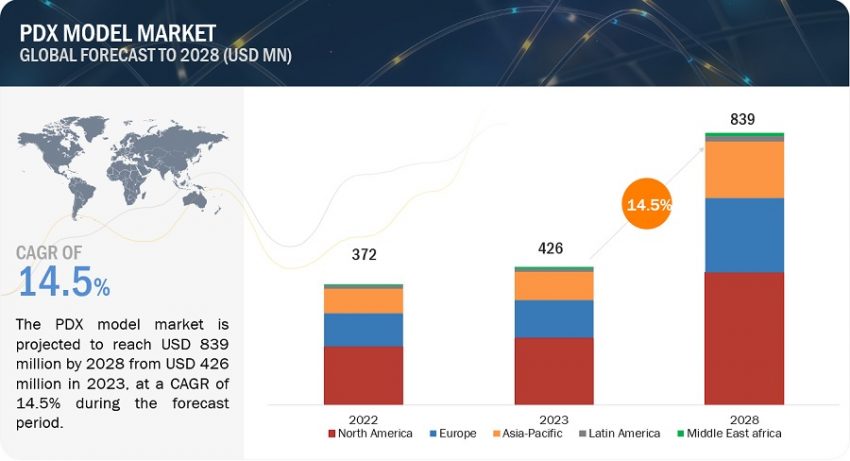

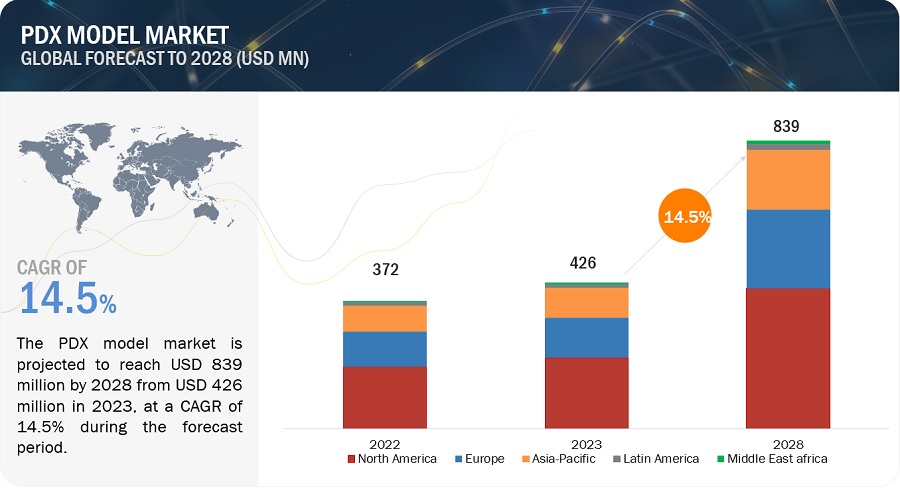

The global PDX (Patient-Derived Xenograft) model market, valued at $426 million in 2023, is projected to grow to $839 million by 2028, with a CAGR of 14.5%. The latest research study offers a comprehensive industry trend analysis, including pricing, patent trends, conference and webinar materials, key stakeholders, and consumer behavior insights. The market’s growth is fueled by the rising demand for personalized medicine, advancements in PDX technology, and increased investments in cancer research. However, the FDA’s decision to phase out animal models for clinical trials may hinder growth.

Attractive Opportunities in the PDX Models Market

Market Drivers

- Growing Demand for Personalized Medicine: Personalized medicine customizes treatments based on individual genetic and molecular profiles, improving efficacy and reducing side effects. PDX models are critical in this approach, allowing for patient-specific tumor replication and therapy testing, closely mimicking real-world scenarios. Pharmaceutical companies and research institutions are increasingly using PDX models to develop and validate personalized treatments.

Market Restraints

- FDA’s Announcement to Discontinue Animal Models for Clinical Trials: In December 2022, the FDA announced the end of the requirement for animal testing in the early stages of pharmaceutical development. This shift acknowledges the limitations of traditional animal models and aims to modernize drug development. While it may bring positive changes, it could also challenge the PDX model market.

Market Opportunities

- Emergence of CRISPR in Biomedical Research: CRISPR technology enables precise genetic modifications in PDX models, creating accurate disease models. CRISPR-edited PDX models replicate patient-specific genetic alterations, enhancing the study of genetic drivers and disease mechanisms. This supports the development of personalized therapies.

Market Challenges

- Development of Alternative Testing Methods: Alternatives like in vitro cell culture models, organoids, and microphysiological systems reduce animal use, cut costs, and offer high-throughput capabilities. These alternatives align with ethical and regulatory concerns, posing a potential threat to PDX models. They provide faster results, necessitating strategic adaptations by PDX model providers.

PDX Model Market Ecosystem

Prominent market players include well-established manufacturers with diverse technologies and global networks. Key companies are JSR Corporation (Japan), Wuxi Apptec (China), The Jackson Laboratory (US), Charles River Laboratories (US), Taconic Biosciences (US), Oncodesign Precision Medicine (France), Inotiv (US), Pharmatest Services (Finland), Hera BioLabs (US), EPO Berlin-Buch GmbH (Germany), Xentech (France), Urosphere (France), Altogen Labs (US), Abnova Corporation (US), Genesis Biotechnology Group (US), Biocytogen Pharmaceuticals (China), Creative Animodel (US), BioDuro-Sundia (US), Aragen Life Sciences (India), Shanghai LIDE Biotech (China), Certis Oncology Solutions (US), InnoSer (Netherlands), IVRS AB (Sweden), Beijing IDMO (China), and Shanghai Chempartner (China).

Segmentation and Regional Insights

By Implantation Method

- Subcutaneous Implantation: Leading segment due to accessibility, ease, and cost-effectiveness.

- Orthotopic Implantation: Emerging segment.

- Other Methods: Growing interest.

By End Users

- Pharmaceutical & Biotechnology Companies: Dominated in 2023 due to collaborative projects, R&D investment, and drug pipeline expansion.

- Contract Research Organizations (CROs)

- Academic & Research Institutions

Regional Insights

- North America: Largest market in 2023, driven by oncology research, cancer prevalence, and personalized medicine adoption.

- Europe, Asia Pacific, Latin America, Middle East, and Africa: Emerging regions with growing interest and investments.

Recent Developments

- December 2022: Crown Bioscience, Inc., a JSR Life Sciences subsidiary, signed a global licensing agreement with ERS Genomics Limited for CRISPR/Cas9 technology, enhancing its genetic editing capabilities.

- July 2022: GemPharmatech partnered with Charles River Laboratories for exclusive distribution of advanced NOD CRISPR Prkdc Il2r gamma (NCG) mouse lines in North America.

- November 2021: Inotiv acquired Envigo RMS Holding Corp., a leading provider of research models and services.

Report Metrics

- Market Revenue in 2023: $426 million

- Estimated Value by 2028: $839 million

- CAGR: 14.5%

- Key Market Drivers: Personalized medicine demand

- Key Opportunities: CRISPR advancements

Submarket Analysis

By Type

- Mouse Model

- Rat Model

By Tumor Type

- Gastrointestinal, Gynecological, Respiratory, Urological, Hematological, Other Tumor Models

By Application

- Preclinical Drug Development, Biomarker Analysis, Translational Research, Biobanking

By Region

- North America: US, Canada

- Europe: Germany, UK, France, Italy, Spain, Rest of Europe

- Asia Pacific: Japan, India, China, Australia, South Korea, Rest of Asia Pacific

- Latin America: Brazil, Rest of Latin America

- Middle East & Africa: Middle East, Africa