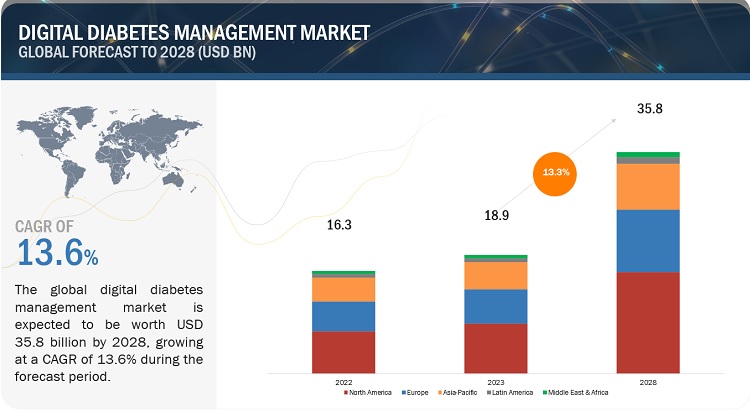

The global digital diabetes management market, valued at $18.9 billion in 2023, is projected to expand to $35.8 billion by 2028, growing at a compound annual growth rate (CAGR) of 13.6% over this period. This forecast is supported by comprehensive industry trend analyses, including pricing trends, patent reviews, and stakeholder insights. The increasing prevalence of diabetes and advancements in technology are major drivers behind this market growth. Rising demand for connected devices and cloud-based solutions also contributes to the market’s expansion. However, high device costs and limited reimbursement in developing countries may impede market progress.

Market Drivers and Opportunities

Artificial Intelligence in Diabetes Care Artificial intelligence (AI) is transforming diabetes management by enhancing diagnostic and treatment approaches. AI-powered algorithms now support predictive models for diabetes risks and complications. This technological evolution has improved glycemic control and reduced glucose level fluctuations. Companies like Livongo Health are leveraging big data to optimize health management, while Medtronic, Abbott, and Dexcom are using AI in their diabetes care devices to offer real-time monitoring and predictive alerts.

Rising Health Expenditure on Diabetes Global health expenditure on diabetes has surged from $232 billion in 2007 to $966 billion in 2021, reflecting a 316% increase over 15 years. The International Diabetes Federation (IDF) projects that expenditures will continue to rise, reaching $1.03 trillion by 2030. This growing financial commitment underscores the increasing investment in diabetes management solutions and creates significant opportunities for market players, particularly in emerging economies.

Market Restraints

High Device Costs and Reimbursement Issues The high cost of advanced diabetes management devices—ranging from $4,500 to $6,500 for insulin pumps and $1,000 to $1,400 for continuous glucose monitors—poses a challenge, particularly in developing countries. The lack of reimbursement and high device costs restrict access and limit market penetration. In regions like China and India, patients bear the full expense for diabetes management tools, impacting device adoption.

Low Penetration in Developing Economies Technologically advanced diabetes management solutions are less prevalent in developing countries due to inadequate infrastructure, data privacy concerns, and limited financial resources. Low health expenditure and access issues further constrain the adoption of digital diabetes management technologies.

Market Segmentation

Device Type

- Wearable Devices: Dominated the market with a 60.3% share in 2022, driven by innovations in smart insulin pumps and patches.

- Smart Insulin Pens: Expected to grow at the highest CAGR due to increasing demand for patient-centric devices.

Digital Diabetes Management Apps This segment is projected to grow at a CAGR of 15.4%, with diabetes & blood glucose tracking apps accounting for 44.9% of the market in 2022.

Regional Insights

- North America: Expected to experience the highest CAGR, driven by the adoption of connected devices and advanced digital health solutions.

- Europe and Asia Pacific: Follow North America, with significant growth due to rising health awareness and technological advancements.

Key Players

Prominent companies in the digital diabetes management market include:

- Medtronic (Ireland)

- B. Braun Melsungen AG (Germany)

- Dexcom, Inc. (US)

- Abbott Laboratories (US)

- F. Hoffmann-La Roche (Switzerland)

- Insulet Corporation (US)

- Tandem Diabetes Care (US)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- LifeScan, Inc. (US)

- DarioHealth Corporation (Israel)

- One Drop (US)

- Ypsomed Holding AG (Switzerland)

- ARKRAY (Japan)

Recent Developments

- Dexcom launched the G7 CGM device in the US in February 2023 and plans to expand to Europe and Asia Pacific by early 2024.

- Abbott Laboratories introduced the Freestyle Libre 3 CGM device globally in October 2022.

- Ascensia Diabetes Care launched Eversense’s 6-month CGM system in the US in April 2022.