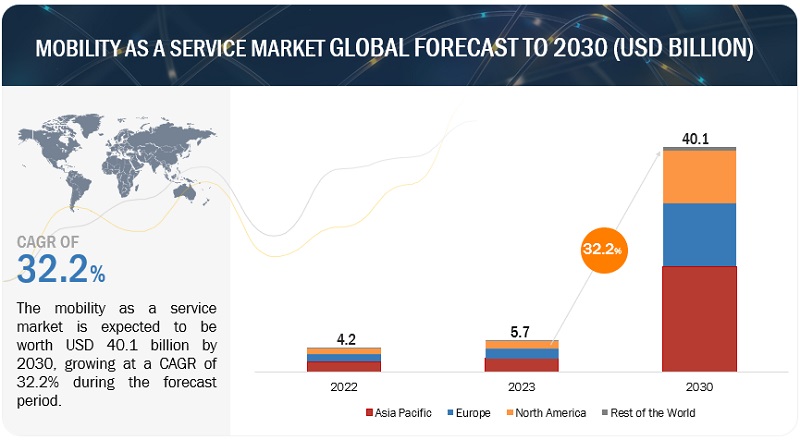

The global mobility as a service market size is valued at USD 5.7 billion in 2023 and is expected to reach USD 40.1 billion by 2030, at a CAGR of 32.2% over the forecast period. With rapid urbanization, congestion and traffic-related challenges are increasing. MaaS offers a solution by providing users with multimodal transportation options, which in turn reduces the number of private vehicles on the road, and alleviates traffic congestion. In most cases, these services are flexible and highly customized per independent user. Faster internet connectivity, falling vehicle ownership, and the need to reduce traffic congestion and vehicular emissions will fuel the demand for seamless MaaS applications for end-to-end multimodal transport solutions.

Mobility as a Service Market Dynamics

Driver: Improvements in 4G/5G infrastructure and penetration of smartphones

As an internet-enabled service, connectivity is a basic requirement for MaaS. According to the International Telecommunication Union, by the end of 2023, an estimated 64.4% of the global population, or 5.16 billion people, will be using the Internet. Smartphones are vital infrastructure for new mobility models since mobility services like ride-sharing run on smartphones and require good connectivity. Over the last few years, smartphone use has increased significantly across the world, with developed countries accounting for around 80% of smartphone ownership.

5G network and better telecom infrastructure are expected to pave the way for a revolution in cities and in inter-city mobility. Wireless communication technologies (such as DSRC) can help improve traffic safety and increase traffic flow throughput. With onboard units (OBU), connected and automated vehicles (CAVs) can reduce the driver’s perception-reaction time and improve safety. Vehicular communication can enable CAVs to collect information from other vehicles and roadside units (RSUs) and coordinate with other CAVs to control and manage the platoon, such as merging, splitting, and maintaining a particular gap. The ongoing development of OBU, RSU, etc., enables and enhances the MaaS of vehicle platooning and would require better and faster telecom infrastructure. Hence, the increasing penetration of smartphones with efficient telecom infrastructure will not only assist vehicle platooning for MaaS but also assist in seamless navigation and payment services through MaaS mobile applications.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=78519888

Opportunities: Inclusion of on-demand ferry and freight services

Urban transportation systems are usually run by state-owned mobility as a service companies, while intercity transport is mostly run by private entities. Thus, pricing for urban transportation is not flexible in general, while ferries (and airlines as well) adopt flexible pricing schemes based on modern revenue-management techniques. With the advent of electrification, automation, and process digitalization, transportation is becoming a high-technological-opportunity industry where profitability promotes innovation. These principles easily apply to MaaS and, more specifically, MaaS in the ferry industry.

In the urban context, mobility is largely based on transport mode ownership. Hence, MaaS aspires to transform the existing asset ownership model into a subscription-based mobility model. However, in the case of sea passenger transportation, very few people own a vehicle (i.e., a ship/catamaran/yacht, etc). Consequently, for sea trips, the main objective of MaaS is to fill the need for an integrated system that offers different transport solutions together and consolidates trip planning and ticketing for every part of the total trip.

Challenges: Difficulty in integrating ticketing and payment systems

In order to accomplish complete implementation of MaaS it is important to integrate payment of all the transport modes used in a single app. Thus, the user can manage the entire transportation experience through the MaaS app instead of being redirected to another app or another external system to pay for the ticket. The involvement of different ticketing and payment gateways and the lack of an account-based system has proved to be inconvenient for users, deterring them from adopting MaaS applications.

Seamless partner settlements and financial management are important to encourage a critical mass of operators to participate in a single MaaS platform. The higher the number of transportation providers, the greater the appeal of the application for users.

Asia Pacific region holds the largest market share in the mobility as a service market in terms of value.

Asia Pacific owing to its large population will hold a significant share of the MaaS market. The region is a growing market for mobility as a service, with China (a global hub for EVs) and Japan (an important automotive hub with a focus on autonomous vehicles) being the major countries driving growth. The presence of prominent ride-sharing providers, MaaS applications, and automotive OEMs such as Uber, Grab, Didi, Toyota, Hyundai, and Honda are expected to prompt product development and push automakers to adopt the technology in their models. A high population growth rate in the region, as well as increasing urbanization, have intensified the need for efficient transportation. Developing countries in the Asia Pacific, especially India, and Indonesia, are projected to experience significant growth in urban transportation, while most other countries are also shifting their focus to smart personal mobility to reduce travel time and congestion. China, being a hub for electric vehicles, is expected to showcase increasing demand for MaaS due to the increasing sales of EVs. The Asia Pacific mobility market is also expected to be driven by the emergence of MaaS in Singapore, Indonesia, and India.

Key Market Players

The global mobility as a service market is led by established players, such as Moovit (Israel), MaaS Global (Finland), Citymapper (UK), FOD Mobility UK Ltd. (UK), and SkedGo (Australia), all of which adopted several strategies to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=78519888