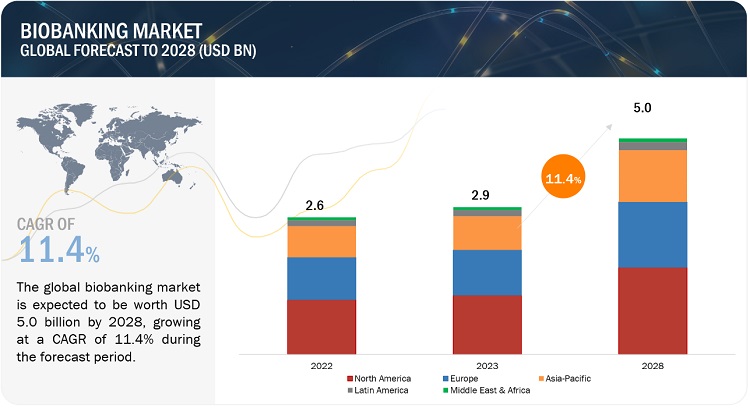

The global biobanking market, valued at $2.9 billion in 2023, is projected to reach $5.0 billion by 2028, growing at a CAGR of 11.4%. The market’s growth is driven by increasing investments and funding for biobanks, a focus on genetic testing and precision medicine, the preservation of cord blood stem cells, and favorable funding for regenerative medicine research. Challenges include the high cost of automated equipment and biospecimen sample management issues. Emerging markets such as China, India, and South Korea offer significant growth opportunities due to lower manufacturing costs and skilled resources. Key players in the market include Thermo Fisher Scientific, PHC Holdings Corporation, Becton, Dickinson and Company, QIAGEN, and Merck KGaA. The equipment segment held the largest market share in 2022, with the Asia Pacific region expected to register the highest CAGR during the forecast period.

Biobanking Market Dynamics

DRIVER: Growing investments and funding for biobanks

Biobanks have gained significant recognition from governments, research organizations, and funding agencies worldwide, resulting in a rise in investments in biobanks. For example, the Biorepository and Precision Medicine Initiative (PMI) Cohort Program, funded by the US National Institutes of Health (NIH), aims to collect biological samples from one million or more individuals to create a national research resource. Similarly, the European Commission has invested in the Biobanking and Biomolecular Resources Research Infrastructure (BBMRI), a pan-European infrastructure for biobanking and biomolecular resources.

RESTRAINT: High cost of automated equipment

The high cost of automated equipment is expected to restrain the growth of the market. Automated equipment, such as advanced sample handling systems, can significantly improve the efficiency and quality of biobanking operations. However, the high cost of this equipment can be a significant barrier to the entry of smaller biobanking companies or those with limited financial resources. For instance, the cost of an automated storage system can vary depending on the size and complexity of the system. The initial investment in an automated storage system can be significant, with costs ranging from tens of thousands to hundreds of thousands of dollars. In addition to the initial investment, there are ongoing maintenance and operational costs that must be considered, such as software updates, repairs, and training.

OPPORTUNITY: Emerging countries to provide lucrative opportunities

Developing countries are expected to offer significant growth opportunities for players operating in the global market due to the low-cost manufacturing advantage offered by these countries, coupled with the availability of skilled resources at lower costs. Moreover, as compared to developed markets, such as the US, Germany, and Japan, the demand for medical products in emerging Asian markets, such as China and India, is growing at a robust rate. This has prompted medical product companies to focus on these countries for future growth.

CHALLENGE: High operational cost of biobanks

Due to the increasing utilization of biospecimens for research and the emergence of new technologies, there is a growing focus on the availability and quality of biospecimens and their effective collection. However, the long-term economic situation of biobanks is still mostly unclear, which raises questions regarding their overall sustainability. Several costs add up in the complete functioning of a biobank, including in-case collection, tissue processing, storage management, sample distribution, and infrastructure and administration costs. Additionally, high investments are required to set up the required infrastructure in biobanks. For instance, the cost of installing laboratory facility infrastructure, liquid nitrogen supplies, mechanical freezers, and software systems add to the overall operating costs. Since biobanks have to store samples over a period of time, there is a significant need to optimize operations and costs for their long-term sustainability

The North America region catered the largest share of the biobanking market in 2022.

The biobanking market in North America has experienced significant growth in recent years, showcasing a robust expansion trajectory. This can be attributed to the increasing number of biobanks and the growing investments in biobanking infrastructure. Major healthcare institutes and research organizations in North America have made substantial commitments to expanding their biobanking capabilities. Additionally, the rising prevalence of chronic diseases and the subsequent demand for personalized medicine has fueled the growth of the biobanking market in North America, with biobanks playing a pivotal role in storing and providing high-quality biological specimens for research and development purposes.

Prominent players in the biobanking market include:

- Thermo Fisher Scientific, Inc. (US)

- PHC Holdings Corporation (Japan)

- Becton, Dickinson and Company (US)

- QIAGEN N.V. (Germany)

- Merck KGaA (Germany)

Recent Developments

- In February 2023, PHC Corporation of North America launched the PHCbi Brand VIP ECO SMART Ultra-low Temperature Freezer with industry-leading energy efficiency.

- In September 2022, Cryoport entered into a strategic partnership with BioLife Plasma Services to offer supply chain solutions and service offerings, such as bioservices and cryo-processing, for BioLife Plasma Services.