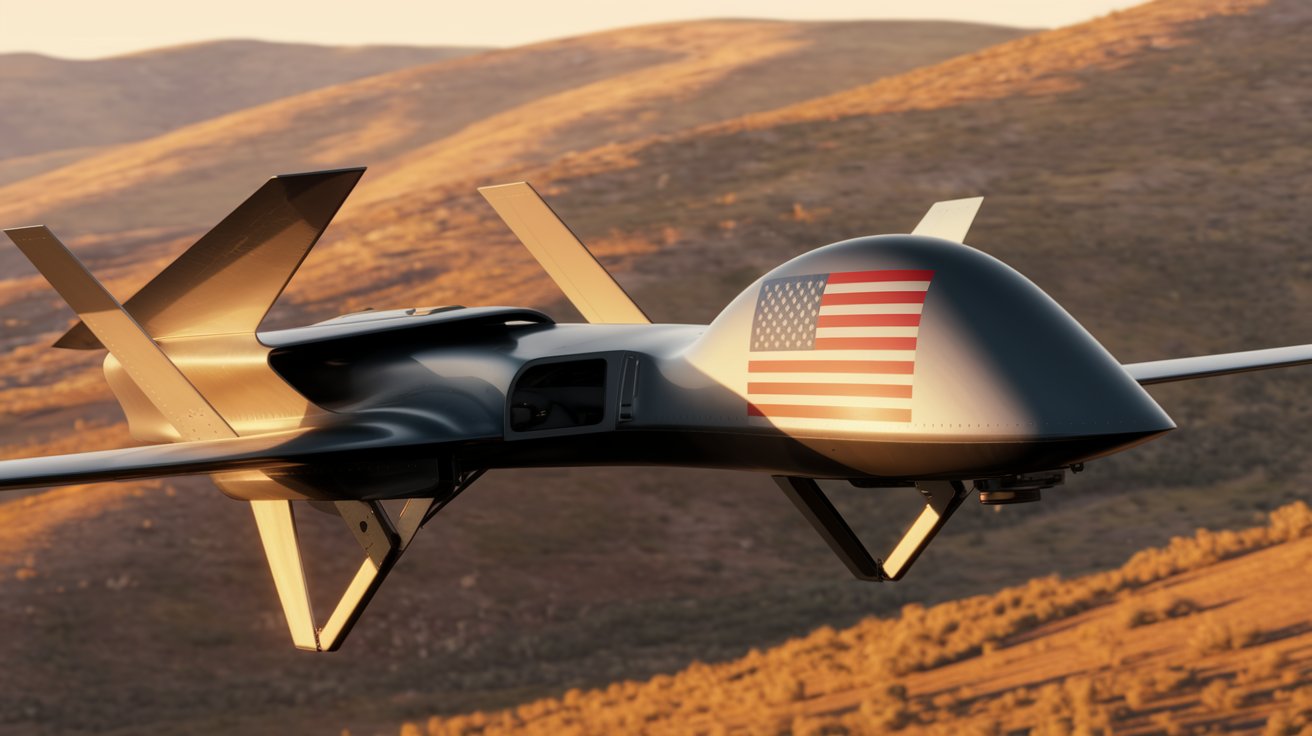

The U.S. military drone industry stands at the intersection of national security and global commerce. As tensions between the U.S. and China escalated during the Trump administration, the introduction of sweeping tariffs—especially on high-tech imports—dramatically disrupted critical supply chains.

Now, several years later, the effects of these policies continue to ripple through the platform design, propulsion systems, and applications of military drones. This article examines how Trump-era tariffs forced a realignment in defense procurement strategies, reshaped innovation pipelines, and exposed vulnerabilities in the United States’ reliance on foreign drone technology.

Request US Tariff Impact Analysis Now @ https://www.marketsandmarkets.com/forms/ctaTariffImpact.asp?id=221577711

1. Platforms: Shifting Design Choices and Supplier Dependencies

Small Drones (sUAS)

Small drones, particularly those used by infantry units and special operations forces for surveillance and reconnaissance, were hit hardest. These platforms often depend on low-cost Chinese electronics, such as flight controllers, GPS modules, and cameras. Tariffs raised costs by up to 25%, prompting the U.S. Department of Defense (DoD) to blacklist several Chinese drone manufacturers, notably DJI.

