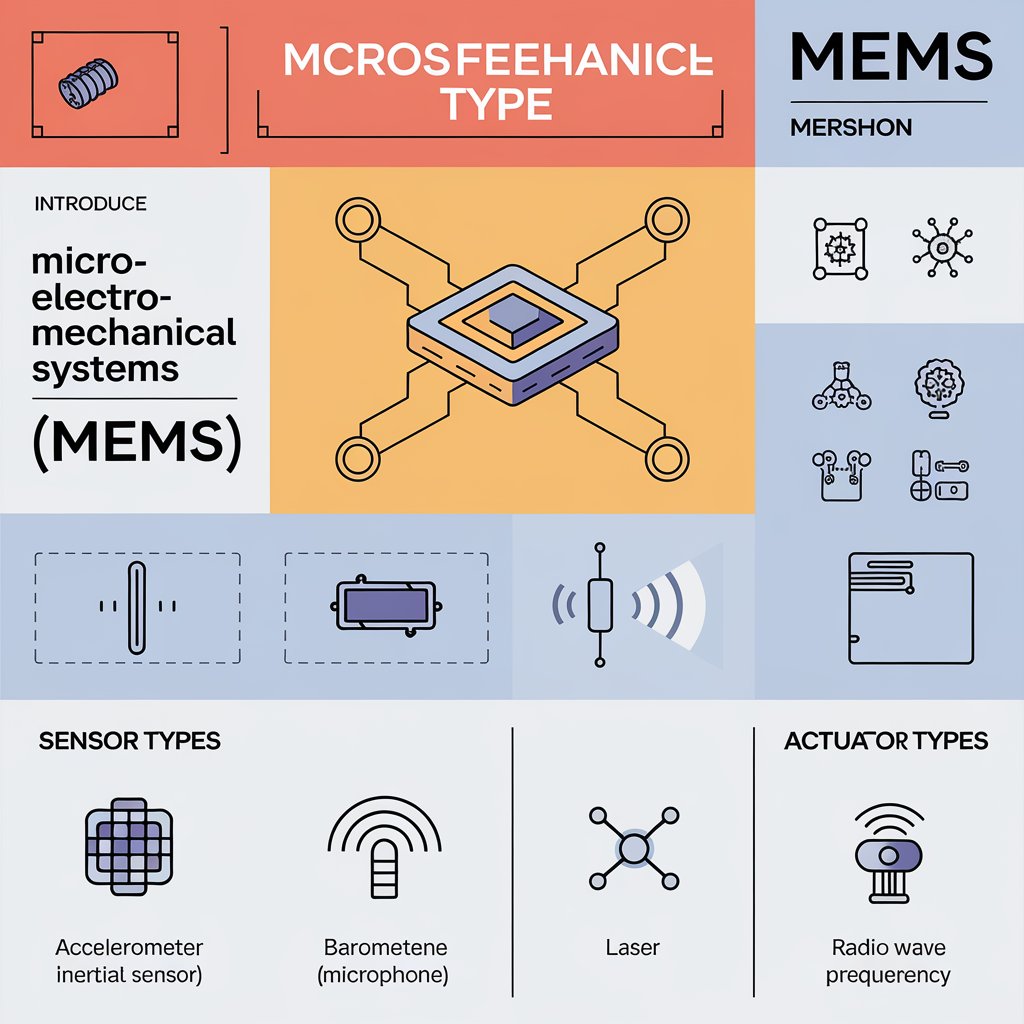

Micro-Electro-Mechanical Systems (MEMS) technology is rapidly evolving, playing an increasingly critical role in modern industries. From smartphones to automotive systems and medical devices, MEMS is the backbone of numerous cutting-edge applications. This article will explore the trends shaping the future of MEMS, its market growth projections, the top companies driving innovation, regional analysis, opportunities, and the challenges that the MEMS industry faces. We’ll also delve into the industry’s segmentation, highlighting its diverse applications.

Trends Shaping the Future of Micro-Electro-Mechanical Systems (MEMS) Industry

- Miniaturization and Precision Manufacturing

As devices become smaller and more sophisticated, the demand for MEMS technology has surged. Innovations in precision manufacturing allow for the production of ultra-compact sensors, actuators, and devices. Miniaturization enables MEMS to be integrated into IoT devices, wearables, and medical implants, making it indispensable in the healthcare, automotive, and consumer electronics sectors. - Integration with AI and IoT

MEMS technology is increasingly being integrated with artificial intelligence (AI) and the Internet of Things (IoT). This combination allows for the development of smart sensors that can process data in real-time, enabling predictive maintenance, automation, and intelligent decision-making across industries like automotive and manufacturing. - Emergence of MEMS for 5G

The rise of 5G technology has further boosted the MEMS market. MEMS-based devices, such as RF filters and antennas, are crucial for enhancing the performance of 5G networks. Their low power consumption and high-frequency capabilities make them essential for the smooth functioning of 5G infrastructure. - Biomedical Advancements

MEMS technology is making strides in the biomedical field, particularly in the development of lab-on-a-chip devices, drug delivery systems, and biosensors. These innovations are revolutionizing medical diagnostics, enabling more accurate, faster, and less invasive treatments.

