The 3D printing industry, also widely recognized as additive manufacturing, has emerged as a transformative force across numerous sectors, from aerospace to healthcare. Its ability to produce complex components on demand, reduce waste, and enable localized production has positioned it as a cornerstone of modern manufacturing.

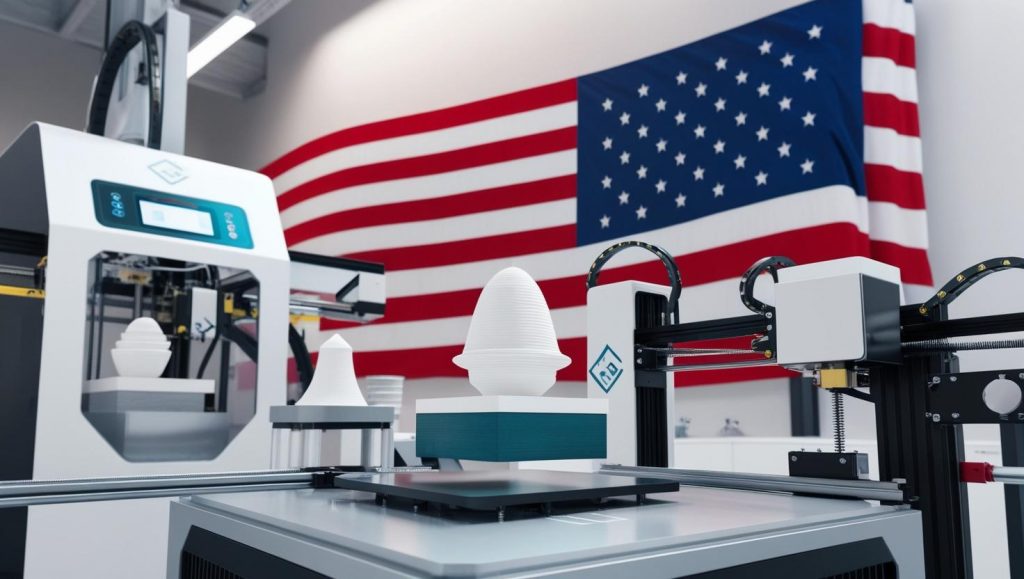

The Trump tariff impact on 3D printing market stems from a broader America First trade policy aimed at bolstering domestic production and reducing reliance on foreign goods. While the intent is to strengthen U.S. manufacturing, the reality for the 3D printing sector is far more complex. This industry thrives on a global ecosystem where raw materials, such as polymers and metal powders, and advanced machinery often originate from countries now subject to heightened tariffs. The increased costs of these inputs threaten to disrupt the delicate balance of affordability and innovation that has fueled the growth of additive manufacturing. Furthermore, the potential for retaliatory tariffs from affected nations adds another layer of uncertainty, complicating export opportunities for U.S.-based 3D printing firms.

Exploring the Trump tariff impact on 3D printing market requires a nuanced understanding of how trade policies intersect with technological advancement. For instance, China, a major player in the production of affordable 3D printers and filaments, faces tariffs that elevate the cost of importing these goods into the United States. Similarly, Canada, a critical supplier of paper and other materials used in certain 3D printing processes, is also affected, driving up operational expenses for American firms. This article delves into the multifaceted implications of these tariffs, offering an in-depth analysis of their effects on the 3D printing industry, the opportunities they present, the challenges they pose, and the potential solutions that could mitigate their impact.

Key Takeaways from Analyzing the Trump Tariff Impact on 3D Printing Market and Its Broader Effects

To fully grasp the Trump tariff impact on 3D printing market, it’s essential to distill the core consequences and insights that emerge from this economic shift. The imposition of tariffs ranging from 10% on Chinese goods to 25% on imports from Canada and Mexico has introduced a new dynamic to the additive manufacturing sector. One of the most immediate takeaways is the upward pressure on costs. Companies that rely on imported 3D printers, such as those produced by Chinese giants like Bambu Lab, or raw materials like titanium powders from overseas suppliers, are now grappling with higher expenses. These increased costs are often passed on to consumers, potentially slowing the adoption of 3D printing technologies in both commercial and personal use contexts.

Another critical takeaway from the Trump tariff impact on 3D printing market is the potential shift in supply chain strategies. As tariffs make foreign goods more expensive, there’s a growing incentive for companies to explore domestic sourcing or nearshoring options. This could lead to a renaissance of U.S.-based manufacturing, aligning with the administration’s goals, but it also raises questions about capacity. The United States has not significantly expanded its printing infrastructure in decades, and the specialized expertise required for high-quality 3D printing may not be immediately available domestically. This gap could hinder the industry’s ability to pivot quickly, leaving it vulnerable to supply shortages and production delays.

