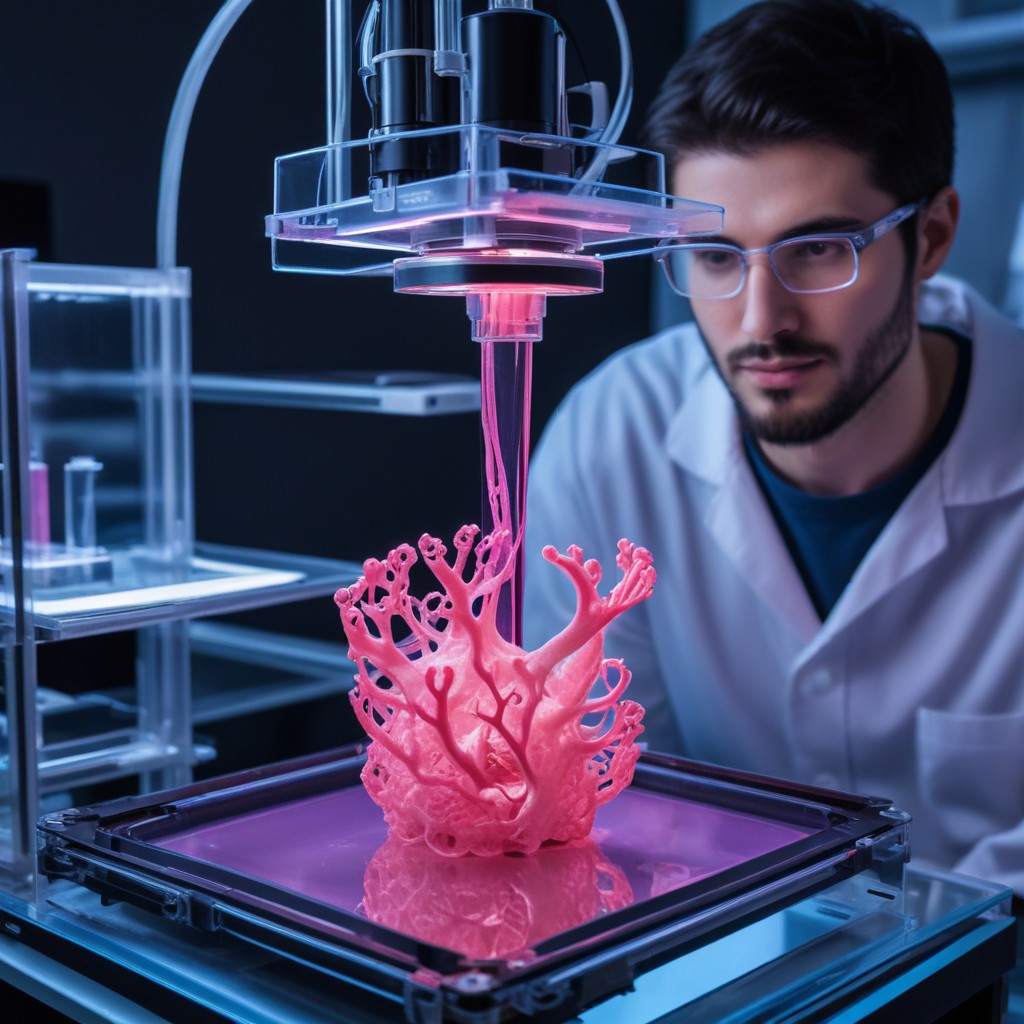

The Global 3D Bioprinting Market valued at $1.3 billion in 2024, is expected to reach $2.4 billion by 2029, growing at a CAGR of 12.7%. This growth is driven by advancements in 3D bioprinting technology, increased public-private partnerships, and its integration into pharmaceutical and cosmetic industries. Key market drivers include the adoption of 3D bioprinting for precise tissue and organ fabrication, facilitating drug testing and personalized medicine. However, high costs of bioprinters and bioinks pose challenges. Opportunities arise from the rising demand for organ transplants, while biocompatibility issues and stringent sterilization protocols present challenges. North America leads the market, with significant contributions from Europe and Asia-Pacific. Major players include BICO Group AB, 3D Systems Inc., and Merck KGaA. Recent developments include new bioprinting software launches and strategic collaborations to enhance bioprinting applications in medicine.