Micro-Electro-Mechanical Systems (MEMS) Market Growth Projection

The MEMS industry is projected to grow significantly over the next few years. According to market analysts, the Micro-electro-mechanical System (MEMS) market size was valued at USD 16.5 billion in 2024 and is estimated to reach USD 24.2 billion by 2029, registering a CAGR of 7.9% during the forecast period. The surge in demand from industries such as automotive, healthcare, telecommunications, and consumer electronics is driving this growth.

Key growth drivers include:

- Increasing adoption of MEMS in smartphones, wearables, and automotive sensors

- Rising demand for advanced driver-assistance systems (ADAS) in the automotive industry

- Growth in medical applications, such as patient monitoring systems and diagnostic devices

Top Companies in the Micro-Electro-Mechanical System (MEMS) Industry

Several top players are at the forefront of MEMS innovation and production:

- STMicroelectronics

A global leader in MEMS technology, STMicroelectronics offers a broad portfolio of sensors and actuators used in automotive, industrial, and consumer applications. - Bosch Sensortec

A subsidiary of Bosch, Bosch Sensortec is a leading supplier of MEMS sensors, particularly for consumer electronics. Their products are used in everything from wearables to home automation systems. - Texas Instruments

Texas Instruments provides a wide range of MEMS products, including digital microphones and accelerometers, used in industries such as automotive, healthcare, and industrial automation. - Analog Devices

Known for its innovation in sensor technology, Analog Devices offers high-performance MEMS sensors and solutions across a variety of sectors, including healthcare, automotive, and telecommunications. - Broadcom

Broadcom is a leading player in the telecommunications and networking space, offering MEMS products that support RF communications, particularly in the growing 5G infrastructure market.

Regional Analysis of the Micro-Electro-Mechanical Systems (MEMS) Industry

- North America

North America, particularly the United States, is a key player in the MEMS market, thanks to its strong focus on innovation and R&D. The region is home to several major MEMS manufacturers, and its automotive and healthcare industries are significant drivers of demand. - Europe

Europe is another leading market for MEMS technology, particularly in automotive applications. Countries like Germany, France, and the UK have strong automotive industries that rely on MEMS for ADAS, sensor systems, and more. - Asia-Pacific

The Asia-Pacific region, particularly China, Japan, and South Korea, is experiencing rapid growth in MEMS adoption. This is driven by the booming consumer electronics market and the growing demand for IoT devices. The region’s robust manufacturing infrastructure also supports the production of MEMS devices at scale. - Latin America and Middle East & Africa

These regions are gradually adopting MEMS technology, driven by growth in industries like healthcare and telecommunications. The adoption rate is expected to increase as more industries incorporate IoT and AI-based solutions.

Opportunities in the Micro-Electro-Mechanical Systems (MEMS) Industry

- Healthcare Applications

MEMS technology presents immense opportunities in healthcare, particularly in medical diagnostics, implantable devices, and patient monitoring systems. The shift towards telemedicine and wearable health tech further expands the scope of MEMS applications. - Autonomous Vehicles

The rise of autonomous vehicles and advanced driver-assistance systems (ADAS) presents a significant opportunity for MEMS manufacturers. MEMS sensors are critical for object detection, navigation, and environmental monitoring in autonomous vehicles. - Sustainability Initiatives

MEMS technology can play a key role in energy management and sustainability efforts. By enabling more efficient use of resources in industries such as manufacturing and agriculture, MEMS can contribute to reducing carbon footprints and energy consumption.

Challenges Facing the Micro-Electro-Mechanical Systems (MEMS) Industry

- High Manufacturing Costs

One of the main challenges facing the MEMS industry is the high cost of manufacturing. As the technology becomes more advanced, the need for precision and high-quality production processes drives up costs. - Complexity in Integration

Integrating MEMS devices with existing systems and networks can be complex, particularly when dealing with IoT applications. Ensuring seamless communication between MEMS sensors and other systems remains a challenge. - Standardization Issues

The lack of universal standards in MEMS manufacturing and design can hinder the growth of the industry. Without standardization, it becomes difficult for manufacturers to produce devices that are interoperable across various platforms.

Micro-Electro-Mechanical Systems (MEMS) Industry Segmentation

- By Type

- Sensors (Pressure, Accelerometers, Gyroscopes, Magnetometers)

- Actuators (Micro-pumps, Micro-valves, Micro-motors)

- Others (RF MEMS, Micro mirrors)

- By Application

- Consumer Electronics (Smartphones, Wearables)

- Automotive (ADAS, Infotainment Systems)

- Healthcare (Implantable Devices, Diagnostic Tools)

- Industrial (Robotics, Automation Systems)

- Telecommunications (5G Infrastructure)

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

The future of the MEMS industry is bright, driven by advancements in miniaturization, integration with AI and IoT, and emerging applications in healthcare and telecommunications. While the industry faces challenges such as high manufacturing costs and standardization issues, the growing demand for MEMS in various sectors presents significant opportunities for growth. With key players like STMicroelectronics, Bosch Sensortec, and Texas Instruments at the forefront, the MEMS market is well-positioned for rapid expansion in the coming years.