The Asia Pacific region is rapidly emerging as a key hub for Extreme Ultraviolet (EUV) Lithography, one of the most transformative technologies in semiconductor manufacturing. As the global demand for more powerful, efficient, and compact electronic devices continues to grow, EUV lithography has become essential for advancing semiconductor manufacturing processes. Asia Pacific, home to some of the world’s largest semiconductor manufacturers, is poised to play a central role in the expansion of this cutting-edge technology.

Explores the dynamics of the EUV lithography market in the Asia Pacific region, including key drivers, challenges, and future prospects for this rapidly evolving market.

The EUV lithography market is expected to reach USD 22.69 billion by 2029 from USD 12.18 billion in 2024, at a CAGR of 13.2% during the 2024-2029

1. Understanding EUV Lithography and Its Importance

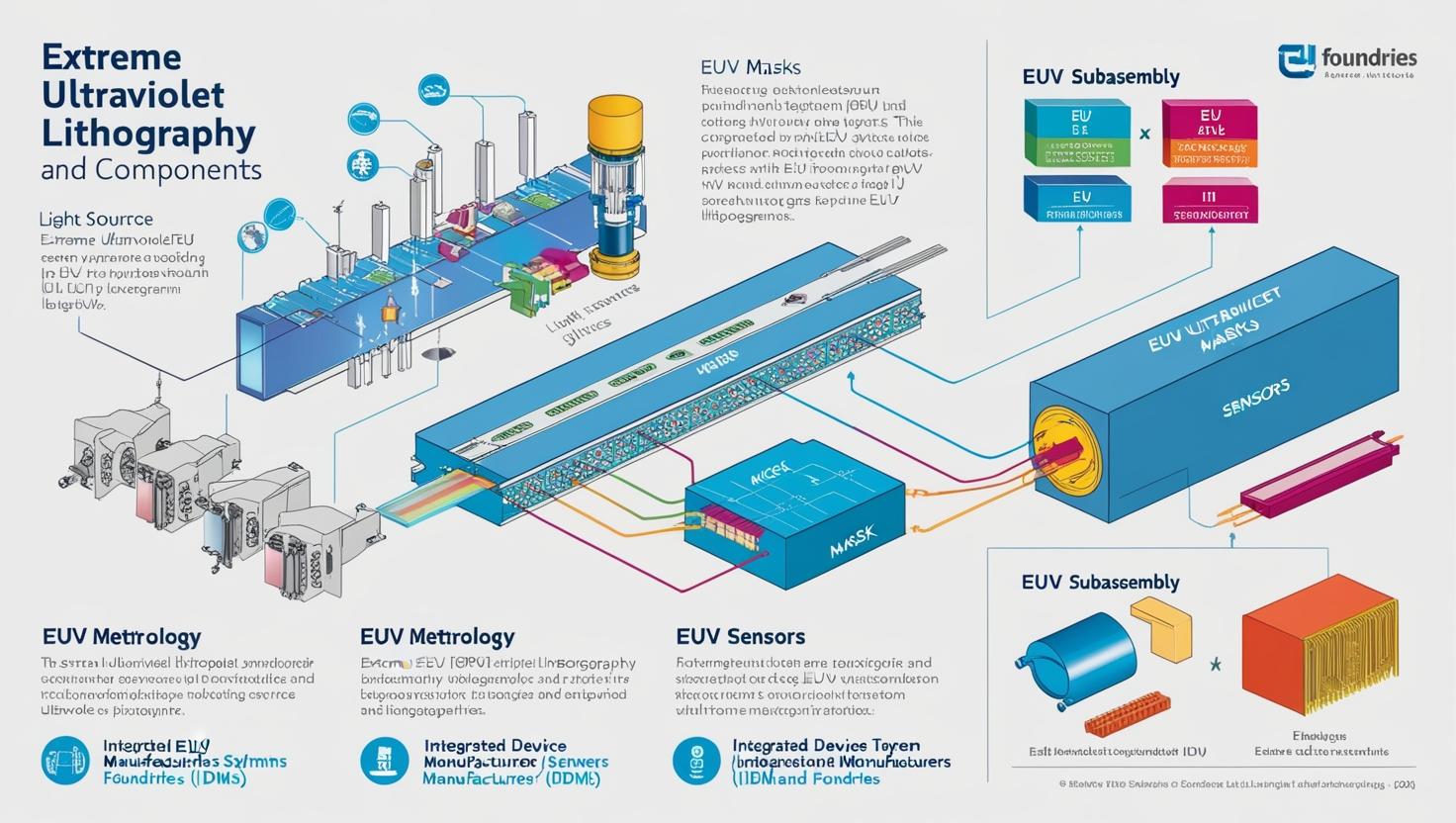

Extreme Ultraviolet (EUV) Lithography is a photolithography technique that uses extremely short wavelengths (around 13.5 nanometers) of ultraviolet light to create the intricate patterns necessary for advanced semiconductor fabrication. EUV allows chipmakers to print smaller, denser, and more complex circuit patterns on semiconductor wafers, enabling the production of the next generation of integrated circuits (ICs) used in everything from smartphones and computers to artificial intelligence (AI) applications and autonomous vehicles.

