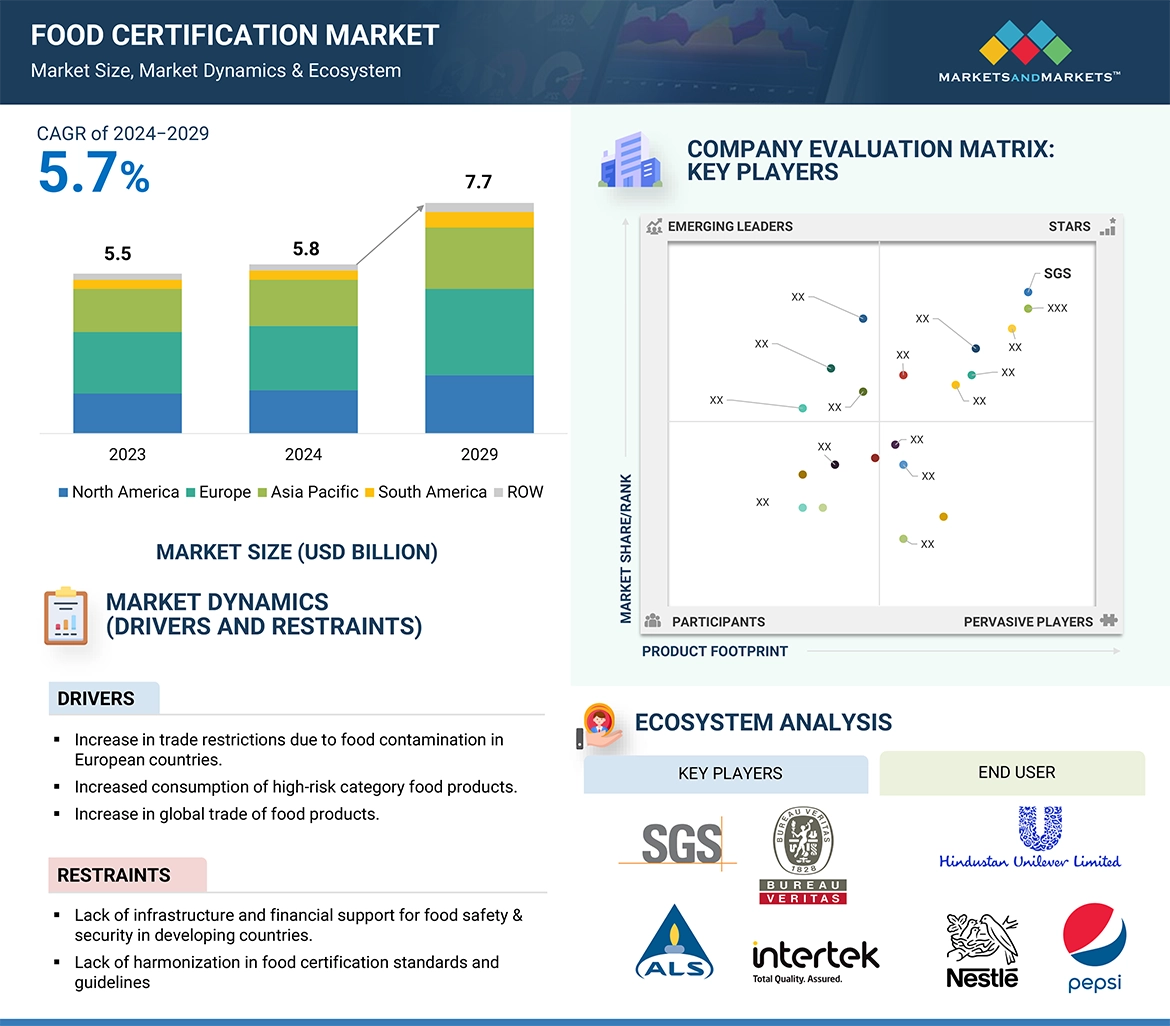

The global food certification market has been estimated to be USD 5.85 billion in 2024 and is projected to grow USD 7.72 in 2029 at a rate of 5.7% between 2024 and 2029. Food safety is becoming a critical focus throughout the supply chain, presenting significant business opportunities in the food certification market. As consumers increasingly prioritize safe food, the demand for certifications has surged. Food certification plays a vital role in food processing and production, enhancing consumer confidence by ensuring safety and quality standards. These certifications cover compliance across food safety, packaging, materials, storage, and distribution for producers, manufacturers, and distributors. Growing consumer awareness has prompted major global retailers to require supplier certifications like ISO 22000, SQF, BRC, IFS, USDA Organic, Halal, and Kosher. International trade has further fueled market growth, particularly in developing countries, as they need to comply with the food standards of importing nations. As food safety risks persist across the supply chain, certification demand continues to rise, driving market expansion.

