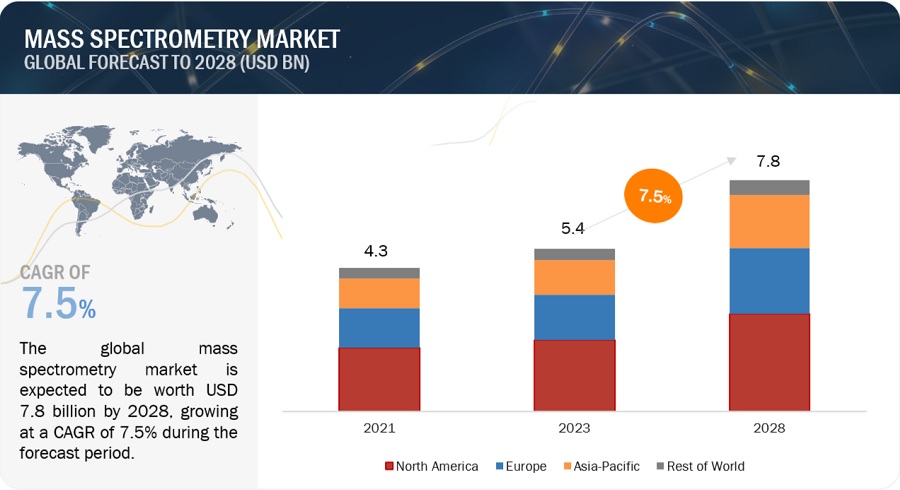

The global mass spectrometry market, valued at $5.4 billion in 2023, is projected to reach $7.8 billion by 2028, expanding at a CAGR of 7.5% from 2023 to 2028. A new research study provides an in-depth analysis of industry trends, pricing, patents, conference and webinar materials, key stakeholders, and market buying behavior. The growth in the clinical mass spectrometry market is driven by increased pharmaceutical R&D spending, stringent government drug safety regulations, a focus on food quality, rising crude and shale gas production, and government initiatives for pollution control.

Mass Spectrometry – Key Market Dynamics

Drivers: Increased R&D Investments in Pharmaceutical and Biotechnology

R&D spending in the pharmaceutical and biotechnology sectors has risen significantly, particularly in biopharmaceuticals and personalized medicine. The 2022 EU Industrial R&D Investment Scoreboard reports that these sectors account for 21.5% of global R&D expenditure. Mass spectrometry is integral to pharmaceutical research, from early drug discovery to clinical trials, making increased funding a key driver for market growth.

Restraints: High Costs of Premium Products

Mass spectrometry instruments, equipped with advanced features, are expensive. Compliance costs further add to their high price, making them less accessible to academic research labs with limited budgets. The high capital cost influences the purchasing decisions of end users, limiting the adoption of mass spectrometry systems.

Opportunities: Growth in Emerging Markets

Emerging markets like China and India offer significant growth opportunities due to their robust biopharmaceutical industries and numerous Greenfield projects. Key industry players are establishing new facilities and R&D centers in these regions, capitalizing on the growing demand for mass spectrometry instruments.

Challenges: Shortage of Skilled Professionals

The effective use of mass spectrometry equipment requires skilled personnel. Errors in sample handling and preparation can affect results, while a lack of knowledge in technology selection can incur additional costs. The shortage of skilled professionals for method development, validation, and troubleshooting is a significant challenge for the market.

Mass Spectrometry Market Segmentation

By Product

- Instruments: Hybrid mass spectrometers dominate this segment due to their rapid and high-resolution testing capabilities.

- Software & Services

By Sample Preparation Technique

- LC-MS: Leading segment due to its high sensitivity and ability to identify a broad range of compounds with minimal preparation.

- GC-MS

- ICP-MS

- Others

By Application

- OMICS Research: Expected to grow significantly, driven by advancements in diagnostics and biomarker identification.

- Drug Discovery

- Environmental Testing

- Food Testing

- Pharma-Biopharma Manufacturing

- Clinical Diagnostics

- Applied Industries

- Other Applications

By End User

- Pharmaceutical Companies: Fastest-growing segment, supported by global expansion and technological advancements.

- Biotechnology Companies

- Research Labs & Academic Institutes

- Environmental Testing Labs

- F&B Industry

- Forensic Labs

- Petrochemical Industry

- Other End Users

Mass Spectrometry Market – Regional Insights

North America

North America, particularly the US and Canada, held the largest market share in 2021. The region benefits from significant research funding, government initiatives, and extensive use of mass spectrometry in various sectors.

Prominent Market Players

- SCIEX AB (US)

- Thermo Fisher Scientific (US)

- Agilent Technologies (US)

- Waters Corporation (US)

- PerkinElmer Inc. (US)

- Shimadzu Corporation (Japan)

- Bruker Corporation (US)

- Analytik Jena (Germany)

- JEOL Ltd. (Japan)

- Hiden Analytical (UK)

- MKS Instruments (US)

Recent Developments

- Thermo Fisher and Symphogen (Jan 2022): Extended collaboration to simplify characterization and quality monitoring of complex therapeutic proteins.

- SCIEX and HighRes Biosolutions (Feb 2023): Collaborated to provide customizable automation solutions for the Echo MS system.

- Waters Corporation (Feb 2022): Acquired Charge Detection Mass Spectrometry technology from Megadalton Solutions to enhance cell and gene therapy applications.

- Agilent Technologies and MOBILion Systems (Sep 2022): Partnered to integrate ion mobility separation technology into Q-TOF mass spectrometers.

Conclusion

The global mass spectrometry market is set for significant growth, driven by increased R&D investment and expanding opportunities in emerging markets. However, high costs and a shortage of skilled professionals remain challenges. Key industry players are continuously innovating and forming strategic partnerships to capitalize on market opportunities and drive future growth.