As the demand for increasingly powerful and energy-efficient semiconductor devices grows, EUV technology is critical in enabling the scaling of chips at the smallest nodes—5nm, 3nm, and even 2nm. Without EUV, it would be nearly impossible to manufacture these advanced semiconductor devices using conventional photolithography techniques.

2. Asia Pacific Leading the Charge in Semiconductor Manufacturing

Asia Pacific has long been a leader in semiconductor production, with countries like Taiwan, South Korea, China, and Japan dominating the industry. Major semiconductor manufacturers such as TSMC (Taiwan Semiconductor Manufacturing Company), Samsung Electronics, and SMIC (Semiconductor Manufacturing International Corporation) are at the forefront of adopting and expanding EUV lithography technology.

- Taiwan: TSMC, the world’s largest contract semiconductor manufacturer, is one of the biggest proponents of EUV technology. TSMC has already adopted EUV for its 7nm and 5nm nodes and is preparing for its 3nm and smaller processes using EUV technology. Taiwan’s dominance in the global semiconductor market has positioned it as a key player in the adoption and development of EUV technology.

- South Korea: Samsung Electronics, another major player in the semiconductor industry, is also leading the adoption of EUV lithography. Samsung has successfully deployed EUV for its 5nm and 3nm nodes and is looking ahead to adopting EUV for its even smaller semiconductor processes. South Korea’s strong semiconductor industry and government support further boost the adoption of advanced manufacturing technologies like EUV.

- China: While China is still working to catch up in terms of EUV adoption, the country is heavily investing in semiconductor manufacturing and lithography technologies, with plans to integrate EUV in the near future. The country’s long-term strategy to achieve semiconductor self-sufficiency and reduce dependence on foreign technology may result in accelerated EUV adoption as part of its push to modernize its semiconductor industry.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=241564826

Extreme Ultraviolet (EUV) Lithography Industry

3. Key Drivers of the EUV Lithography Market in Asia Pacific

Several factors are contributing to the rapid growth and adoption of EUV lithography in the Asia Pacific region:

- Rising Demand for Smaller and More Powerful Chips: As the demand for high-performance chips grows, especially in sectors like 5G, AI, automotive, and consumer electronics, semiconductor manufacturers need to shrink their devices while improving performance. EUV lithography is the key enabler for producing these smaller, more powerful chips.

- Advanced Node Development: With global semiconductor manufacturers shifting to 5nm, 3nm, and even 2nm technology, EUV lithography is the only viable option for etching these tiny and intricate patterns. The transition to these advanced nodes has created an urgent need for EUV tools to achieve the precision required for next-generation chips.

- Government and Industry Support: Governments in countries like Taiwan, South Korea, and Japan have recognized the importance of semiconductor manufacturing and are providing substantial support for the adoption of advanced lithography technologies. In particular, Taiwan’s government has made significant investments in research and development (R&D) for semiconductor technologies, including EUV, to ensure the region remains a dominant force in the global semiconductor market.

- Improved Yield and Cost Efficiency: EUV lithography offers better yield compared to traditional deep ultraviolet (DUV) lithography processes at smaller nodes, making it more cost-efficient in the long term. As EUV systems evolve and become more affordable, their adoption will only increase, improving the overall efficiency of semiconductor manufacturing.

4. Challenges Facing the EUV Lithography Market

While EUV lithography offers many benefits, the technology is still in its early stages, and its widespread adoption faces several challenges:

- High Cost of EUV Machines: One of the major barriers to broader adoption of EUV lithography is the extremely high cost of the EUV machines themselves. These machines, manufactured by ASML, can cost upwards of $150 million each, making them an expensive investment for semiconductor manufacturers. However, as the technology matures and production volumes increase, the cost of EUV systems is expected to decrease, making them more accessible to a wider range of companies.

- Complexity of EUV Technology: EUV lithography is more complex than traditional photolithography techniques. It requires advanced infrastructure, including specialized light sources, optics, and masks, to operate effectively. The development of EUV technology is a long-term and complex process, requiring significant investment in research, development, and training.

- Supply Chain Challenges: The EUV lithography supply chain is heavily reliant on companies like ASML, which holds a near-monopoly on the manufacturing of EUV machines. Political and trade tensions between key players, such as the United States and China, could impact the availability and development of EUV technology in the region.

