Clinical Decision Support Systems (CDSS) Market by Component (Services, Software), Delivery (On-premise, Cloud), Product (Standalone, Integrated), Application (Advanced, Therapeutic, Diagnostic), Interactivity (Active, Passive) – Global Forecasts to 2028″, is projected to reach USD 2.5 billion by 2028 from USD 1.7 billion in 2023, at a CAGR of 7.5% during the forecast period.

According to article published in BMJ Health & Care Informatics 2019 stated, in the US Clinical Decision Support Systems (CDSS), particularly in the categories of basic preventive reminders and drug interaction alerts, are commonly utilized, with usage ranging from 68% to 100% in primary care practices that rely solely on Electronic Medical Records (EMR) or Electronic Health Records (EHR) systems. Learn about clinical decision support systems industry trends, technology analysis, regulatory analysis, key stakeholders and buying criteria and key conferences & events in this report.

Growth in this market is majorly driven by the implementation of government regulations, expanding incidence of medication errors, and the development of mHealth and big data tools. However, huge investment needs for the implementation of clinical decision support systems are factors expected to restrain the growth of this market during the forecast period.

Download an Illustrative overview

Browse in-depth TOC on “Clinical Decision Support Systems (CDSS) Market”

218 – Tables

51 – Figures

288 – Pages

Clinical Decision Support Systems (CDSS) Market Dynamics:

Drivers:

- Implementation of government regulations & initiatives to promote the adoption of HCIT solutions

Restraints:

- Data security concerns related to cloud-based CDSS

Opportunities:

- The growth potential of emerging markets

Challenge:

- Requirement of high investments for the implementation of CDSS infrastructure

“The On-premise CDSS segment is estimated to account for the largest share of the Clinical decision support systems market in 2023”

By delivery mode, the clinical decision support systems market is divided on-premise and cloud-based modes. In 2023, the on-premise CDSS segment is estimated to account for the largest share of the clinical decision support systems market. These solutions have a lower risk of data breach and allow buyers to decide when to implement a software upgrade (ensuring time to test the software and train employees on new features).

“Knowledge-based CDSS segment accounted for the largest share of the global Clinical decision support systems market, by model”

By model, the clinical decision support systems market is divided into knowledge-based CDSS and non-knowledge-based CDSS. The knowledge based CDSS segment accounted for the largest share of the market in 2022. This segment is also estimated to witness high growth during the forecast period primarily due to the increasing demand for evidence-based & personalized medicine and the rising incidence of chronic disorders.

“The Active CDSS segment is expected to grow with the highest CAGR during the forecast period”

By interactivity level, the clinical decision support systems market can be divided into active CDSS and passive CDSS. In 2022, the active CDSS segment accounted for the largest share of the market in 2021 and is projected to grow at the highest CAGR during the forecast period. Robust government initiatives to promote clinical IT solutions, such as EHR, CDSS, and CPOE, and the growing pressure to curtail healthcare costs serve to support the growth of this market segment

Asia Pacific to witness the highest growth during the forecast period.

In 2022, North America accounted for the largest share of the global clinical decision support systems followed by Europe, Asia Pacific, and Rest of the World. During forecast period, Asia Pacific to witness high growth rate, owing to the factors such as the growing burden of chronic diseases, and the rising focus of various market players on emerging Asian countries are expected to drive the growth of the CDSS market in this region.

Key Market Players:

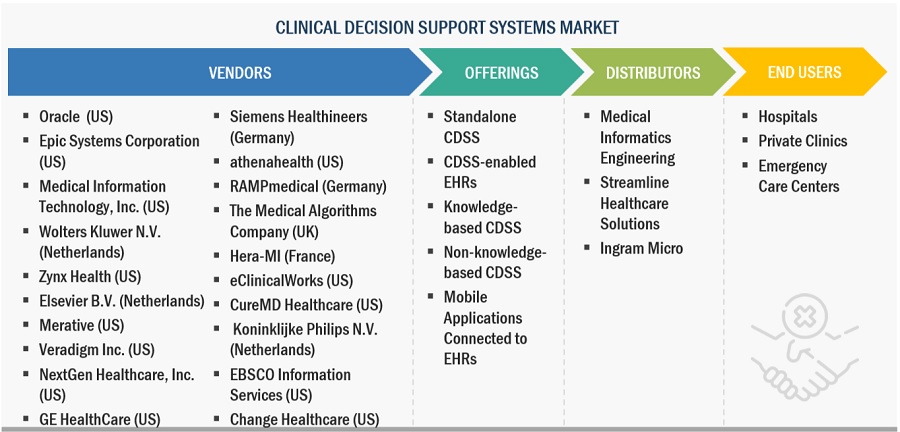

Prominent players in this market are Wolters Kluwer N.V. (Netherlands), Oracle (US), Merative (US), Change Healthcare (US), Veradigm Inc. (US), athenahealth (US), Epic Systems Corporation (US), Elsevier B.V. (Netherlands), Zynx Health (US), Koninklijke Philips N.V. (Netherlands), Medical Information Technology, Inc. (US), NextGen Healthcare, Inc. (US), CureMD Healthcare (US), Siemens Healthineers (Germany), EBSCO Information Services (US), GE HealthCare (US), eClinicalWorks (US), The Medical Algorithms Company (UK), RAMPmedical (Germany), Hera-MI (France), CareCloud, Inc. (US), VisualDx (US), Premier, Inc. (US), First Databank, Inc. (US), and Strata Decision Technology (US).

Get 10% Free Customization on this Report

Clinical Decision Support Systems (CDSS) Market Advantages:

- Enhanced Clinical Decision-Making: CDSS leverages vast amounts of patient data and medical knowledge to provide clinicians with evidence-based recommendations, aiding in more accurate and informed decision-making.

- Improved Patient Safety: By alerting healthcare professionals to potential medication errors, drug interactions, and allergies, CDSS helps reduce adverse events and enhances patient safety.

- Efficiency and Productivity: CDSS streamlines clinical workflows, reducing the time spent on administrative tasks and enabling clinicians to focus more on patient care.

- Personalized Medicine: CDSS tailors treatment plans and recommendations to individual patient profiles, leading to more personalized and effective healthcare interventions.

- Reduced Healthcare Costs: By preventing unnecessary tests, treatments, and hospital readmissions, CDSS helps lower healthcare costs and optimize resource allocation.

- Accessibility and Remote Care: CDSS can be integrated into telehealth and remote monitoring systems, expanding access to healthcare services and enabling timely interventions, especially in underserved areas.

- Continuous Learning: These systems continuously update their knowledge base, staying up-to-date with the latest medical research and guidelines, ensuring the most current recommendations for clinicians.

- Compliance with Regulations: CDSS can assist healthcare organizations in complying with regulatory requirements and quality standards, reducing the risk of legal and financial penalties.

- Data Analysis and Research: CDSS can aggregate and analyze large datasets, supporting research efforts, clinical trials, and epidemiological studies to advance medical knowledge.

- Patient Empowerment: CDSS can provide patients with access to their health information and treatment options, enabling them to actively participate in their care decisions.

Recent Developments:

- In April 2023, Microsoft (US) and Epic Systems Corporation (US) expanded their long-standing strategic collaboration to develop and integrate generative AI into healthcare by combining the scale and power of Azure OpenAI Service with Epic’s industry-leading electronic health record (EHR) software. This co-innovation is focused on delivering a comprehensive array of generative AI- powered solutions integrated with Epic’s EHR to increase productivity, enhance patient care, and improve financial integrity of health systems globally.

- In April 2023, Elsevier B.V. (UK) announced the launch of an upgraded version of its clinical decision support solution, ClinicalKey. This enhanced platform incorporates a comprehensive drug compendium, a cutting-edge mobile application, and seamless integration into Electronic Health Records (EHR). These new features have been strategically designed to offer physicians in the United States and international markets convenient access to reliable and extensive medical content directly at the point of care, speeding up diagnosis and treatment for their patients.

- In February 2023, The province of Nova Scotia, in collaboration with Nova Scotia Health Authority (NSHA) and IWK Health (IWK) entered into a new 10-year agreement has been signed with Oracle (US) to implement an integrated electronic care record across the province for the more than one million Nova Scotians. This technology can help improve the way health professionals use and share patient information.

- In December 2022, athenahealth (US) announced that it had released enhancements to its athenaOne EHR to facilitate immediate administration of COVID-19 vaccines. The rollout includes communications, scheduling, workflow, documentation, and reporting capabilities.

- In April 2022, Change Healthcare (US) launched a new edition of InterQual 2022, the firm’s flagship clinical decision support solution for delivering the latest evidence-based appropriate care.

Content Source:

https://www.marketsandmarkets.com/PressReleases/clinical-decision-support-systems.asp