Companion Diagnostics Market Overview

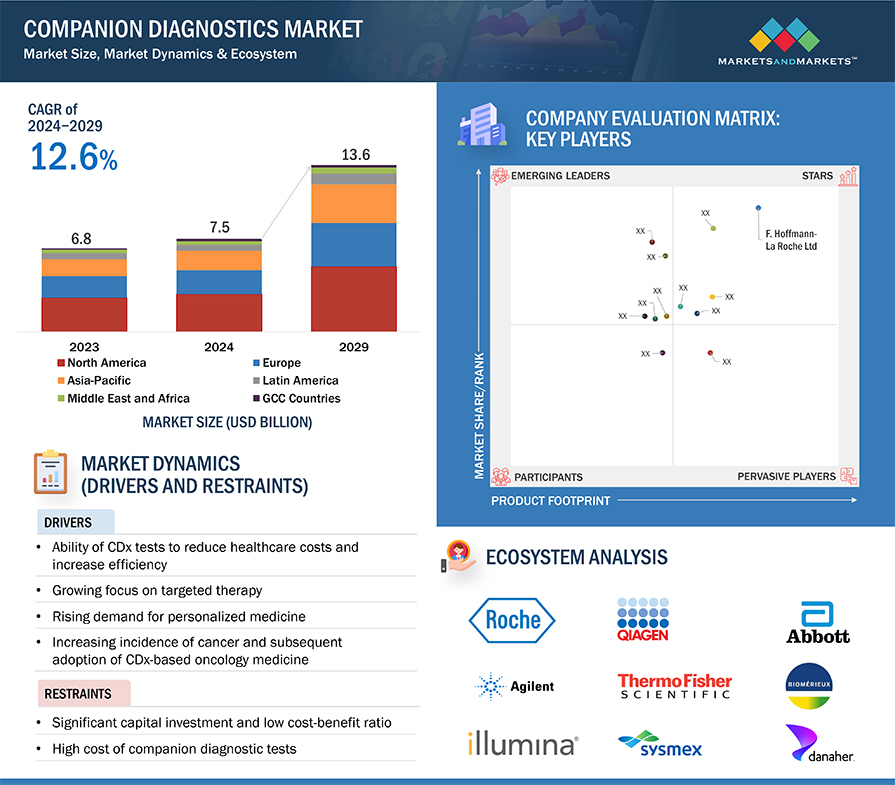

The global companion diagnostics market, valued at approximately $7.5 billion in 2024, is projected to surge to $13.6 billion by 2029, reflecting a robust compound annual growth rate (CAGR) of 12.6% over the forecast period. This growth is fueled by advancements in medical technology, increasing the importance of companion diagnostics in drug development, particularly in oncology.

Key Market Dynamics

Growth Drivers:

- Personalized Medicine: The shift towards personalized medicine, which tailors treatments to individual patients based on genetic and molecular profiles, is a primary driver of the companion diagnostics market. These diagnostics enable healthcare providers to make precise treatment decisions, reducing the risk of adverse events and improving patient outcomes.

- Cancer Prevalence: The rising incidence of cancer worldwide has also spurred demand for companion diagnostics, which are essential in identifying appropriate targeted therapies.

Challenges:

- High Costs: The market faces significant barriers due to the high capital investment required for biomarker discovery, development, and validation. The low success rate of drugs in clinical trials further exacerbates these challenges, making it difficult for smaller companies to enter the market.

- Skilled Workforce Shortage: A shortage of trained professionals proficient in companion diagnostics technologies hampers the widespread adoption of these tests, particularly in emerging markets.

Opportunities:

- Drug Development: The integration of companion diagnostics in drug development processes presents a significant opportunity. Co-developing diagnostics with therapeutic products can accelerate the development of safer, more effective drugs.

Market Segmentation

By Product & Service:

- The assays, kits, and reagents segment dominated the market in 2023, driven by the broad range of available products and their widespread use across various therapeutic areas.

By Technology:

- Polymerase Chain Reaction (PCR) technology held the largest market share in 2023 due to its ease of use and widespread availability of PCR kits and reagents for diagnostic testing.

By Indication:

- Cancer remains the leading indication for companion diagnostics, with the segment capturing the largest market share in 2023. The growing role of companion diagnostics in personalized cancer treatments is a key driver.

By Sample Type:

- Tissue samples led the market in 2023, preferred for their ability to provide a comprehensive analysis of genetic mutations and biomarkers directly from the tumor.

By End User:

- Pharmaceutical and biotechnology companies were the largest end users in 2023, owing to the increasing adoption of companion diagnostics in drug development.

Geographical Insights

North America held the largest market share in 2023, driven by technological advancements and a high number of product approvals by regulatory bodies such as the FDA. The U.S. and Canada are leading markets due to their strong healthcare infrastructure and innovation in medical diagnostics.

Competitive Landscape

The companion diagnostics market is highly consolidated, with major players such as F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (US), QIAGEN (Netherlands), Thermo Fisher Scientific Inc. (US), and Abbott Laboratories (US) holding significant market shares. These companies leverage their extensive product portfolios, robust R&D investments, and global reach to maintain their competitive edge.

Recent Developments

- Agilent Technologies received European IVDR Certification for its companion diagnostic assay in August 2023.

- QIAGEN received FDA approval for its companion diagnostic for Blueprint Medicines’ AYVAKIT in August 2023.

- F. Hoffmann-La Roche achieved FDA approval for label expansion of its VENTANA PD-L1 Assay in March 2023.

Market Outlook

The companion diagnostics market is set for significant growth, driven by the increasing adoption of personalized medicine and advancements in diagnostic technologies. However, challenges such as high capital requirements and a shortage of skilled professionals need to be addressed to unlock the market’s full potential. The ongoing developments in the co-development of companion diagnostics and therapeutic products are expected to further enhance the market’s growth trajectory, offering new opportunities for innovation and improved patient care.

Content Source:

https://www.marketsandmarkets.com/PressReleases/companion-diagnostics.asp

https://www.marketsandmarkets.com/ResearchInsight/companion-diagnostics-market.asp