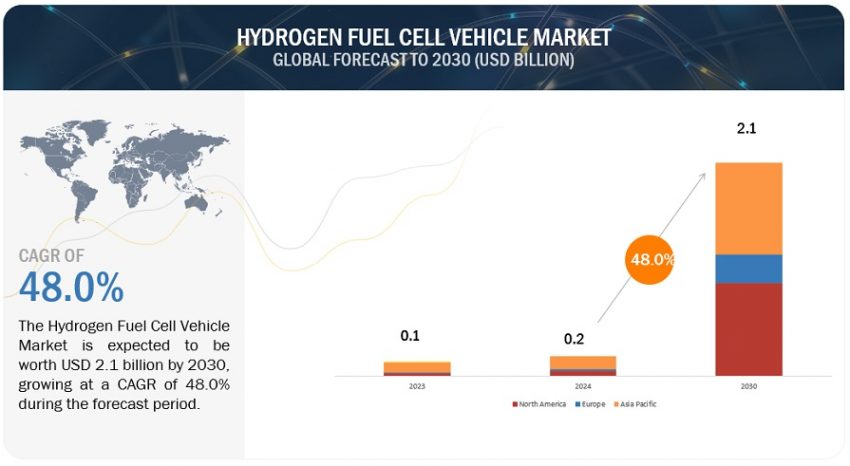

The global hydrogen fuel cell vehicle market size is valued at USD 0.2 billion in 2024 and is expected to reach USD 2.1 billion by 2030, at a CAGR of 48.0%, during the forecast period 2024 to 2030. Government subsidies for environmentally friendly hydrogen production, the development of an integrated hydrogen ecosystem, the launch of new generation H2 fuel vehicles, and OEM plans to establish their own H2 refueling ecosystems are all expected to boost the automotive fuel cell business.

Factors such as advancements in better fuel efficiency and increased driving range, rapid increase in investment and development for green hydrogen production, fast refueling, reduced oil dependency, and lower emissions compared to other vehicles are anticipated to contribute significantly to the revenue growth of the hydrogen fuel cell vehicle market. The evolution of fuel cells, combined with advancement in hydrogen technology, is poised to create favorable opportunities within this market.

Fuel Cell Hybrids with Battery Integration will form a promising product segment during forecast period

Fuel Cell Hybrid Electric Vehicles (FCHEVs) have emerged as a promising solution in the hydrogen fuel cell vehicle market, embodying a harmonious integration of fuel cell technology and secondary energy storage systems. Leading the way in this domain are upcoming models such as the Ford F-550 and H2X Warrego, showcasing the successful amalgamation of fuel cells and batteries in a single powertrain. These future models stand as pioneers, demonstrating the viability of FCHEVs, with automakers like Ford and H2X at the forefront. The popularity of FCHEVs is driven by their ability to address challenges faced by pure Fuel Cell Electric Vehicles (FCEVs). One of the key advantages of FCHEVs is their enhanced efficiency achieved by incorporating a secondary energy storage system, often taking the form of a battery. FCHEVs offer distinct advantages over their FCEV counterparts. Including a secondary battery facilitates smoother power delivery, reducing stress on the fuel cell and potentially extending its lifespan. Moreover, the presence of a battery enables energy recovery during braking, enhancing overall energy utilization. These factors make FCHEVs an appealing option for consumers looking for a cleaner and more efficient alternative to conventional vehicles. As technology advances and automakers refine their designs, FCHEVs are expected to play a crucial role in the transition toward sustainable and zero-emission transportation.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=14859789

Fuel Stack to act as growth catalysts in the Hydrogen fuel cell vehicle market

The rapid growth of the automotive fuel stack market can be attributed to several factors, including stringent emissions regulations, government incentives, technological advancements, and diverse applications of fuel cell vehicles (FCVs). The fuel cell stack, a crucial fuel cell system component, consists of two flow field plates and a Membrane Electrode Assembly (MEA). It generates electricity in the form of direct current (DC), requiring a DC/AC converter for conversion into alternating current (AC) suitable for AC applications in Fuel Cell Electric Vehicles (FCEVs). An individual fuel cell produces less than 1.16 V of electricity in automotive applications. Multiple fuel cells are stacked together to enhance power generation, forming what is commonly known as a fuel cell stack. The fuel cell stack is considered the fuel cell system’s most expensive component due to platinum’s inclusion. The stack size determines the fuel cell’s power output, and increasing the number of fuel cell stacks can amplify power generation. Stacks are equipped with end plates and connections for integration into Fuel Cell (FC) modules. As the stack size increases, the cost per unit of power generated decreases, making fuel cells an efficient option for long-range transportation.

Asia Oceania’s to lead the market with strong market demand in China

The Asia Oceania region has the largest H2 refueling station presence, with strong government support for setup across Japan, China and South Korea. This is driving the expansion of hydrogen stations and FCEVs in the region. They are also fostering the growth of FCEVs with an evolving hydrogen ecosystem in the hydrogen automotive fuel cell vehicle market. Leading OEMs such as Toyota and Hyundai are driving the adoption of fuel cell cars across the region. Countries have planned use of fuel cell buses and trucks, with companies such as Ballard playing key roles in developing an extensive FCEV bus & truck ecosystem. Leading factors such as growing deployment of H2 buses such as in Kansai Airport (Japan), mass deployment of H2 buses in China along with companies like Solaris and West Midlands deploying H2 fuel cell buses in Australia. In the H2 truck industry, companies such as SINOTRUK, BAIC, Hyundai, Sym.Pjg, among others are deploying heavy- duty hydrogen fuel cell trucks in the region.

Key Market Players

The hydrogen fuel cell vehicle market is dominated by companies such as Toyota Motor Corporation (Japan), Hyundai Group (South Korea), Honda (Japan), General Motors (US), Stellantis (Netherlands) among others.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=14859789