Food Certification Market Drivers: Consumer demand for food transparency and credibility

Consumer demand for transparency is significantly shaping the food industry. Many consumers are opting for healthier ingredients, fresher products, and options that reduce environmental impact, both in food and packaging. Premium products are associated with specific sources of raw materials, high quality, good manufacturing practices, and natural ingredients. There is an increasing demand for premium, branded, and well-labeled products as consumers seek a healthier lifestyle. This trend of premiumization among manufacturers is expected to encourage consumer demand for certified food products.

Stakeholders are focusing on certifications to enhance product transparency and foster long-term customer loyalty. As consumer preference for ingredient traceability grows, there is a projected increase in demand for “free-from” certifications, including allergen-free, organic, and non-GMO labels. This rising interest in certification labels further encourages manufacturers and brands to adopt them, aligning with the needs of their target consumers. In a survey conducted by the International Food Information Council Foundation (IFICF) regarding food safety and low-calorie sweeteners, 30% of respondents believe that companies should be responsible for reviewing the safety of these products. While most respondents hold the government accountable, a notable percentage also believe that manufacturers and sellers should share this responsibility. Additionally, one-quarter of participants expressed uncertainty about who should ensure the safety of low-calorie sweeteners.

This perception that companies should oversee safety reviews could potentially influence the food certification market. If a significant number of consumers and stakeholders feel that companies should shoulder this responsibility, it may lead to an increased demand for certifications and regulatory standards focused specifically on the safety assessment of low-calorie sweeteners. This could create new opportunities for certification bodies and regulatory agencies to develop specialized certifications and guidelines to ensure the safety of these products. Furthermore, companies in the low-calorie sweetener market may seek these certifications to build consumer trust and differentiate themselves from competitors, thereby driving growth in the food certification market in this area.

The meat, poultry & seafood segment accounted for the largest during the forecast period.

Meat and meat products fall under high-risk food categories. They are highly susceptible to bacterial growth and microbial contamination. The significant increase in meat consumption over recent years underscores the necessity for stringent food certification standards to ensure the safety and authenticity of meat, including Halal and Kosher options. According to the FAO, global meat production in 2020 remained steady at approximately 328 million metric tons (Mt). Increased production of poultry and sheep meat balanced the decline in pig and bovine meat production. Poultry meat production reached an estimated 134 Mt, representing a 1.2% growth compared to 2019, driven largely by high demand in China. The outbreak of African Swine Fever (ASF) notably impacted pig meat production in East Asia, especially in China, leading to reduced output. Additionally, several major producing countries, including Australia, New Zealand, and the European Union, faced declines in bovine meat production due to limited availability of slaughter animals and regulations regarding animal welfare, purchasing, and transportation in countries like India.

North America dominated the food certification market during the forecast period.

The market in the region is primarily driven by stringent food safety regulations imposed by governments in North American countries for imported goods. In 2022, the US dominated the North American market, holding an 86% share. Initiatives by the US government regarding certification and accreditation services provided by organizations such as the ANSI-ASQ National Accreditation Board (ANAB) and the American National Standards Institute (ANSI) are expected to boost the growth of the food certification market in the country. Additionally, the US government promotes various food certifications, including Safe Food Quality (SQF), GlobalGAP, British Retail Consortium (BRC), International Featured Standards (IFS), HACCP, and ISO 22000. This promotion is another key factor contributing to the growth of the food certification market in the US.

Leading Food Certification Companies:

The report profiles key players such as DEKRA (Germany), SGS (France), Intertek Group plc (UK), AsureQuality (New Zealand), Bureau Veritas (France), LQRA (UK), DNV (Norway), TÜV SÜD (Germany), Kiwa (Netherlands), ALS (US), UL LLC (US), EAGLE Certification Group (US), INTL Certification Limited (UK), Assurecloud (Africa), and Control Union Certifications (Netherlands).

Food Certification Industry Recent Developments:

- April 2023, Acquisition, Intertek Group plc, Analitico Análises Técnicas Ltda (Brazil). The acquisition of Controle Analítico provides an appealing and complementary opportunity for Intertek Group plc to enhance its leading Food and Agri Total Quality Assurance (TQA) solutions in Brazil by broadening its presence and service offerings in the environmental testing market.

- In July 2022, DNV acquired The Registrar Company (TRC), a family-owned certification body providing certification and training services to SMEs in North America. The acquisition expands and strengthens DNV’s certification and training services to small and medium enterprises in North America.

- In January 2022, Bureau Veritas entered into an agreement with Avena Foods Limited to provide onsite laboratory testing services at their Avena Purity Protocol facility located in Regina, SK, Canada. This partnership will help Bureau Veritas in expanding its testing laboratories that service the agri-food market in North America.