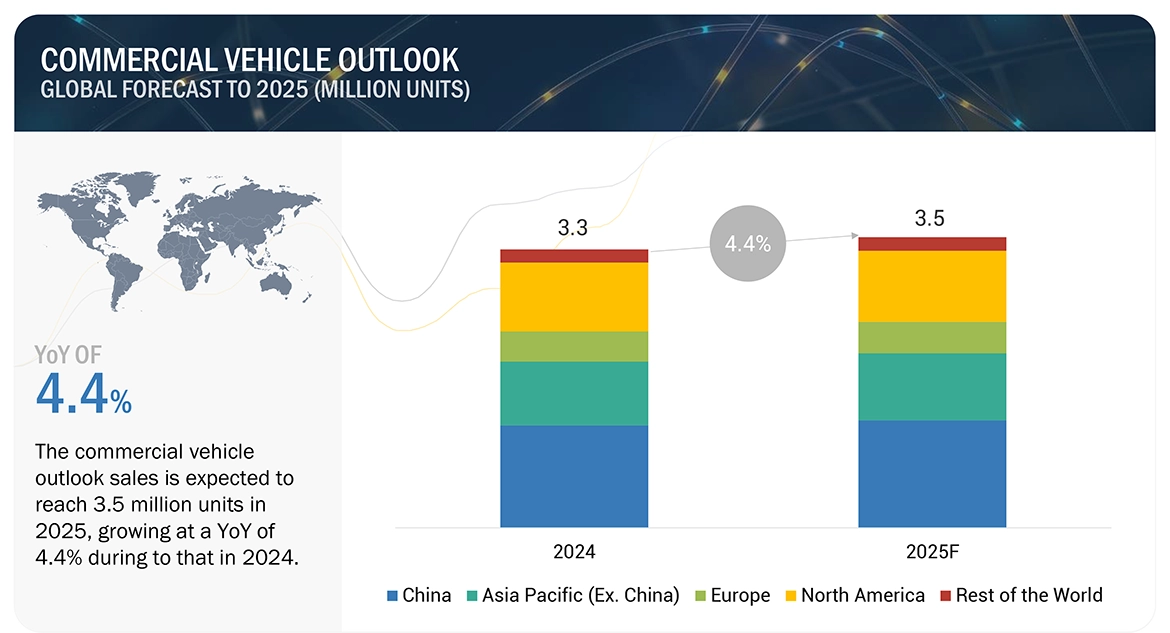

The global medium & heavy commercial vehicle sales were 3.3 million units in 2024 and are projected to reach 3.5 million units in 2025, witnessing a YoY growth of 4.4% from 2024 to 2025. Further, within the regional market Asia Pacific region accounted for almost half of the market share. While the Internal Combustion Engine (ICE) Vehicles held the major share, the Battery Electric Vehicles (BEV) segment is expected to grow at a higher rate over 2024-2025.

The growth of commercial vehicle sales is influenced by various factors, such as the Integration of Autonomous Technologies, Advancements in Energy Storage Systems (ESS), the emerging concept of Second Life Battery, and advancements in electrification and battery technologies.

Countries such as China, Brazil, South Korea, and India have increased their investments in the development of the automotive industry including commercial vehicles due to their growing urban population and economies. Due to such investments, the demand for commercial vehicles will be higher during the forecast period.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=260284800

Opportunity: New revenue pockets in North America and Northern Europe

North America is a high-growth market for electric commercial vehicles (ECVs). The region has witnessed a surge in demand for low-emission, fuel-efficient, high-performance vehicles due to stringent emission norms and the growing logistics sector. Growth opportunities are also available in Nordic countries, including Denmark, Finland, Iceland, Norway, and Sweden. Both North America and Northern Europe are actively investing in charging infrastructure to support the growing electric vehicle market. For instance, in January 2024, the US Department of Transportation granted USD 91.8 million to 20 states for the repair or replacement of 4,500 existing electric vehicle charging ports.

Additionally, the US Government aims to expand the nationwide network of chargers to 500,000 by 2030, which includes high-speed chargers, a maximum of 50 miles apart on the highways and interstates. Meanwhile, in Northern Europe, as of Early 2023, the region had 574,863 public charging points, a 44% increase from the previous year.

Challenge: Low availability of lithium for batteries

Lithium-ion battery manufacturers are experiencing major shortages with the growth in the demand for electric vehicles. The world only produces around 80,000 tons of lithium. While electric vehicle manufacturers are looking for alternatives to reduce the usage of lithium, a viable option is yet to be found. This would lead to lithium prices rising in the coming decade. OEMs are also developing solid-state battery technology to provide a longer range per EV charge. This is a significant challenge to the fast growth in EV demand, especially in countries that do not have lithium deposits.

Asia Pacific is anticipated to dominate the commercial vehicle market

Asia Pacific is estimated to lead global commercial vehicle sales in 2024 and China holds the dominant position in both heavy truck and buses sales inclusive of both ICE and electric propulsion. The growth is mainly attributed to factors such as rising urbanization rate, rapid industrialization, and a growing demand for efficient and sustainable transportation. China and Japan lead in the manufacturing and adoption of advanced commercial vehicle technologies. China features predominantly in electric vehicle adoption, which is supported by aggressive government policies. Alternatively, hydrogen fuel cell technologies for a long distance are promoted in Japan and South Korea. All these nations have an established manufacturing base, excellent R&D investments, and government incentives for switching to greener alternatives. The shift will be expedited towards zero-emission vehicles in 2025, primarily electric trucks and buses based on technological developments such as improved batteries, autonomous driving, and connectivity. Thus, a progressive approach toward energy-efficient transportation, improved charging infrastructure, and implementation of strict environmental regulations will demonstrate the transformation in logistics and urban transport, subsequently boosting the regional commercial vehicle market growth in 2025.

Key Players

The top commercial vehicle OEMs in the market are TATA Motors (India), AB Volvo (Sweden), Daimler AG (Germany), PACCAR Inc. (US), HINO (Japan), IVECO S.p.A (Italy), MAN (Germany), and Ashok Leyland (India). The other companies that support the automobile industry with technology development are CATL, Robert Bosch, ZF, and others. These companies adopted new product launches, acquisitions, partnerships, collaborations, and other key strategies to gain traction in the commercial vehicle market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=260284800