Key Impacts:

-

Delays in procurement cycles as compliant alternatives were sourced.

-

Surge in funding to domestic drone startups like Skydio, Teal Drones, and Parrot.

-

Development of “Blue UAS” program to establish trusted supply chains.

Tactical and Strategic Drones

Larger drones used for long-range missions, including ISR (Intelligence, Surveillance & Reconnaissance) and combat roles, rely on sophisticated avionics and structural materials like carbon composites and titanium—many of which were tariffed.

Resulting Trends:

-

Reassessment of supply chain sourcing for materials and subsystems.

-

Increased investment in Made-in-America drone infrastructure.

-

Slower production timelines due to qualification of new vendors.

2. Propulsion Systems: Fuel vs Battery in a Tariffed World

Battery-Powered Systems

China dominates global lithium-ion battery production, supplying over 70% of drone batteries prior to the tariffs. Trump’s 10–25% tariffs on Chinese-made batteries and electronic components made battery-powered drones more expensive and harder to produce at scale.

Consequences:

-

Shift to South Korean and U.S.-based battery suppliers.

-

Decrease in flight time and range during the transition due to energy density limitations in alternative cells.

-

Push for innovation in solid-state batteries and other energy storage solutions.

Fuel-Powered Systems

Larger drones, such as those used by the U.S. Air Force and Navy, rely on fuel-based propulsion systems (including turboprops and piston engines). While less dependent on Chinese parts, some imported engine components and alloys were subject to tariffs.

Key Takeaways:

-

Increase in engine production costs and longer maintenance cycles.

-

Acceleration of U.S. engine R&D initiatives for drone-specific propulsion units.

-

Greater interest in hybrid propulsion models for medium-endurance UAVs.

3. Applications: Tactical Adjustments and Budget Reallocations

ISR (Intelligence, Surveillance, and Reconnaissance)

ISR drones rely heavily on high-fidelity optical, thermal, and radar sensors—components that were commonly imported or assembled abroad. Tariffs and export controls disrupted availability, leading to mission-critical delays.

Industry Response:

-

Surge in U.S.-based EO/IR sensor startups.

-

Collaborations with allies (e.g., Israel and NATO countries) to co-develop sensor packages.

-

Greater integration of AI-based analytics to extract more data from fewer flights.

UCAVs (Unmanned Combat Aerial Vehicles)

UCAVs were less directly affected by tariffs due to their typically classified or domestically developed nature. However, supply chain friction still affected non-critical systems like comms gear and composite shells.

Highlights:

-

UCAV programs were shielded by military waivers, but subcontractors bore the brunt of cost overruns.

-

Emergence of more modular designs to future-proof platforms against supplier volatility.

-

Reallocation of budgets from hardware to AI and autonomy software.

Delivery Drones

Drones used for battlefield logistics and resupply missions rely on lightweight materials and compact propulsion—many of which were tariff-affected. Their adoption in field trials slowed down between 2018–2021 due to rising costs.

Evolution:

-

Military pivoted to 3D printing of components on base to reduce reliance on imported parts.

-

Focus on dual-use commercial logistics drones with military-grade modifications.

-

Expanded testing in non-combat roles like medical delivery and base support.

Strategic Implications

The Trump tariffs, while politically motivated, created a strategic wake-up call for the defense industry. They revealed just how dependent U.S. drone programs were on foreign—especially Chinese—technologies. In response, the Pentagon adopted a multi-pronged strategy to mitigate risk:

-

Supply Chain Diversification: Proactively seeking non-Chinese suppliers, especially in Southeast Asia and North America.

-

Domestic Innovation Incentives: Funding drone R&D through programs like DIU and AFWERX.

-

Policy Realignment: Creation of secure sourcing standards like the DoD’s Trusted Capital Marketplace.

Future Outlook

The impact of the Trump tariffs on military drone platforms, propulsion systems, and applications has been profound—triggering both short-term pain and long-term adaptation. While procurement costs rose and timelines were disrupted, the strategic push for domestic capability and supply chain resilience has begun to pay dividends.

As the global military drone market continues to evolve through 2028, defense agencies and manufacturers must balance cost efficiency, geopolitical awareness, and technological self-reliance in equal measure.