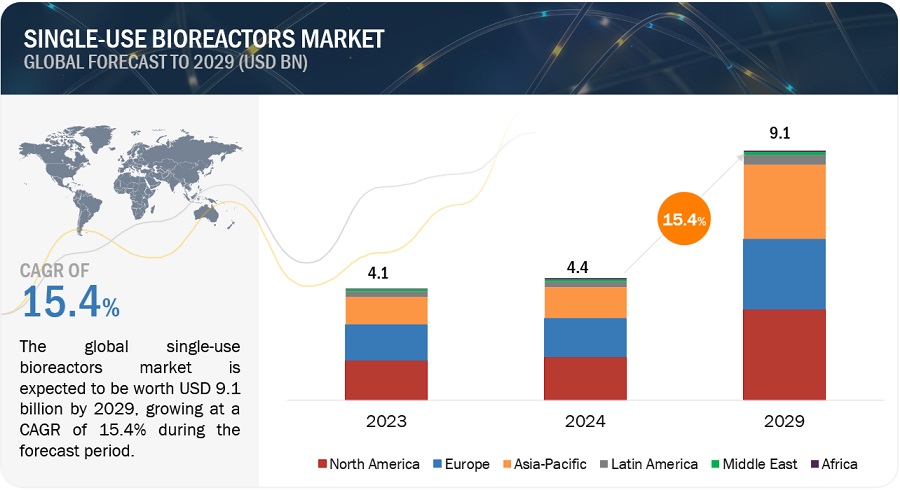

The report “Single-Use Bioreactors Market by Product (Systems, Bags, Assemblies), Type (Stirred Tank, Bubble-Column, Wave induced), Molecule (mAbs, Vaccines), Cell Type (Mammalian, Bacterial, Yeast), Application (R&D, Bioproduction) – Global Forecast to 2029″, is projected to reach USD 9.1 billion by 2029 from USD 4.4 billion in 2024, at a CAGR of 15.4% during the forecast period of 2024 to 2029. Growing acceptance of single-use technologies among CDMOs and CMOs as SUBs offer enhanced flexibility and cost-effectiveness, lower capital investment required compared to stainless-steel systems as SUBs eliminated the need for permanent infrastructure and costly cleaning & validation procedure, lower utilization of water and energy required for cleaning & sterilization processes during use-phase of the product life cycle, and expanding biologics and biosimilar markets are some of the factors driving the expansion of the global market. Additionally, the adoption of hybrid facilities incorporating both stainless steel as well as single-use systems and untapped market potential among emerging economies presents a substantial opportunity for the SUB market.

Browse 572 market data Tables and 58 Figures spread through 442 Pages and in-depth TOC on “Single-Use Bioreactors Market by Product (Systems, Bags, Assemblies), Type (Stirred Tank, Bubble-Column, Wave induced), Molecule (mAbs, Vaccines), Cell Type (Mammalian, Bacterial, Yeast), Application (R&D, Bioproduction) – Global Forecast to 2029”

View detailed Table of Content here –

The >1,500 L bioreactors segment accounted for the largest share of the single-use bioreactor systems segment in the single-use bioreactors market in 2023.

Based on scale range, the single-use bioreactor systems market is segmented into ≤10 L, 11–100 L, 101–500 L, 501–1,500 L, and >1,500 L. The >1,500 L bioreactors segment dominated the market in 2023 and is expected to dominate the market in the forecast period. Single-use bioreactors with capacities above 1,500 L are employed to commercialize high-demand biopharmaceuticals and vaccines. They offer the highest production capacity, making them essential for meeting global market needs. The adoption of single-use bioreactors at this scale reflects the industry’s shift towards flexible and cost-effective manufacturing solutions that quickly adapt to changing production requirements and regulatory standards.

The mammalian cells segment is estimated to register the highest growth rate during the forecast period in the single-use bioreactors market.

Based on cell type, the single-use bioreactors market is further segmented into mammalian cells, bacterial cells, yeast cells, and other cells (insect and plant cells). Mammalian cell cultures have been effectively employed in clinical and commercial drug manufacturing facilities due to the superior scalability of single-use bioreactors. In mammalian applications, there are relatively few engineering challenges, including heat removal, O2 mass transfer, and process control. Single-use bioreactors must be configured to accommodate extremely high metabolic rates in order to accommodate bacteria, fungi, or yeasts. This results in a greater amount of heat evolution and a greater need for oxygen than mammalian cells.

The Asia Pacific region will be the fastest-growing region of the single-use bioreactors market in 2023.

Based on the region, the single-use bioreactors market is segmented into major regions: North America, Europe, Asia Pacific, Latin America, Middle East and Africa. The Asia Pacific is anticipated to register fastest growth in the single-use bioreactors owing to the increasing demand for biosimilars, significant investments by biopharmaceutical companies & CMOs in emerging Asia Pacific countries, and increasing focus on developing advanced healthcare products.

Key players in the single-use bioreactors market include Sartorius AG (Germany), Danaher Corporation (US), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Avantor, Inc. (US), Repligen Corporation (US), Getinge AB (Sweden), Eppendorf SE (Germany), Parker Hannifin Corporation (US), Entegris (US), Saint-Gobain (France), Corning Incorporated (US), Lonza (Switzerland), TECNIC Bioprocess Equipment Manufacturing (Spain), FUJIMORI KOGYO CO., LTD. (Japan), Kühner AG (Switzerland), OmniBRx Biotechnologies (India), New Horizon Biotechnology, Inc. (US), PBS Biotech, Inc. (US), bbi-biotech GmbH (Germany), ABEC, Inc. (US), Esco Lifesciences Group Ltd. (US), Distek, Inc. (US), SATAKE MultiMix Corporation (Japan), Cell Culture Company, LLC (US), Micro Digital Co., Ltd. (South Korea), Celltainer Biotech B.V. (Netherlands), Meissner Filtration Products, Inc. (US), Solida Biotech GmbH (Germany), G&G Technologies, Inc. (US), PharmNXT Biotech (India), and Tofflon Life Science Co., Ltd. (China).