Browse in-depth TOC on “3D Bioprinting Market”

530 – Tables

46 – Figures

453 – Pages

Key Player

BICO Group AB (US), 3D Systems, Inc. (US), Merck KGaA (Germany), Organovo Holings Inc (US), CollPlant Biotechnologies Ltd. (Israel), regenHU (Switzerland), Aspect Biosystem Ltd. (Canada), Advanced Solutions Life Sciences, LLC (US), Cyfuse Biomedical K.K (Japan), Rokit Healthcare Inc. (South Korea), Hangzhou Genofei Biotechnology Co., Ltd. (China), Foldink (Armenia), Brinter (US) and 3D bioprinting solution (Russia) and REGEMAT 3D, SL (Spain) are some of the leading players in this market. Most companies in the market focus on organic and inorganic growth strategies, such as product launches, expansions, acquisitions, partnerships, agreements, and collaborations, to increase their product offerings, cater to the unmet needs of customers, increase their profitability, and expand their presence in the global market.

Driver: Growing adoption of 3D bioprinting technology within the pharmaceutical and cosmetic industries

Increasing adoption of 3D bioprinting technology in the pharmaceutical industry has catalyzed substantial growth in the market. This innovative technology enables the precise fabrication of tissues and organs, offering pharmaceutical & biotechnology companies unprecedented opportunities for drug testing, disease modeling, and personalized medicine development. By accurately replicating the complex structures of human tissues, 3D bioprinting allows for more reliable preclinical testing, reducing the need for animal models and accelerating the drug development process. Moreover, it helps create patient-specific organ models for studying diseases and developing tailored treatments, thereby fostering advancements in precision medicine. cosmetology industry, companies leverage bioprinted skin tissue models to conduct more precise evaluations of the safety and efficacy of skincare products. These models replicate the structure and function of human skin, providing an authentic platform to evaluate how products interact with skin cells, tissues, and microbiota. By utilizing bioprinted skin models, companies can streamline product development processes, reduce reliance on animal testing, and ensure that their products adhere to rigorous safety standards while delivering optimal results for consumers.

Restraint: High cost of 3D bioprinters and bioinks

The high cost of 3D bioprinting poses a significant challenge to its widespread adoption and accessibility. This cutting-edge technology, which holds immense promise in revolutionizing healthcare and regenerative medicine, requires sophisticated equipment, specialized materials, and skilled expertise, all of which contribute to its hefty price tag. For example, 3D bioprinters are highly precise machines that use complex designs and advanced systems to accurately place biological materials layer by layer. These printers can cost hundreds of thousands to millions of dollars because of their sophisticated design. Creating the bioinks used in printing, which contain living cells and special materials, requires a lot of research and special processes to make sure they are efficient and safe for the human body.

The 3D Bioprinters segment segment is expected to have the dominant share of the 3D bioprinting market in 2023.

Based on component, the global 3D bioprinting market is segmented into 3D bioprinters, bioinks, software and consumables. 3D bioprinters accounted for the larger market share in 2023. The segment is witnessing growth driven by technological innovations and escalating demand for organ transplantation services.

The Research applications segment is expected to account for the largest share of the application segment in the 3D bioprinting market in 2023.

Based on application, the 3D bioprinting market is segmented into research applications and clinical applications. research applications segment accounted for the larger share of the 3D bioprinting market in 2023. The market for research applications is further segmented into drug research, regenerative medicine, and 3D cell culture. Among these, the drug research segment accounted for the largest share of the market during forecast period of 2024-2029, due to the pharmaceutical & biotechnology firms intensifying their integration of 3D bioprinting technology.

The Asia Pacific region is anticipated to grow at significant CAGR during the forecast period.

The Asia Pacific is accounted to be the fastest-growing segment of the market. Large population base and robust domestic manufacturing capabilities for systems, fostering heightened partnerships and collaborations geared towards healthcare enhancement characterized by substantial investment in research and development (R&D), rising demand for organ transplants, rising government funding for advancement of 3D bioprinting technology in the region. Additionally, notable surge in stem cell research activities across several APAC countries, further contributing to the biomedical landscape is driving 3D bioprinting uptake in the region.

Recent Developments of 3D Bioprinting Industry:

- In February 2024, BICO Group AB (Cellink) launched DNA Studio 4 Vault, a bioprinting software, providing users with confidence and trust in their documentation, enabling a faster translation from the research lab to the clinic

- In February 2024, Merck KGaA (Germany) established a distribution center in Brazil with an investment of USD 21.7 million to better serve its Life Science customers for faster deliveries in the region.

- In April 2023, Aspect Biosystem Ltd (Canada) and Novo Nordisk (Denmark) entered into a collaboration, development, and Licence agreement to develop bioprinted tissue therapeutics designed to replace, repair, or supplement biological functions inside the body to deliver a new class of truly disease-modifying treatments for diabetes and obesity.

- In April 2023, CollPlant Biotechnologies Ltd (Israel) and Stratasys (US) entered into a collaboration for the development of collaborated to develop a solution to bio-fabricate human tissues and organs using Stratasys’ P3 technology-based bioprinter and CollPlant’s rh-Collagen-based bioinks