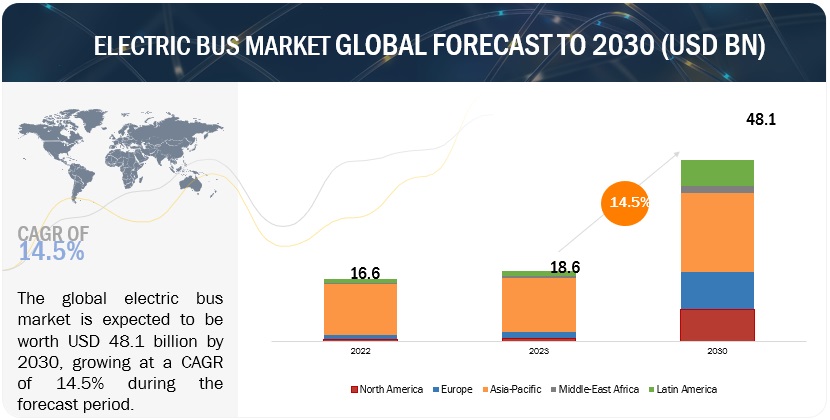

The global electric bus market is projected to be USD 17.0 billion in 2024 and to grow to USD 37.5 billion by 2030, at a compound annual growth rate (CAGR) of about 14.2%. The electric bus market will witness high acceleration in the upcoming years due to zero-emission vehicle promotion in countries with respect to their public transportation fleets and government initiatives backing electrification. For the forecast period, it is expected that the Asia Pacific will dominate the market for electric buses. The existence of leading electric bus manufacturers such as BYD and Yutong operating in every major region has influenced this market, coupled with a variety of affordable electric buses due to lower prices of parts and components. Besides, government initiatives, large investment in charging infrastructure, and improvements in battery technologies continue to further drive the market in this region. North America is estimated to grow with the highest CAGR over the forecast period, followed by Latin America and Europe.

Electric buses will find traction across major regions, driven by emission regulations, battery price drops, the emergence of low-emission zones, purchase subsidies, and tax exemptions. Also, significant investments and funding initiatives are supporting the deployment of EV charging infrastructure globally. For instance, the European Union, comprising 27 nations, intends to allocate approximately USD 10.08 billion for initiatives throughout Latin America and the Caribbean which drives the electric bus market in this region.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38730372

The battery electric bus segment is estimated to be the largest segment during the forecast period.

The BEVs segment dominates the electric bus market with around 95% share in 2024. Even though BEVs are more expensive to acquire initially compared to diesel buses, they have more operational efficiency, with the average being about 90% as compared to diesel ones, which is between 30% and 40%. The average range of battery electric buses usually delivers an average range of 150 to 250 miles, based on the installed battery type, and cost less with power consumption compared to diesel-powered vehicles. This results in reduced operational expenses for pure electric buses. The Asia-Pacific will remain the largest market for BEVs, with government policies supportive to pure electric buses. Aggressive efforts of China and financial support of India are the main forces behind this industry at present. By 2023, over 70% of all electric buses running on roads across the world will be from India. Besides, a significant dependence of battery electric buses lies in the improvement of battery technology. LFP, NMC, LTO, LMO, and other lithium-ion types of batteries had higher energy density and were cost-efficient. That way, electric buses can now go further between charges compared to earlier models of electric vehicles, thus reducing operational costs. Suppliers such as CATL, LG Energy Solution, and Panasonic have increased their production in order to satisfy the increasing need for high-performance batteries designed for electric buses. Therefore, increased regulatory compliance efforts, advancements in technology by manufacturers and suppliers, rising environmental consciousness, and a focus on sustainable mobility have all contributed to substantial growth in the battery electric bus sector.

City/ transit bus by application is the largest market in 2024 and is projected to dominate the market by 2030

The usage of electric buses for city application is maximum across all the regions during the forecast period. The demand is mainly prominent for this application due to its suitability for urban environments, comparatively lower travel distance, and fixed defined routes. Local governments are giving benefits and requiring the use of electric buses in their public transportation collections. The pressure from regulations has encouraged Volvo, BYD, and Daimler to develop electric buses tailored for urban environments, with enhancements in maneuverability, seating capacity, and accessibility features. The main motive of the eBRT2030 project in Europe is to enhance urban transportation by developing advanced electric Bus Rapid Transit (BRT) systems. Demonstrations have taken place in several European cities like Amsterdam, Athens, Barcelona, and Prague. As reported in the study funded by C40 in partnership with the Clean Transport Finance Academy 2023 and other backers, there are plans to introduce a fleet of more than 25,000 e-buses by 2030 and surpass 55,000 by 2050 in 32 Latin American cities. Therefore, the electric buses market is projected to remain strong in the future due to advancements like smart charging infrastructure and vehicle-to-grid technologies, which aim to enhance energy efficiency and lower operational expenses for city buses.

North America will be the fastest-growing market for electric buses from 2024-2030.

North America is estimated to be the fastest-growing market during the forecast period. In North America, government incentives, the presence of individual investors, and technological edge are driving the electric bus market. The US has been leading the market in this region. The market is expanding due to government incentives, tax breaks, and private investments. The Federal Transit Administration set aside USD 1.7 billion in 2023 for buses, with an emphasis on zero-emission vehicles, even though European acceptance lags lag. This shift is further supported by the USD 5.6 billion set up in the Bipartisan Infrastructure Law for cleaner buses. make at least one-third of its 70,000 public transit buses electric by 2045. Government incentives and public-private partnership (PPP) schemes and policies like Toronto’s plan to convert 50% of its fleet to electric by 2050 show the region’s commitment to sustainable transport solutions.

Key Market Players:

The report profiles key players such as BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden) and CAF (Solaris Bus & Coach sp. z o.o.) (Spain). These companies adopted new product development, and supply contract strategies to gain traction in the terminal tractor market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=38730372