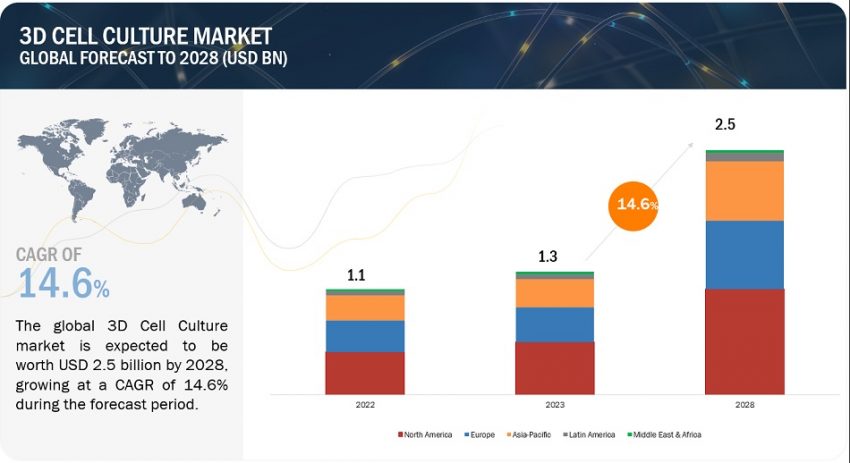

The global 3D cell culture market, estimated at $1.3 billion in 2023, is projected to reach $2.5 billion by 2028, growing at a CAGR of 14.6% from 2023 to 2028. This new research study analyzes industry trends, pricing, patents, conference materials, key stakeholders, and buying behavior. Market growth is driven by the rising incidence of chronic diseases, increased demand for personalized medicine, and the launch of novel products by key market players.

Attractive Opportunities in the 3D Cell Culture Market

Market Dynamics

DRIVER: High Focus on Developing Alternatives to Animal Testing Animal studies have been a cornerstone in pharma and scientific research to investigate complex biological phenomena. However, ethical concerns, high costs, time consumption, and the limitations of animal models in accurately reflecting human physiological responses have prompted a shift towards alternatives like 3D cell culture. These models provide a more human-relevant and predictive platform for studying drug efficacy and toxicity, reducing reliance on animal models. Regulatory bodies like the FDA and EMA are encouraging the adoption of 3D cell cultures for drug screening and safety assessment, enhancing the market’s growth across various industries.

RESTRAINT: High Costs of Implementing 3D Cell Culture Technologies Despite the advantages and the ban on animal testing in several countries, the high cost of 3D cell culture is a significant challenge. Implementing 3D cell culture technologies can vary widely in cost, influenced by the system’s complexity, production scale, and specific application requirements. Instruments like CO2 incubators and bioreactors can range from a few thousand to over $100,000. This high cost limits adoption primarily to large research institutions and pharmaceutical companies, restricting access for smaller research groups and individual researchers.

OPPORTUNITY: Emergence of Microfluidics-Based 3D Cell Culture Microfluidic-based cell culture uses miniaturized devices to control fluid flow, creating controlled microenvironments for cells. This platform offers increased adoption globally due to its ability to create complex cellular environments that mimic in vivo conditions. The technology facilitates the development of organ-on-chip models, providing a realistic representation of human physiology for drug testing. Key players are leveraging partnerships and collaborations to advance this technology, promising lucrative growth opportunities.

CHALLENGE: Lack of Consistency and Standardization in 3D Cell Culture Products Increased adoption of 3D cell culture products in research faces challenges such as standardization issues, variability in cell culture, and quality control. Scaling up from small-scale laboratory production to large-scale manufacturing introduces additional variables that impact product consistency. The lack of standardized protocols and guidelines further complicates the market growth.

Market Segmentation and Insights

Product Segmentation: The 3D cell culture market is divided into scaffold-based, scaffold-free, microfluidics-based, and magnetic & bioprinted 3D cell cultures. Scaffold-based 3D cell cultures held the largest market share in 2022 due to their structural rigidity and support features.

Application Segmentation: The market is segmented into cancer & stem cell research, drug discovery & toxicology testing, and tissue engineering & regenerative medicine. Cancer & stem cell research dominated the market in 2022, driven by the increasing prevalence of cancer and significant funding from both government and private sectors.

End User Segmentation: End users include pharmaceutical & biotechnology companies, research institutes, and the cosmetics industry. Pharmaceutical & biotechnology companies held the largest market share in 2022, driven by the ban on animal testing, increased R&D investment, and the rising adoption of personalized medicines.

Regional Insights: The market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America led the market in 2022, supported by advanced R&D in biotechnology and pharmaceuticals. Europe is expected to see high adoption in pharmaceutical and biotechnology companies and research institutes. The Asia Pacific region is anticipated to grow at the highest CAGR due to increasing R&D activities and the presence of major market players.

Key Market Players

Leading players in the 3D cell culture market include Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Corning Incorporated (US), Lonza (Switzerland), and Avantor Inc. (US). These companies are actively engaged in expanding their product offerings and market presence through strategic initiatives.

Scope of the 3D Cell Culture Industry

| Report Metric | Details |

|---|---|

| Market Revenue in 2023 | $1.3 billion |

| Projected Revenue by 2028 | $2.5 billion |

| Revenue Growth Rate | Poised to grow at a CAGR of 14.6% |

| Market Driver | High focus on developing alternatives to animal testing |

| Market Opportunity | Emergence of microfluidics-based 3D cell culture |

Recent Developments

- October 2022: Corning launched the Elplasia 12K flask, a microcavity geometry enabling easy spheroid formation and yielding 125 times more spheroids than conventional 96-well plates.

- March 2021: Thermo Fisher Scientific introduced a plasma-like medium mimicking human plasma’s metabolic profile, providing a realistic view of cell growth in the human body.