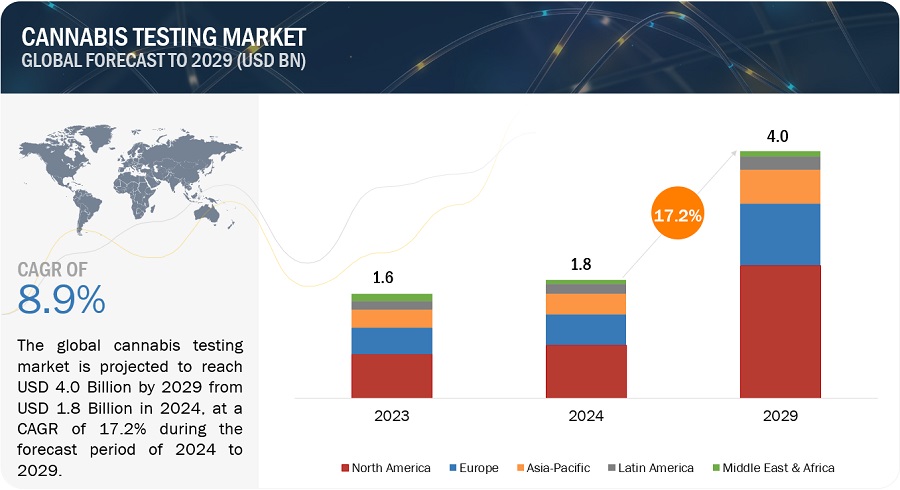

The global cannabis testing market in terms of revenue was estimated to be worth $1.8 billion in 2024 and is poised to reach $4.0 billion by 2029, growing at a CAGR of 17.2% from 2024 to 2029. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Global Cannabis testing market Dynamics

Driver: Increasing legalization of medical and recreational cannabis

The progressive legalization of medical and recreational cannabis across various jurisdictions, both at the state and international levels, presents significant growth opportunities for the cannabis testing market. As more regions legalize cannabis use, the demand for testing services to ensure compliance with regulatory standards and consumer safety requirements increases. With an increasing number of states in the US legalizing medical and recreational cannabis, there is a surge in demand for testing services to verify product potency, purity, and safety. Additionally, a few countries have legalized medical cannabis, creating new markets for testing laboratories to provide regulatory-compliant testing solutions.

Restraint: Lack of standardization

The lack of standardization presents a significant challenge for the cannabis testing market. Inconsistent testing methodologies, varying quality standards, and regulatory fragmentation hinder the reliability, comparability, and credibility of testing results. Different testing laboratories may employ varying analytical techniques, such as HPLC, GC, or mass spectrometry, for cannabinoid potency testing. Variances in instrument calibration, sample extraction methods, and data processing algorithms can result in divergent potency measurements for the same cannabis sample. Additionally, conflicting federal and state cannabis regulations present obstacles to research in multiple ways. To address this challenge, the National Cannabis Laboratory Council (NCLC) identified the necessity of moving from state variable testing programs to a standardized testing framework. This harmonized scheme aimed to establish a consistent baseline for quality testing of cannabis products, facilitating interstate commerce as the industry shifts to risk-based testing protocols developed by cultivators and manufacturers. The NCLC’s proposal advocated for a unified testing approach, leveraging data from participating laboratories and adhering to scientifically recognized standards.

Opportunity: Untapped markets in emerging economies

Emerging economies present untapped markets with substantial growth potential for the cannabis testing industry. As these countries undergo regulatory reforms and societal shifts regarding cannabis legalization and medical acceptance, new opportunities for testing services emerge. In Latin America, countries like Colombia and Uruguay are liberalizing cannabis laws, creating a burgeoning market for medical cannabis. As these nations develop their cannabis industries, there is a growing demand for testing facilities to ensure product quality, safety, and compliance with international standards. Similarly, in Asia, countries such as Thailand and South Korea are exploring medical cannabis legalization, driven by evolving attitudes toward its therapeutic potential. This shift opens up opportunities for testing laboratories to support the development and regulation of the nascent cannabis industry in the region.

Challenge: High setup costs

One significant challenge facing businesses in the cannabis testing market is the high setup costs associated with establishing and operating testing laboratories. Establishing a cannabis testing laboratory requires substantial upfront investment in infrastructure, equipment, personnel, and accreditation processes. Costs can run into millions of dollars, depending on the scale and scope of the laboratory. According to Agilent Technologies, operators of cannabis testing laboratories should be aware that setting up a cannabis testing laboratory requires around USD 2 million. A startup seeking to enter the cannabis testing market may need to invest in state-of-the-art analytical instrumentation (e.g., chromatography systems, mass spectrometers), laboratory facilities, safety equipment, quality assurance protocols, and personnel training. The capital expenditure for a fully equipped laboratory can be substantial, requiring careful financial planning and resource allocation.

Europe is estimated to exhibit highest CAGR during the forecast period of cannabis testing industry 2024-2029.

There are five main regional segmentations for the cannabis testing market—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2023, In 2023, North America held dominant share in cannabis testing market. Presence of key market players, increasing use of cannabis for medicinal use are some of the factors uplifting the market growth in the region. Europe is anticipated to grow at significant CAGR during the forecast period of 2024-2029. Increased legalization for use of cannabis coupled with rise in number of cannabis testing labs in the region is likely to drive the growth of the cannabis testing market in the region.

Prominent players in the Cannabis Testing Market include:

- Agilent Technologies, Inc.(US)

- Shimadzu Corporation (Japan)

- Thermo Fisher Scientific Inc. (US)

- Danaher Corporation (US)

- Waters Corporation (US)

Recent Developments of Cannabis Testing Industry:

- In September 2023, Shimadzu Corporation launched the Brevis GC-2050 gas chromatograph used in various applications including cannabis testing.

- In April 2023, SC Labs, one of the leading cannabis testing company, acquired C4 Laboratories, one of the first Arizona cannabis labs, thus allowing it to be licensed and accredited in five states: California, Colorado, Michigan, Oregon, and Arizona.

- In June 2022, Shimadzu Corporation launched the AA-7800 series atomic absorption spectrophotometers. The AA-7800 series is used for quality control in the raw material, food, and for inspecting water quality and hazardous substances in soil thus presenting an advantage in heavy metal testing of cannabis.