5. The Future of the EUV Lithography Market in Asia Pacific

Despite these challenges, the EUV lithography market in Asia Pacific is poised for significant growth. The continued evolution of semiconductor manufacturing and the increasing demand for smaller, more powerful chips will drive investments in EUV technology. Key trends shaping the future of the market include:

- EUV Adoption Across the Supply Chain: As more semiconductor foundries adopt EUV lithography, the technology will likely become more ubiquitous across the semiconductor supply chain. The shift to 3nm and smaller nodes, particularly in the 5G, AI, and automotive sectors, will continue to push demand for EUV.

- Technological Advancements: Continued advancements in EUV technology, such as improved light sources, mask materials, and manufacturing processes, will make the technology more efficient and affordable. This will lead to increased adoption across a wider range of manufacturers in the Asia Pacific region.

- Investment in R&D: Countries and companies in Asia Pacific are heavily investing in research and development for next-generation semiconductor manufacturing technologies, including EUV. Governments in the region are prioritizing the development of high-tech industries, which will further accelerate the growth of the EUV market.

The Asia Pacific EUV lithography market is at the forefront of the semiconductor industry’s next generation of manufacturing technology. With rapid industrial growth, increasing demand for advanced chips, and strong government and industry support, the region is expected to lead the global market for EUV lithography in the coming years. While challenges such as high costs and technological complexity remain, the long-term prospects for EUV adoption are promising. As semiconductor manufacturers in Asia Pacific continue to innovate and push the boundaries of miniaturization, EUV lithography will remain a critical enabler for the future of electronics and technology.

Frequently Asked Questions (FAQ)

1. What is EUV lithography, and why is it important in semiconductor manufacturing?

Answer:

Extreme Ultraviolet (EUV) lithography is a cutting-edge technology used to manufacture semiconductor devices. It utilizes extremely short wavelengths (around 13.5 nanometers) of ultraviolet light to create intricate patterns on semiconductor wafers. This allows for the fabrication of smaller, denser, and more powerful chips, which are essential for the development of advanced electronics, such as smartphones, AI systems, and autonomous vehicles.

EUV lithography is crucial for producing chips at advanced nodes (5nm, 3nm, and smaller), enabling the production of high-performance, energy-efficient semiconductor devices required for next-generation applications.

2. Which countries in the Asia Pacific region are leading the adoption of EUV lithography?

Answer:

The Asia Pacific region is a major hub for semiconductor manufacturing, and several countries are leading the adoption of EUV lithography:

- Taiwan: TSMC (Taiwan Semiconductor Manufacturing Company), the largest contract semiconductor manufacturer globally, is a key adopter of EUV technology, with its 7nm, 5nm, and upcoming 3nm processes utilizing EUV.

- South Korea: Samsung Electronics has also adopted EUV lithography for its 5nm and 3nm nodes, with plans to continue using it for smaller semiconductor processes.

- China: While still behind, China is heavily investing in its semiconductor manufacturing capabilities and is planning to integrate EUV technology in the near future to reduce dependency on foreign technologies.

- Japan: Japan’s strong semiconductor industry is also exploring the potential of EUV lithography, supported by both private investment and government initiatives.

3. What are the main drivers of the EUV lithography market in Asia Pacific?

Answer:

The main drivers of the EUV lithography market in Asia Pacific include:

- Demand for Smaller and More Powerful Chips: There is a growing need for smaller, high-performance semiconductor devices across various industries, including consumer electronics, 5G, AI, and automotive sectors.

- Advanced Node Development: As semiconductor manufacturers move to advanced nodes (3nm, 2nm), EUV lithography is the only viable technology capable of etching these smaller and more complex patterns.

- Government and Industry Support: Governments in key Asia Pacific countries are investing in semiconductor innovation and providing support for the development of EUV technology to stay competitive in the global market.

- Cost Efficiency and Better Yield: EUV technology can achieve better yield and efficiency at advanced nodes, making it a cost-effective solution for semiconductor manufacturers in the long run.

4. What challenges does the EUV lithography market face in Asia Pacific?

Answer:

Despite its potential, EUV lithography faces several challenges:

- High Equipment Costs: EUV machines are extremely expensive, often costing upwards of $150 million each. This high cost can be a barrier for smaller manufacturers to adopt the technology.

- Technological Complexity: EUV lithography requires specialized infrastructure, including high-powered light sources and complex optics. This makes the technology difficult to implement and maintain.

- Supply Chain Dependencies: The EUV supply chain is dependent on few manufacturers, primarily ASML, which controls the production of EUV machines. Geopolitical tensions, such as trade issues between the US and China, could disrupt the supply chain and affect the availability of this technology.

- Skillset and Training Requirements: EUV technology requires a highly skilled workforce. Developing the necessary talent to operate and maintain EUV machines is a challenge for some countries in the region.