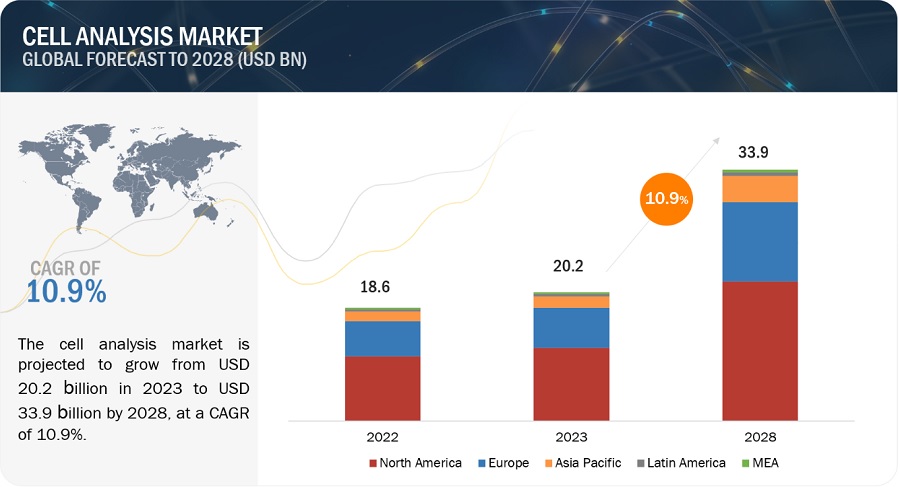

The global cell analysis market in terms of revenue was estimated to be worth $20.2 billion in 2023 and is poised to reach $33.9 billion by 2028, growing at a CAGR of 10.9% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Increase in the preference for cell-bsaed assays along with strong funding for cell-based research is expected to drive the market growth. The conventional methods of toxicity and drug safety assessment (involving animal testing) are expensive, time-consuming, and offer low-throughput. In this regard, modern cell-based assays merge the advantages of cell cultures and animal models to allow researchers to identify problems with lead compounds in early screening, ensuring greater efficiency in the drug discovery and development process.

Cell Analysis Market Dynamics

DRIVER: Growing number of drug discovery activities

Adoption of cell-based screening assays has increased in he drug discovery activities to understand associated complexities. Additionally, advances in cell biology, bioinformatics, molecular biology, genomics, and proteomics have generated large volumes of data, owing to which the use of cell-based assays in the drug development process has gained importance. Similarly, the Human Genome Project has generated a number of targets on which drug screening experiments can be carried out. This rapid expansion in drug targets and drug leads in recent years has accelerated the development of cell-based assays for primary and secondary screening in drug discovery.

RESTRAINT: High cost of instruments and restrictions on reagent use

The introduction of high-throughput screening (HTS) and high-content screening (HCS) technologies in cell analysis has increased their reliability. However, these technologies have also resulted in a significant increase in the cost of instruments. Moreover, the time and cost involved in each HTS process are directly proportional to the target molecule’s complexity; consequently, the higher the complexity, the greater the cost. In biopharmaceutical companies, the overall cost of production of biopharmaceuticals has increased considerably due to the use of these expensive systems.

OPPORTUNITY: Application of novel cell-based assays in cancer research

In the last few decades, the incidence and prevalence of cancer have increased significantly across the globe, and this trend is expected to continue in the coming years. In an effort to reduce cancer incidence and mortality, the demand for novel approaches that offer effective cancer diagnosis and treatment has increased in recent years. In this regard, some recent studies have been published that highlight the importance of cell-based assays in cancer research.

North America was the largest regional market for cell analysis industry in 2022.

Geographically, the cell analysis market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America region is expected to dominate the market through 2021-2028, followed by Europe. The US pharmaceutical industry has witnessed tremendous growth due to the increasing approval of first-in-class drugs by the Food and Drugs Administration (FDA), rising R&D expenditure by pharmaceutical companies, and the establishment of startups focusing on developing promising drugs for rare diseases and neurological conditions. This has propelled cell-based research activities, offering lucrative opportunities for the growth of the market in the US. Asia Pacific market is expected to grow at the fastest pace through 2023 to 2028.

Prominent players in the cell analysis market include:

- Danaher (US)

- Thermo Fisher Scientific (US)

- Becton, Dickinson and Company (US)

- General Electric (US)

- Merck KGaA (US)

Recent Developments of Cell Analysis Industry

- In 2023, Becton, Dickinson and Company (US) launched a Spectral Cell Sorter that is coupled with high-speed cell imaging. this product combines real-time imaging technology with spectral flow cytometry.

- In 2020, Miltenyi Biotec (Germany) launched MACS GMP Tyto Cartridge, a GMP-compliant cell sorter..

- In 2020, Bio-Rad Laboratories, Inc. (US) acquired Celsee, Inc., a provider of instruments and consumables for the isolation, detection, and analysis of single cells. This acquisition expanded the company’s product offerings in the flow cytometry market.