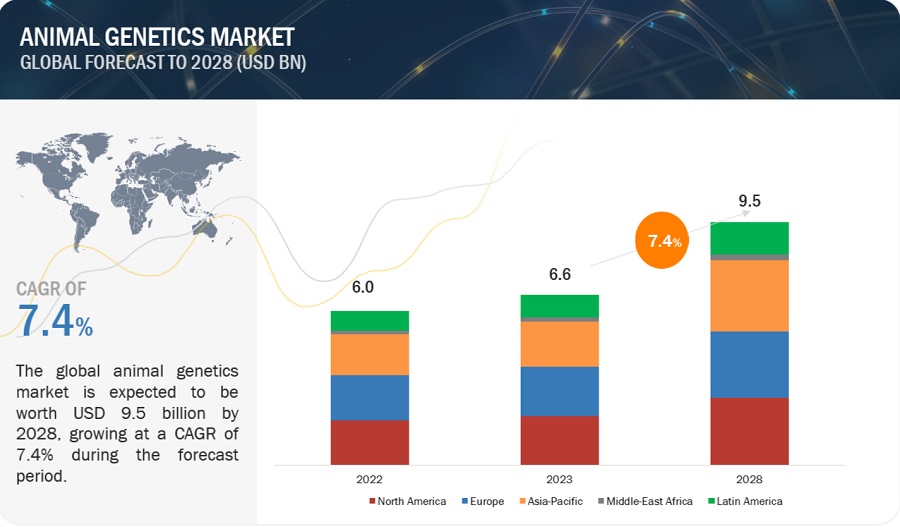

The size of global animal genetics market in terms of revenue was estimated to be worth $6.6 billion in 2023 and is poised to reach $9.5 billion by 2028, growing at a CAGR of 7.4% from 2023 to 2028. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Driver: Growing global population and rapid urbanization

Globally, farmers are expected to produce 70% more food to feed a population that is estimated to reach 9.6 billion by 2050, according to the UN Food and Agriculture Organization. Most of this projected growth is expected to be in developing countries. Although the global population growth is projected to stabilize during the present century, rapid population growth is expected to be one of the major challenges for achieving improvements in food security in some countries.

Restraint: The emergence of alternative such as lab-based meat

Although the ongoing population growth and urbanization in developing countries are drivers of its increase, the per capita meat consumption is partially offset by the shift towards a demand for quality products. This includes a move towards lab-based meat. Lab-grown meat, also known as cultured or cell-based meat, is an innovative technology that involves growing animal muscle tissue in a controlled environment, rather than raising and slaughtering animals for meat production. This technology has the potential to address various challenges associated with traditional meat production, such as environmental sustainability, animal welfare, and resource consumption.

Opportunity: Innovations in phenotyping services

Technological developments in animal genetic testing are mainly focused on two areas—the measurement of an increasingly large array of new phenotypes and the development of systems for automatic trait measurement and recording (such as automated milk-recording systems and pedometers for ambulatory activities). For instance, for animal breeds with limited scope for improving trait measurement, new phenotype tests are being developed. Milk quality trait measurement in dairy cattle now includes not only total protein and fat content but also the measurement of sub-components like lactoferrin and fatty acids. The measurement of health-related traits is also an emerging field of phenotypic investigation, which includes indirect measures for the detection of mastitis (electrical conductivity of milk and milk mineral content), female fertility (milk hormone assays and physical activity), and traits related to the detection of lameness or metabolic syndromes.

Challenge: Economic sustainability in local breeds

The implementation of genetic improvement programs for local breeds requires significant investments. A lack of infrastructure in areas where local breeds are present requires huge investments to develop said infrastructure. Such investments are often given low importance due to their economic feasibility and outcomes. For instance, artificial insemination in a small population of local animal breeds has higher per dose semen costs than the same in large animal populations due to economies of scale. The cost-benefit analysis in such cases results in negative or poorer outcomes against many required investments. Considering this scenario, the growing need to improve the productivity of local breeds and improve the affordability and economic feasibility of genetic improvement programs for these breeds is one of the major challenges in the animal genetics industry.

Europe accounted for the largest share of the animal genetics market.

The global animal genetics market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, Europe accounted for the largest share of the animal genetics market, followed by North America and Asia Pacific. Market growth is driven by the need to improve livestock productivity, growing demand for animal food products, and the high intake of animal-derived proteins.

Prominent players in the Animal Genetics market include:

- Neogen Corporation (US)

- Genus (Uk)

- Urus (US)

- EW Group Gmbh (Germany)

- Groupe Grimaud (France)

Recent Developments of Animal Genetics Industry

- In March 2023, URUS Group collaborated with Genetics Australia. The JV will be 60 percent owned by URUS and 40 percent owned by Genetics Australia (GA). It will have access to the full suite of GENEX products and access to the PEAK program.

- In January 2023, Zoetis collaborated with VAS to give farmers better compatibility crossover between Vas’s PULSE platform, a broad farm management cloud-based software, and DairyComp, a herd health system with Zoetis’s CLARIFIDE genetic and fertility testing.

Conclusion

The animal genetics market is experiencing significant growth, driven by advancements in genetic research and biotechnology. This growth is further fueled by the increasing demand for high-quality livestock and pets, the rising awareness of animal health and productivity, and the expansion of the animal breeding industry. Key trends include the adoption of advanced genetic technologies such as CRISPR, the integration of genomic selection in breeding programs, and the development of DNA-based tests for disease resistance and productivity traits.