The report “Drug Screening Market by Product (Rapid Testing (Urine, Oral), Analytical (Breathalyzer, Immunoassay, Chromatography)), Sample (Urine, Breath, Hair), Drug (Alcohol, Cannabis, Opioids), End User (Workplace, Hospital, Law) – Global Forecast to 2029″, is projected to reach USD 19.5 billion by 2029, from USD 9.1 billion in 2024, at a CAGR of 16.6%. Factors such as mounting drug & alcohol consumption, enforcement of stringent laws mandating drug and alcohol testing, increasing government funding in major markets, and rising regulatory approvals and service and product launches are the some of the factors driving the growth of this market.

Browse 740 market data Tables and 62 Figures spread through 504 Pages and in-depth TOC on “Drug Screening Market by Product (Rapid Testing (Urine, Oral), Analytical (Breathalyzer, Immunoassay, Chromatography)), Sample (Urine, Breath, Hair), Drug (Alcohol, Cannabis, Opioids), End User (Workplace, Hospital, Law) – Global Forecast to 2029”

View detailed Table of Content here –

Services segment is expected to grow at the highest CAGR during the forecast period in 2024.

On the basis of product & service segment, the drug screening market is bifurcated into services and products. In 2023, the services segment accounted for the largest share of the drug screening market. Factors such as rising global drug and alcohol consumption, funding schemes for drug testing laboratories, and rising regulatory approvals for drug products & services, and geographic extensions of drug & alcohol testing laboratories.

Analytical instruments are projected to dominate the drug screening products market in 2023, by product.

On the basis of drug screening product, the drug screening market is bifurcated into analytical instruments, rapid testing devices, and consumables. The analytical instruments is expected to dominate the market in 2023. However, the rapid testing devices segment is expected to register the highest CAGR during the forecast period, owing to its recurring requirement. Analytical instruments for drug screening are further categorized into immunoassay analyzers, chromatography instruments, and breathalyzers. The breathalyzers segment accounted for largest share of the drug screening products market, by analytical instruments.

Urine sample segment is accounted for the largest share of the drug screening market in 2023, by sample type.

On the basis of sample type, drug screening market is bifurcated into urine, breath, oral fluid, hair, and other samples. In 2024, the urine sample segment is expected to account for the largest share of drug screening market. Urine tests are widely adopted in drug screening tests due to their accuracy in detecting multiple drug classes. Urine tests are also cost-effective and showcase instant results.

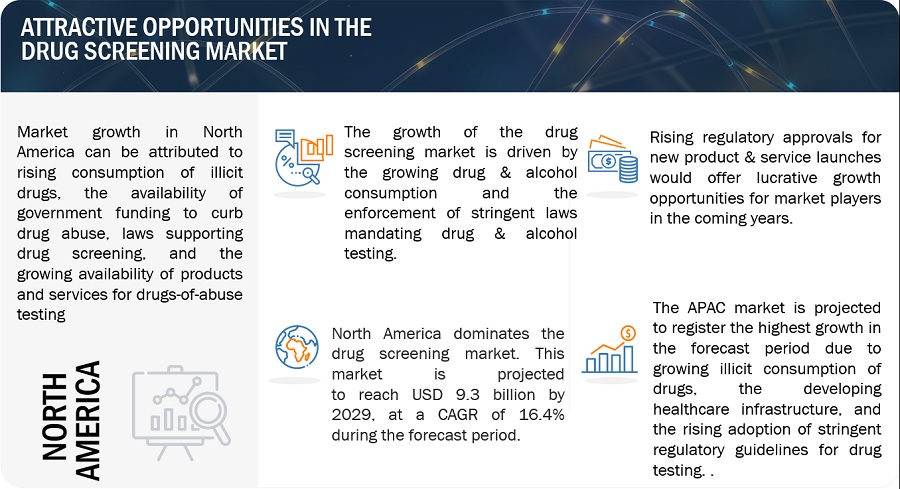

By region, North America to dominate the market for drug screening in 2024

In 2024, North America is projected to dominate the market followed by Europe. Factors such as the increasing consumption of illicit drugs, the increasing burden of accidents due to alcohol impairment, the availability of government funding to curb drug abuse, laws supporting drug screening, and the existence of key players in the region are factors driving the growth of the drug screening market in this region.

Prominent players offering drug screening products and services include Labcorp (US), Quest Diagnostics (US), Abbott (US), Thermo Fisher Scientific Inc. (US), Alfa Scientific Designs, Inc. (US), OraSure Technologies Inc. (US), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd (Switzerland), MPD Inc. (US), Shimadzu Corporation (Japan), Lifeloc Technologies, Inc. (US), Drägerwerk AG & Co. KGaA (Germany), Premier Biotech, Inc. (US), Omega Laboratories, Inc. (US), Psychemedics Corporation (US), Clinical Reference Laboratory, Inc. (US), American Bio Medica Corporation (US), ACM Global Laboratories (US), CareHealth America Corp (US), Sciteck, Inc. (US), Intoximeters, Inc. (US), AccuSourceHR, Inc. (US), Cordant Health Solutions (US), Intoxalock (US), Millennium Health (US).