The semiconductor industry is undergoing a significant transformation, driven by the demand for more powerful, energy-efficient, and compact devices. At the heart of this evolution lies extreme ultraviolet (EUV) lithography, a cutting-edge technology that is enabling manufacturers to continue the miniaturization of semiconductor components. As the backbone of the next generation of chip production, EUV lithography is poised to redefine the semiconductor manufacturing landscape, offering unprecedented levels of precision and resolution. This article delves into the EUV lithography market, exploring its technology, applications, growth drivers, and future outlook.

What is Extreme Ultraviolet (EUV) Lithography?

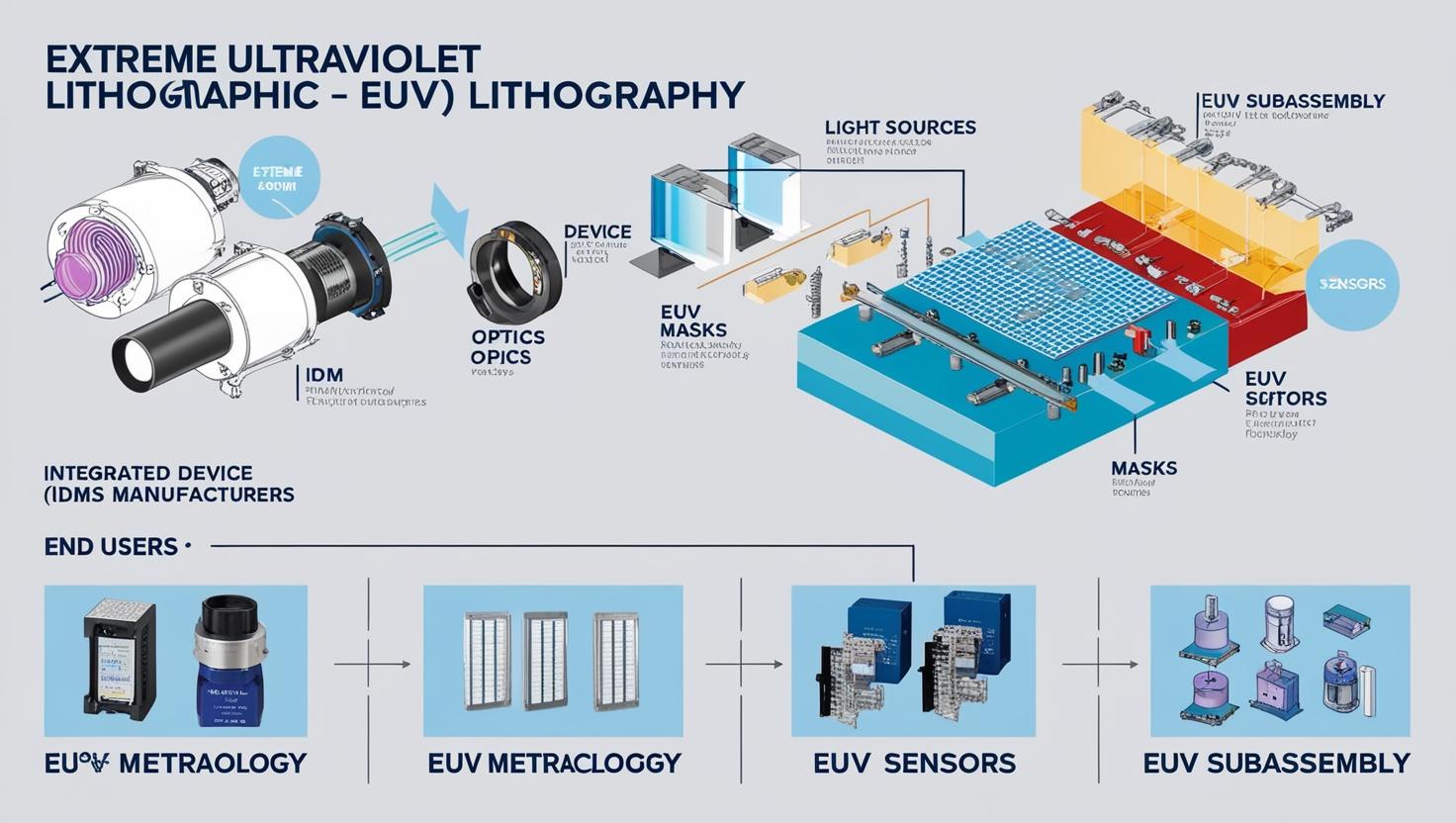

Lithography is the process of transferring intricate patterns onto semiconductor wafers to create the circuits that power electronic devices. Traditional lithography techniques use deep ultraviolet (DUV) light, but as the demand for smaller and more powerful chips increases, DUV technology has reached its physical limits. To continue advancing chip performance, manufacturers turned to EUV lithography, which uses light with wavelengths as short as 13.5 nanometers (nm), compared to the 193 nm wavelength used by DUV lithography.

The EUV lithography market is expected to reach USD 22.69 billion by 2029 from USD 12.18 billion in 2024, at a CAGR of 13.2% during the 2024-2029

The shorter wavelength of EUV light allows for higher resolution and finer patterning, enabling the production of smaller transistors and more complex chip designs. This is crucial for meeting the demands of modern technologies such as 5G, artificial intelligence (AI), and high-performance computing (HPC), where even the tiniest improvements in chip density can lead to significant performance gains.

EUV lithography Market Growth Drivers

Increasing Demand for Smaller, Faster, and More Energy-Efficient Chips

The primary driver behind the growth of the EUV lithography market is the ongoing demand for smaller, more powerful, and energy-efficient semiconductor devices. As consumer electronics, IoT devices, and industrial applications become more integrated into everyday life, there is a constant need for more advanced chips that can process larger volumes of data at faster speeds while consuming less power. EUV lithography provides the precision required to meet these needs by enabling the production of smaller transistors and intricate designs that traditional lithography techniques cannot achieve.

Advancements in 5G and AI Technologies