The Trump tariff impact on 3D printing market also highlights the dual nature of trade policies as both a challenge and an opportunity. While the tariffs threaten profit margins and market accessibility, they also encourage innovation. Firms may accelerate the development of alternative materials or invest in advanced technologies to reduce reliance on imports. Additionally, the emphasis on domestic production could spur job creation in the U.S. 3D printing sector, provided the industry can scale up effectively. These takeaways set the stage for a deeper exploration of how tariffs are reshaping additive manufacturing, revealing a landscape marked by uncertainty but also potential for growth and adaptation.

Request Trump Tariff Threat Assessment Analysis Now: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1276

Detailed Examination of the Trump Tariff Impact on 3D Printing Market Across Various Dimensions

The Trump tariff impact on 3D printing market manifests in several distinct yet interconnected ways, each with profound implications for the industry’s trajectory. At the heart of this impact is the cost of imported equipment and materials, which form the backbone of additive manufacturing. China, for example, has become a powerhouse in the 3D printing industry, producing affordable desktop printers and a significant share of the global supply of filaments like PLA and ABS. With tariffs now escalating to 34% on Chinese goods—building on previous levies—the cost of importing these essential tools has surged. This directly affects small businesses and hobbyists who rely on cost-effective solutions, potentially shrinking the consumer base for personal 3D printing.

Beyond equipment, the Trump tariff impact on 3D printing market extends to the raw materials critical for industrial applications. Metal powders, such as those used in aerospace and medical 3D printing, are often sourced from international suppliers. The tariffs on Canada and Mexico, key trading partners under the USMCA, disrupt the flow of these materials, increasing costs and complicating supply chains. For instance, Canadian paper, used in some hybrid 3D printing processes, now carries a 25% tariff, forcing manufacturers to either absorb these costs or seek pricier domestic alternatives. This shift challenges the economic viability of projects that depend on low-cost inputs, particularly for small and mid-sized enterprises operating on tight margins.

The Trump tariff impact on 3D printing market also reverberates through the global competitiveness of U.S. firms. American companies that export 3D-printed parts or printers face the risk of retaliatory tariffs from affected countries. China, for example, could impose duties on U.S.-made additive manufacturing products, limiting their market reach in Asia. Similarly, Canada and Mexico, integral to North American supply chains, might retaliate, further isolating U.S. manufacturers. This tit-for-tat escalation threatens to undermine the collaborative spirit that has driven innovation in the 3D printing industry, where the sharing of ideas and resources across borders has been a key growth driver.

Moreover, the Trump tariff impact on 3D printing market influences investment and research within the sector. As costs rise, companies may redirect funds from innovation to offsetting tariff-related expenses, slowing the pace of technological advancement. This is particularly concerning for additive manufacturing, an industry still in its growth phase, where breakthroughs in materials science and printing speed are critical to mainstream adoption. The tariffs could also deter foreign investment in U.S. 3D printing ventures, as international firms weigh the risks of operating in a protectionist environment. Collectively, these dimensions illustrate a complex web of challenges that the industry must navigate in response to shifting trade policies.

Exploring the Opportunities and Challenges Arising from the Trump Tariff Impact on 3D Printing Market in Depth

The Trump tariff impact on 3D printing market presents a dual-edged sword, offering both opportunities for growth and significant challenges that test the industry’s resilience. On the opportunity side, the push for domestic production aligns with the inherent strengths of additive manufacturing. Unlike traditional manufacturing, which often requires extensive infrastructure, 3D printing enables distributed production—small-scale, localized facilities that can operate closer to demand centers. This flexibility positions the industry to capitalize on the tariffs by reducing reliance on imports and building a more self-sufficient U.S. supply chain. Companies like A3D Manufacturing, which emphasize on-demand production, exemplify how the Trump tariff impact on 3D printing market could drive a shift toward nearshoring and reshoring.

Another opportunity tied to the Trump tariff impact on 3D printing market lies in innovation. The pressure to circumvent rising costs could accelerate the development of alternative materials, such as bio-based filaments or recycled powders, reducing dependence on foreign suppliers. Additionally, the tariffs may bolster sectors like aerospace and defense, where 3D printing is already gaining traction. With Elon Musk’s influence in the Trump administration and his support for additive manufacturing at SpaceX, there’s potential for increased government investment in 3D printing to support military and commercial goals. This could lead to a surge in demand for domestically produced printers and parts, offsetting some of the tariff-induced losses.

However, the challenges posed by the Trump tariff impact on 3D printing market are equally formidable. The most pressing issue is the immediate cost increase, which threatens the affordability that has made 3D printing accessible to a broad audience. For small businesses and startups, already operating on razor-thin margins, these added expenses could be crippling, potentially stifling innovation and market entry. The lack of domestic infrastructure to replace imported goods exacerbates this challenge. While the idea of onshoring production is appealing, the U.S. lacks the scale and expertise of countries like China, where the additive manufacturing ecosystem is more mature. Bridging this gap requires significant investment and time—luxuries the industry may not have amidst rapid tariff implementation.

