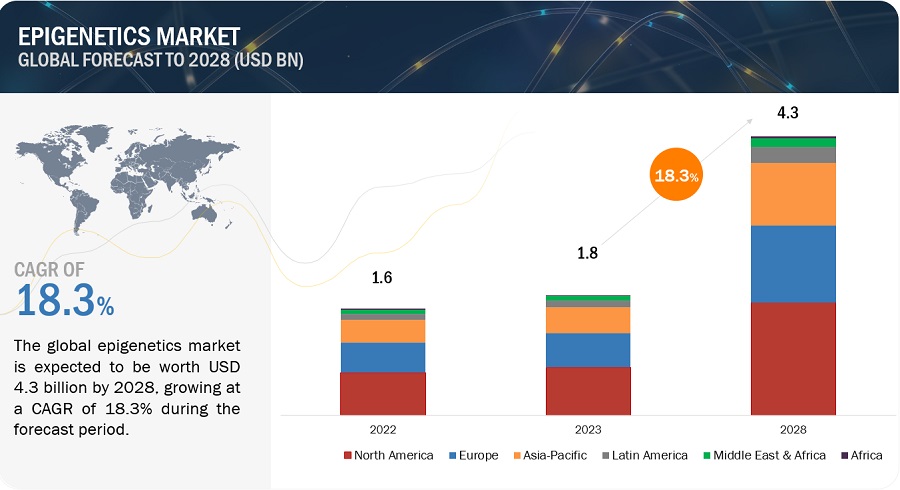

The global epigenetics market was valued at approximately $1.8 billion, with projections suggesting it will grow to $4.3 billion by 2028, reflecting a compound annual growth rate (CAGR) of 18.3% from 2023 to 2028. This comprehensive analysis explores industry trends, pricing strategies, patent landscapes, conference and webinar insights, key stakeholders, and the dynamics of market purchasing behavior.

Market Growth Drivers The market’s expansion is driven by favorable government initiatives, funding for epigenetics research, and the increasing demand for epigenetic-based therapies.

Epigenetics Market Dynamics

- Driver: Increased Investment in Research & Development Epigenetic research is enhancing our understanding of gene expression and its implications for diseases such as cancer, neurological disorders, and autoimmune diseases. Pharmaceutical and biotech companies are heavily investing in this area to unlock therapeutic potential. For example, in September 2023, Harbinger Health secured $140 million in Series B funding from Flagship Pioneering and other global investors. The funds will support the completion of the Cancer ORigin Epigenetics-Harbinger Health (CORE-HH) clinical study. Harbinger Health’s platform, HarbingerHx, utilizes machine learning to identify epigenetic patterns associated with tumor development, with the first product launch anticipated in 2025.

- Restraint: Limited Applications of Epigenomic Data in Toxicology While epigenetic data offers insights into toxicity mechanisms, it may not reliably predict substance toxicity. The field of toxicoepigenetics is still in its infancy, necessitating further research to understand the link between epigenetic modifications and toxicity fully. Profiling technologies in this area are also costly and time-consuming. Additionally, the lack of established guidelines from the US FDA for using epigenetic data in toxicology complicates the development and commercialization of epigenetic-based toxicology tests.

- Opportunity: Integration of AI and Machine Learning Integrating AI and machine learning algorithms into epigenetics could revolutionize our understanding of epigenetic mechanisms and their biological impact. AI is being used to create predictive models for diseases like cancer by analyzing patient data to assess disease risk and tailor treatment strategies. Companies like PacBio with their SMRT Analysis algorithms for epigenetics, and partnerships such as FOXO (Australia) and Datarobot (US) for AI-based epigenetic biomarker research, are at the forefront of this innovation.

- Challenge: Quality Concerns Surrounding Antibodies Antibody quality issues present a significant challenge in the epigenetics market. Problems like cross-reactivity with unintended targets, inconsistent sensitivity, and batch-to-batch variations can lead to unreliable experimental results. Additionally, the lack of standardized validation protocols and the scarcity of well-validated antibodies for new epigenetic markers further exacerbate these concerns.

Epigenetics Market Ecosystem

Dominant Segment: Kits & Reagents The kits & reagents segment is expected to maintain its dominant position in the epigenetics market during the forecast period, driven by the development of user-friendly, cost-effective, and advanced epigenetics kits & reagents.

Regional Insights: North America North America held the largest share of the epigenetics market in 2022, a trend that is anticipated to continue. The region’s dominance is due to the presence of leading epigenetics companies and favorable government and private sector initiatives promoting the development and adoption of next-generation sequencing (NGS) technologies.

Key Players in the Epigenetics Market Major players include Thermo Fisher Scientific Inc. (US), Illumina, Inc. (US), PacBio (US), Abcam plc (UK), Merck KGaA (Germany), Active Motif, Inc. (US), Bio-Rad Laboratories Inc. (US), Promega Corporation (US), Revvity (US), Qiagen (Germany), and New England Biolabs (US), among others.

Market Segmentation

By Product & Service

- Kits & Reagents (Antibodies, ChiP-seq Kits, Bisulfite Conversion Kits, etc.)

- Enzymes (DNA-modifying Enzymes, Protein-modifying Enzymes, etc.)

- Instruments and Accessories

- Software

- Service

By Methods

- DNA Methylation

- Histone Modifications

- Other Methods (non-coding RNA, chromatin remodeling)

By Technique

- NGS

- PCR & qPCR

- Mass Spectrometry

- Sonication

- Other Techniques

By Application

- Oncology

- Metabolic Diseases

- Immunology

- Developmental Biology

- Cardiovascular Diseases

- Other Applications (neurology, infectious diseases, gynecology)

By End User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Recent Industry Developments

- In August 2023, PacBio acquired Apton Biosystems to expedite the development of next-generation, high-throughput, short-read sequencers.

- In March 2022, Thermo Fisher Scientific Inc. launched a CE IVD Marked NGS instrument for clinical laboratories, enabling both diagnostic testing and clinical research on a single platform.

- In January 2022, Illumina, Inc. partnered with SomaLogic to introduce the SomaScan Proteomics Assay on Illumina’s high-throughput NGS platforms.