The global rollout of 5G networks and the rapid advancement of AI and machine learning applications are driving the demand for high-performance semiconductors. EUV lithography plays a crucial role in enabling the production of chips that are optimized for these technologies. For example, EUV is helping manufacturers create chips with more processing cores, faster clock speeds, and greater energy efficiency—key attributes for 5G base stations, data centers, and AI-powered devices.

Increased Investment in Semiconductor Manufacturing

The semiconductor industry is witnessing record levels of investment as governments, private companies, and tech giants invest heavily in R&D and manufacturing capabilities. The United States, Europe, and Asia are all increasing their focus on semiconductor production to ensure self-sufficiency and secure supply chains for advanced technologies. The adoption of EUV lithography is seen as a critical enabler of next-generation chip production, prompting manufacturers to upgrade their fabs (fabrication plants) with EUV systems.

Cost Reduction in EUV Equipment

Historically, EUV lithography was an expensive and complex technology, with extremely high capital costs for the equipment required to produce EUV-based chips. However, the continued development of EUV technology has led to cost reductions, making it more accessible for semiconductor foundries. Leading EUV equipment manufacturers, such as ASML, have made significant strides in increasing the yield and efficiency of EUV machines, reducing their overall cost and making the technology more feasible for mass production.

Key Applications of EUV Lithography

Semiconductor Manufacturing

EUV lithography is primarily used in semiconductor manufacturing for advanced node processes, particularly those in the 7 nm, 5 nm, and 3 nm range. As the semiconductor industry moves towards smaller nodes, the need for EUV technology becomes more pronounced. EUV enables the production of chips with more transistors per square millimeter, leading to increased computational power and reduced power consumption. This is particularly important for high-performance processors used in mobile devices, servers, and automotive electronics.

Memory Chips

The growing demand for memory chips, driven by applications like cloud computing, gaming, and AI, has spurred the need for EUV lithography. EUV is used in the production of DRAM (dynamic random-access memory) and NAND flash memory chips, allowing manufacturers to produce smaller, more efficient memory devices with higher storage capacity. The ability to create smaller, more densely packed memory cells enhances data transfer rates and reduces power consumption, which is vital for data-intensive applications.