The Trump tariff impact on 3D printing market also introduces supply chain vulnerabilities. Companies accustomed to just-in-time delivery of materials from Canada or Mexico now face delays and higher costs, disrupting production schedules. Retaliatory tariffs further complicate exports, limiting the global reach of U.S. 3D printing firms at a time when international markets are crucial for growth. These challenges underscore the tension between the tariffs’ protectionist aims and the globalized nature of additive manufacturing, forcing the industry to adapt under pressure while seeking pathways to thrive.

Proposing Viable Solutions to Mitigate the Trump Tariff Impact on 3D Printing Market and Ensure Industry Resilience

Addressing the Trump tariff impact on 3D printing market requires a strategic blend of adaptation, innovation, and collaboration to safeguard the industry’s future. One of the most promising solutions is the acceleration of domestic production capabilities. By investing in U.S.-based manufacturing of 3D printers and materials, companies can reduce their exposure to tariffs. This approach aligns with the administration’s goals and leverages the unique advantages of additive manufacturing, such as its ability to produce small batches efficiently. Government incentives, such as tax breaks or grants for firms that onshore production, could catalyze this shift, helping bridge the gap between current capacity and industry needs.

Another solution to the Trump tariff impact on 3D printing market involves diversifying supply chains. Rather than relying solely on China, Canada, or Mexico, companies can explore alternative sourcing from tariff-exempt countries or invest in regional hubs within the U.S. Nearshoring to countries like Vietnam or India, which have growing 3D printing capabilities, could also mitigate costs while maintaining quality. This diversification requires upfront investment but offers long-term stability, reducing the risk of future trade disruptions. Additionally, partnerships with local manufacturers can enhance scalability, ensuring a steady supply of critical inputs like filaments and powders.

Innovation serves as a cornerstone for overcoming the Trump tariff impact on 3D printing market. Companies can prioritize research into alternative materials that can be sourced or produced domestically, such as recycled plastics or bio-based polymers. Advancements in printer technology, such as faster or more energy-efficient models, could also offset rising costs by improving productivity. Collaborative efforts between industry leaders, universities, and government agencies can accelerate these developments, pooling resources to tackle tariff-related challenges. For example, initiatives like digital inventories—virtual stockpiles of designs that can be printed locally—could minimize the need for physical imports, aligning with the distributed manufacturing ethos of 3D printing.

Finally, advocacy and policy engagement are vital to softening the Trump tariff impact on 3D printing market. Industry associations, such as PRINTING United Alliance, can lobby for exemptions or reduced rates on essential 3D printing inputs, arguing their strategic importance to U.S. manufacturing. Highlighting the industry’s role in job creation and technological leadership could sway policymakers to adopt a more balanced approach. By combining these solutions—domestic investment, supply chain diversification, innovation, and advocacy—the 3D printing industry can not only weather the tariff storm but emerge stronger, more resilient, and better positioned for future growth.

Navigating the Future Amid the Trump Tariff Impact on 3D Printing Market

The Trump tariff impact on 3D printing market represents a pivotal moment for an industry at the crossroads of innovation and economic policy. As tariffs reshape the cost structures and supply chains of additive manufacturing, the sector faces a blend of disruption and opportunity. Rising costs and global trade tensions challenge the affordability and reach of 3D printing, yet they also spur a reevaluation of production strategies that could strengthen domestic capabilities. The path forward lies in adaptability—leveraging the industry’s inherent flexibility to innovate, diversify, and advocate for supportive policies. While the full scope of the Trump tariff impact on 3D printing market will unfold over time, proactive measures can ensure that this transformative technology continues to thrive in an evolving economic landscape.

FAQs

What is the Trump tariff impact on 3D printing market?

The Trump tariff impact on 3D printing market refers to the economic effects of tariffs imposed by the Trump administration on imports from countries like China, Canada, and Mexico, increasing costs for equipment, materials, and supply chains in the additive manufacturing industry.

How do tariffs affect the 3D printing industry?

Tariffs raise the cost of imported 3D printers, raw materials like metal powders and filaments, and components, disrupting supply chains and potentially slowing adoption while encouraging domestic production in the 3D printing industry.

What opportunities arise from the Trump tariff impact on 3D printing market?

The Trump tariff impact on 3D printing market creates opportunities for domestic manufacturing, innovation in alternative materials, and localized production, aligning with the strengths of additive manufacturing.

What challenges does the 3D printing sector face due to Trump tariffs?

Challenges include higher costs, supply chain disruptions, limited domestic infrastructure, and potential retaliatory tariffs, all of which strain the 3D printing sector’s affordability and global competitiveness.

How can the 3D printing industry mitigate the Trump tariff impact?

The industry can mitigate the Trump tariff impact on 3D printing market by investing in domestic production, diversifying supply chains, innovating with new materials, and advocating for policy support to reduce tariff burdens.