NEOGEN Corporation (US), Bio-Rad Laboratories Inc. (US), Virbac (France), FUJIFILM Holdings Corporation (Japan), Shenzhen Mindray Animal Medical Technology Co. Ltd. (China), INDICAL BIOSCIENCE GmbH (Germany), BioNote, Inc. (South Korea), Biogal Galed Labs (Israel), Agrolabo S.p.A. (Italy), Innovative Diagnostics (France), Randox Laboratories Ltd. (Ireland), BioChek (Netherlands), Fassisi GmbH (Germany), Alvedia (France), SKYER, Inc. (South Korea), Shenzhen Bioeasy Biotechnology Co., Ltd. (China), Gold Standard Diagnostics (Germany), Precision Biosensor Inc. (South Korea), Antech Diagnsotics Inc. (US), and EUROIMMUN Medizinische Labordiagnostika AG (Germany).

Recent Developments:

- In March 2023, Zoetis, Inc. introduced two updates in the VEtscan Imagst platform. One is the AI dermatology and another for AI equine FEC analysis. These diagnostic additions broaden Vetscan Imagyst testing capabilities beyond existing AI canine and feline fecal analysis, AI blood smear analysis and digital cytology applications to include new in-clinic tests that are fully integrated into the company’s cloud-based artificial intelligence capabilities.

- In July 2022, BioNote USA partnered with PSIvet. The partnership will make BioNote’s Vcheck line of analyzers and tests even more affordable to PSIvet’s 5,000-plus veterinary practices.

- In August 2021, INDICAL BIOSCIENCE acquired Checkpoints to expand its poultry portfolio and direct-to-producer offerings.

- In June 2021, Idexx Laboratories acquired ezyVet, a practice information management system (PIMS). The acquisition would expand Idexx’s world-class cloud software offerings that support customers with technology solutions that raise the standard of care for patients, improve practice efficiency, and enable more effective communication with pet owners.

Get 10% Free Customization on this Report

Veterinary Diagnostic Market Advantages:

- Early Disease Detection: Advanced diagnostic tools enable the early detection of diseases and health issues in animals, allowing for timely intervention and better treatment outcomes.

- Precision Medicine: Personalized treatment plans can be developed based on diagnostic results, ensuring that each animal receives care tailored to its specific needs.

- Non-Invasive Techniques: Many modern diagnostic methods are non-invasive, reducing stress and discomfort for animals while providing accurate results.

- Improved Animal Welfare: By identifying and addressing health concerns promptly, the veterinary diagnostic market contributes to overall animal welfare, promoting healthier and happier lives for pets and livestock.

- Rapid Testing: Quick and efficient diagnostic tests save time and resources, enabling veterinarians to make informed decisions more rapidly.

- Data-Driven Insights: The industry’s use of data analytics and AI enhances diagnostic accuracy and provides valuable insights into animal health trends, ultimately improving patient care.

- Telemedicine and Remote Monitoring: The integration of telemedicine and remote monitoring technologies expands access to veterinary care, especially in remote areas, while enhancing convenience for pet owners.

- Research and Development: Ongoing innovations in diagnostic technologies contribute to the advancement of veterinary medicine and drive further research in animal health.

- Enhanced Preventive Care: Veterinary diagnostics support preventive care measures, such as vaccination and parasite control, reducing the risk of disease transmission and improving public health.

- Economic Benefits: Timely and accurate diagnostics can reduce healthcare costs and losses in livestock and agricultural settings, making the veterinary diagnostic market economically advantageous for various stakeholders.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/veterinary-diagnostics-market-26017452.html

https://www.marketsandmarkets.com/PressReleases/veterinary-diagnostics.asp