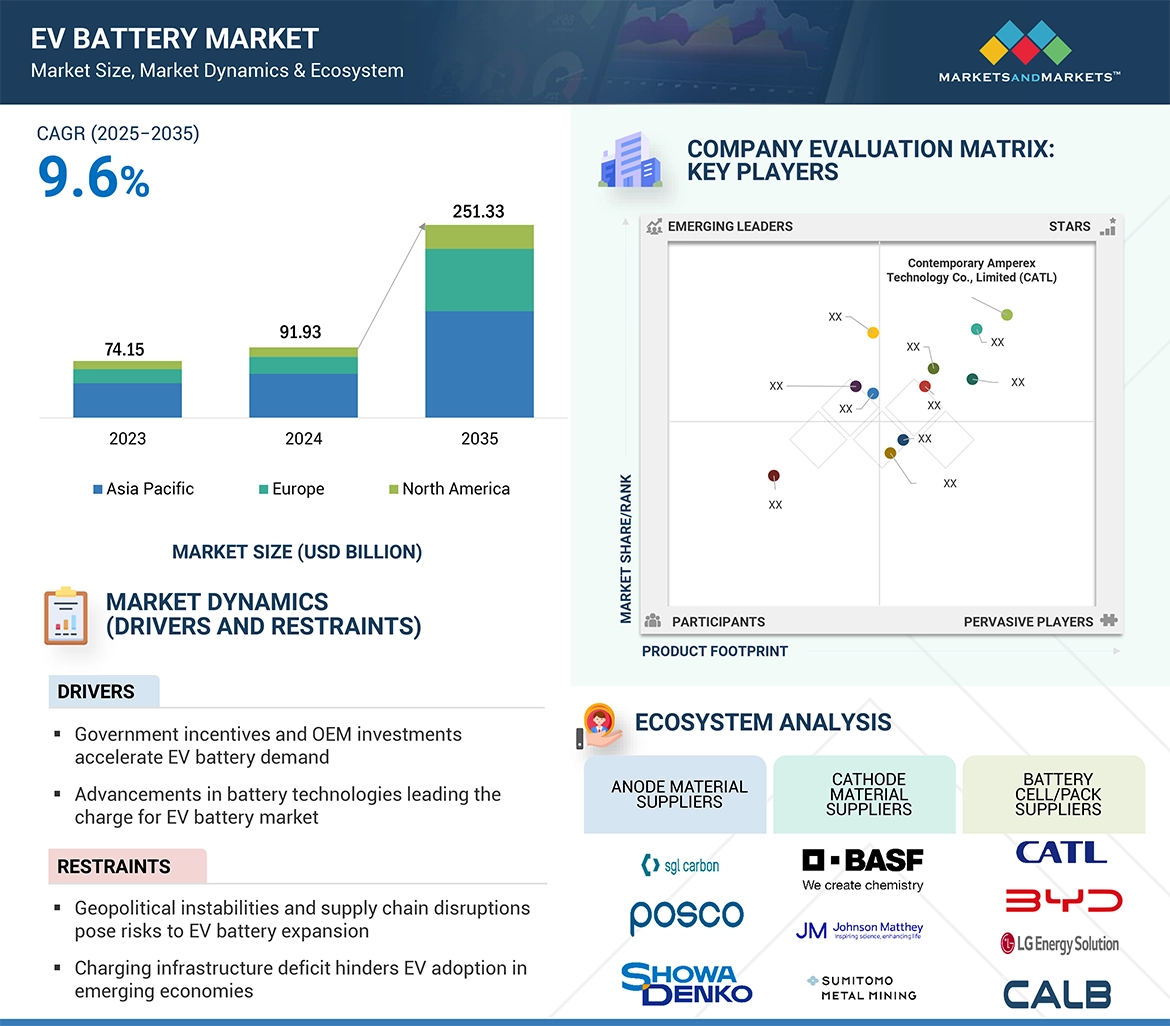

The global EV battery market size was valued at USD 91.93 billion in 2024 and is expected to reach USD 251.33 billion by 2035, at a CAGR of 9.6%, during the forecast period 2024-2035. The EV battery market is expanding rapidly, fueled by increasing electric vehicle (EV) adoption, technological advancements, and supportive government policies aimed at reducing emissions. In October 2023, Tesla announced plans to introduce dry cathodes in Cybertruck batteries by 2026, which promise higher energy density and efficiency.

The electric vehicle (EV) battery market is set for significant growth, driven by increasing EV adoption, advancements in battery technologies, and supportive government policies. As of January 2025, growing concerns over climate change and the push for reduced emissions are boosting demand for EVs. Investments in battery production are rising, with notable partnerships, such as General Motors selecting Vianode as its anode graphite supplier to improve EV battery performance and sustainability. Government incentives, like the US Department of Energy planning to grant over USD 3 billion in September 2024 for domestic EV battery production, further support the market. Additionally, advancements in battery chemistries and the growing demand for long-range, fast-charging EVs are enhancing market opportunities. The shift toward electric commercial vehicles is also driving demand for high-capacity batteries, further expanding the market.

Global EV Battery Market Ecosystem Analysis

The EV battery market thrives on a complex ecosystem. This intricate network involves various stages, starting with raw material suppliers like Glencore, who extract and process critical elements such as lithium, cobalt, and nickel. These materials then flow to anode material suppliers like SGL Carbon, who produce graphite anodes, a crucial component of the battery cell. Cathode material suppliers such as BASF play a vital role in producing materials like lithium cobalt oxide (LCO) and lithium iron phosphate (LFP) for the cathode. Subsequently, battery cell/pack suppliers like CATL, BYD, and LG Energy Solution assemble these components into high-performance battery cells and packs. Finally, OEMs such as Tesla, BMW, NIO, and others integrate these batteries into their electric vehicles, completing the cycle. This interconnected ecosystem drives innovation and ensures the continuous development and advancement of EV battery technology.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=100188347

Lithium-ion batteries expected to dominate the market during forecast period

In the EV battery market, lithium-ion batteries are expected to maintain the largest market share due to their technological maturity, reliability, and safety. Decades of development and refinement have resulted in high energy density, longer lifespans, faster charging, and improved safety features, making them the preferred choice for EV producers. Their decreasing cost further drives demand, making EVs more affordable and accessible to consumers. Recent innovations continue to strengthen lithium-ion battery dominance. For instance, in April 2024, CATL launched its Shenxing PLUS, an LFP battery capable of delivering a range exceeding 1,000 km and supporting ultra-fast 4C charging. Similarly, in June 2024, CALB introduced its OS (One-Stop) lithium iron phosphate battery pack, designed specifically for BAIC electric vehicles. These advancements demonstrate the industry’s focus on enhancing performance and driving adoption.

North America to Account for Largest Market Size During Forecast Period

The research uses extensive secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the EV battery market. Primary sources, such as experts from related industries, OEMs, and suppliers, have been interviewed to obtain and verify critical information and assess the growth prospects and market estimations.

Key Players

The major players in the EV battery market include Contemporary Amperex Technology Co., Limited (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), CALB (China), and SK Innovation Co., Ltd. (South Korea). These companies offer various EV battery products and solutions and have strong global distribution networks. Companies are also actively launching new products and collaborating with other players to expand their market presence. For instance, in January 2025, SK On, a SK Innovation Co., Ltd. company, announced that it has signed a deal worth USD 1.8 billion with Nissan Motor Co., Ltd. (Japan) to supply batteries. SK On is set to supply batteries of 20 GWh capacity to Nissan’s vehicle assembly plants in US from 2028.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=100188347