Download PDF Brochure @

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=241564826

Advanced Process Nodes for Automotive and IoT

EUV lithography is also playing a key role in enabling the production of chips for emerging technologies such as automotive electronics and IoT devices. In the automotive industry, chips used in autonomous vehicles, electric vehicles, and advanced driver-assistance systems (ADAS) require high-performance processing power and low power consumption. Similarly, as IoT devices become more ubiquitous, EUV technology is helping to develop smaller, more efficient chips that can power everything from smart home devices to wearable technology.

Challenges and Obstacles

Despite its many advantages, EUV lithography faces several challenges that need to be addressed to fully realize its potential:

High Capital and Operational Costs

While the cost of EUV equipment has decreased over the years, it still remains a significant investment for semiconductor manufacturers. The extreme complexity of EUV machines, which involve cutting-edge technologies such as lasers, mirrors, and vacuum chambers, leads to high upfront costs and operational expenses. This presents a barrier for smaller foundries that may not have the resources to invest in such advanced equipment.

Material and Process Challenges

EUV lithography requires the use of specialized masks, light sources, and photoresists to produce high-quality patterns. These materials need to be highly precise and are sometimes challenging to produce at the required scale. Additionally, the EUV process is still being optimized, with challenges related to process stability, throughput, and defect reduction. Continuous research and development are needed to improve these aspects and increase the overall efficiency of the EUV manufacturing process.

Supply Chain Constraints

The development of EUV technology depends on a highly specialized supply chain, with only a few companies capable of producing the necessary equipment and materials. ASML, the primary supplier of EUV lithography machines, faces pressure to meet the growing demand for these machines, leading to supply chain constraints. Furthermore, the geopolitical landscape, such as trade tensions and regulatory restrictions, may impact the availability of key components needed for EUV systems.

The Future Outlook for the EUV Lithography Market

The EUV lithography market is poised for significant growth over the next decade. As semiconductor manufacturers continue to push the boundaries of chip miniaturization, EUV will remain a cornerstone technology for enabling smaller, more efficient, and higher-performance chips.

Key trends shaping the future of the EUV market include:

Scaling Down to 3nm and Beyond: As the industry moves to 3 nm and eventually 2 nm process nodes, the demand for EUV will intensify. The technology will continue to evolve to support the production of even smaller transistors and more intricate chip designs.

Adoption of Multiple Patterning Techniques: To further extend the capabilities of EUV, manufacturers may adopt multiple patterning techniques, which combine EUV with other lithography methods to achieve even finer resolutions. This hybrid approach will help address some of the current limitations of EUV.

Wider Industry Adoption: As the cost of EUV equipment continues to decrease, more semiconductor foundries will adopt the technology. This wider adoption will drive competition and innovation, leading to further improvements in EUV lithography capabilities.

Collaborative Research and Development: Continued collaboration between semiconductor manufacturers, equipment suppliers, and research institutions will accelerate advancements in EUV technology. These partnerships will help address current challenges and unlock new opportunities for the future of semiconductor manufacturing.

The EUV lithography market is entering an exciting phase of growth, driven by the increasing demand for smaller, faster, and more efficient semiconductor devices. EUV technology is key to enabling the next generation of chip production, and its applications across industries such as consumer electronics, automotive, and AI are vast. While challenges remain, continuous advancements in EUV technology and increasing investments in semiconductor manufacturing will ensure that this game-changing technology plays a central role in shaping the future of semiconductor innovation.

The key players in EUV lithography are ASML (Netherlands), Carl Zeiss AG (Germany), NTT Advanced Technology Corporation (Japan), KLA Corporation (US), ADVANTEST CORPORATION (Japan), Ushio Inc. (Japan), SUSS MicroTec SE (Germany), AGC Inc. (Japan), Lasertec Corporation (Japan), TOPPAN Inc. (Japan), Energetiq Technology, Inc. (Japan), NuFlare Technology Inc. (US), Photronics, Inc. (Japan), HOYA Corporation (Japan), TRUMPF (Germany), Rigaku Holdings Corporation (Japan), Edmund Optics Inc. (US), Imagine Optic (France), Applied Materials, Inc. (US), Park Systems (South Koria), EUV Tech (US), Mloptic Crop. (China), MKS Instruments (US), Brooks Automation (US), and Pfeiffer Vacuum GmbH (Germany).