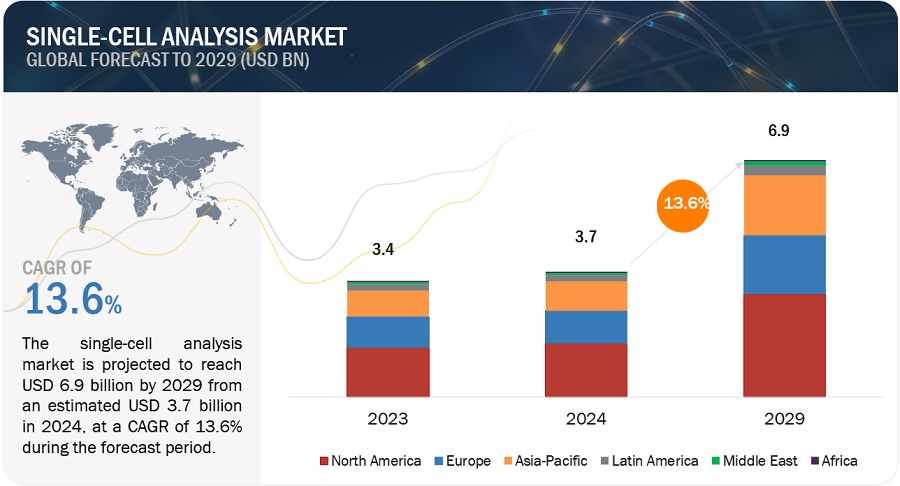

“Single-cell Analysis Market is forecast to reach USD 6.9 billion by 2029, from USD 3.7 billion in 2024, growing at a CAGR of 13.6%. Rising cancer rates and advancements in single-cell analysis products are among the major drivers. Increasing focus on stem cell research, biotechnology advancements, and personalized medicine research are also key factors propelling the market. Additionally, increasing R&D investments in pharmaceuticals and biotechnology to manage complex diseases are contributing to growth. The adoption of single-cell sequencing to analyze cellular heterogeneity is anticipated to further support the market’s expansion, though high costs may limit growth.

Download an Illustrative overview

Browse in-depth TOC on “Single Cell Analysis Market”

699 – Tables

65 – Figures

483 – Pages

Key Player

Key players in the single-cell analysis market include Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Merck KGaA (Germany), BD (US), Agilent Technologies, Inc. (US), QIAGEN (Netherlands), 10x Genomics (US), Illumina, Inc. (US), Bio-Rad Laboratories, Inc. (US), DiaSorin S.p.A. (Italy), Standard BioTools (US), Tecan Trading AG (Switzerland), Sartorius AG (Germany), Corning Incorporated (US), Cytek Biosciences (US), Takara Bio Inc. (Japan), BIOMÉRIEUX (France), Revvity (US), Bio-Techne (US), PacBio (US), Bruker (US), Promega Corporation (US), Oxford Nanopore Technologies plc. (UK), The Menarini Group (Italy), Singleron Biotechnologies (Germany), BICO (Sweden), Fluent BioSciences (US), RareCyte, Inc. (US), Cell Microsystems (US), NanoCellect Biomedical (US), Sphere Fluidics (UK), On-chip Biotechnologies Co., Ltd. Corporation (Japan), and Apogee Flow Systems Ltd. (UK).

DRIVER: Technological advancements in single-cell analysis products

Players operating in the single-cell analysis market increasingly focus on developing more economical, technologically advanced, and easy-to-use instruments. For instance, in February 2024, 10X Genomics launched the GEM-X technology, next generation of its single-cell technology architecture that will power new assays of its Chromium platform. Chromium GEM-X Single Cell Gene Expression v4 and GEM-X Single Cell Immune Profiling v3 assays are the first two products to use 10X Genomics’s new GEM-X technology architecture. Similarly, in April 2023, Standard BioTools launched a new imaging technology, the Hyperion XTi Imaging System, during the American Association for Cancer Research (AACR) meeting in Orlando.

RESTRAINT: High cost of single-cell analysis products

Cell biology involves extensive research on the development of new therapies, such as stem cell and gene therapies. The instruments, reagents, and other products associated with these research activities are required to be of high quality to obtain accurate results. The use of advanced single-cell analysis techniques is largely dependent on the cost of instruments. Flow cytometers, microfluidic devices, and high-content screening systems equipped with advanced features and functionalities are generally priced at a premium. Advancements in various instruments have led to higher prices than previous-generation instruments due to their expensive development process. For instance, the price of ATTUNE NxT Flow Cytometer Invitrogen offered by Thermo Fisher Scientific Inc. is USD 30,000 each. Similarly, the price of SMARTer ICELL8 cx Single-Cell System offered by Takara Bio Inc. is USD 17,995 each.

OPPORTUNITY: High growth potential of single-cell sequencing

Single-cell sequencing (SCS) helps researchers to understand cellular heterogeneity and transcriptional randomness. Advancements in single-cell sequencing helps to improve detection and analysis of infectious disease outbreaks, antibiotic drug-resistant strains, and microbial diversities in the environment. As single-cell sequencing technology provides detailed information about genetic mutations, companies are focusing on development of instruments and reagents that are suitable for single-cell sequencers. For instance, Illumina, Inc. (US), one of the major players in the single-cell analysis market, offers integrated ultra-low-input and single-cell RNA sequencing workflows (with the SMARTer Ultra Low Input RNA Kit by US-based Clontech Laboratories Inc., combined with the Nextera XT DNA Library Preparation Kit and Illumina sequencing technology) that help in the simplification of the entire process, from library preparation to data analysis and biological interpretation. Considering the high-growth potential of this segment, several advanced SCS instruments are expected to be developed and launched in the market in the coming years.

CHALLENGE: Technical challenges associated with single cell analysis

Despite varied applications and advantages of single-cell analysis, it may sometimes show irregular results as a result of technical limitations associated with the single-cell analysis technique. Some of the technical limitations associated with single-cell analysis include technological biases and amplification errors. Technological biases such as amplification biases and batch effects can affect the results of single-cell analysis. Amplification steps in single-cell analysis may introduce biases, leading to the uneven representation of transcripts and potential distortion of gene expression profiles. Also, Variability between different experimental batches can impact the reproducibility and comparability of single-cell datasets. Therefore, technical challenges associated with single cell analysis are expected to affect the growth of the single-cell analysis market.

The consumables segment accounted for the largest share of the product segment in the single-cell analysis market in 2023.

Based on product, the single-cell analysis market is segmented into consumables and instruments. The consumables segment is further divided into reagents, assay kits, beads, microplate, and other consumables. The instruments segment is further segmented into next-generation sequencing, microscopy, flow cytometry, polymerase chain reaction, mass spectrometry, and other techniques. The consumables segment dominated the market in 2023 and is expected to dominate the market in the forecast period. The largest share of the segment is attributed to the increasing demand for high-quality reagents to ensure reliable and reproducible results. Additionally, growing focus on development of advanced cellular therapies is anticipated to promote the segment growth.

The academic & research laboratories companies segment is estimated to register the highest growth rate during the forecast period in the single-cell analysis market.

Based on end user, the single-cell analysis market is segmented into academic & research laboratories, biotechnology & pharmaceutical companies, hospitals & diagnostic laboratories, and cell banks & IVF centers. The academic & research laboratories segment is estimated to register the highest growth rate during the forecast period. The rising focus on development of cell-based therapeutics due to growing incidences of cancer is expected to propel the segment growth. Additionally, increasing investments and fundings for life science research has increased the adoption of advanced technologies such as single-cell analysis, resulting to boost the segment growth in the market.

The Asia Pacific region is expected to register highest CAGR during the forecast period of 2024-2029.

Based on the region, the single-cell analysis market is segmented into six major regions: North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. The Asia Pacific is anticipated to register the fastest growth in the single-cell analysis market owing to the increasing focus on the development of cell-based therapies, high government investments & funding for R&D, and the booming healthcare sector. Moreover, increasing focus on modernization of healthcare infrastructure and growing adoption of advanced technologies for research and clinical applications are expected to support the growth of single-cell analysis in Asia Pacific region.

Recent Developments of Single Cell Analysis Industry:

- In June 2024, Illumina, Inc. launched its latest chemistry, XLEAP-SBS for its NextSeq 1000 and NextSeq 2000 next-generation sequencing (NGS) instruments. XLEAP-SBS chemistry is a faster, higher quality, and more robust sequencing-by-synthesis chemistry that delivers approximately 20% faster turnaround times.

- In October 2023, Danaher Corporation (Beckman Coulter Life Sciences) partnered with 10x Genomics to expand automation solutions for single cell assay workflows.

- In February 2023, BD launched BD Rhapsody HT Xpress System, a new instrument for single-cell multiomics analysis that will enable scientists to run high-throughput studies without sacrificing sample integrity, potentially accelerating time to discovery across a wide range of disciplines, including immunology, genetic disease research, and cancer and chronic disease research..

- In February 2023, Ultima Genomics, Inc. and 10x Genomics collaborated to integrate 10x Genomics Chromium Single Cell Gene Expression solutions with Ultima’s advanced ultra-high throughput sequencing systems.