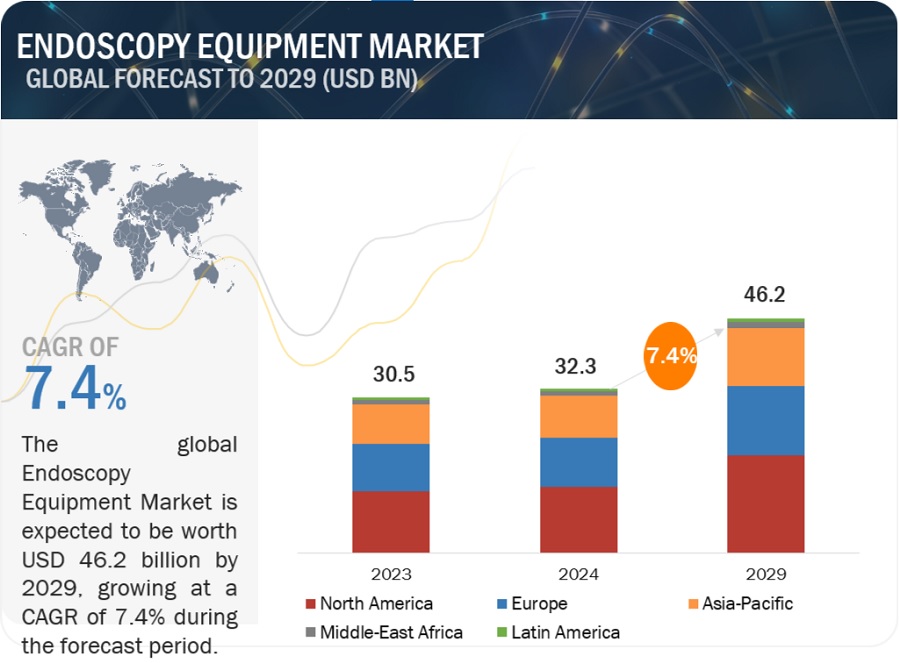

The global endoscopy equipment market is projected to generate $32.3 billion in revenue by 2024, with expectations to reach $46.2 billion by 2029, reflecting a robust CAGR of 7.4% during the forecast period. A new research study offers a comprehensive analysis of industry trends, pricing, patent developments, key stakeholders, and consumer behavior within the market.

Download a PDF Brochure

Market Growth Drivers

Several factors are fueling the growth of the endoscopy equipment market, including increased investments, funding, and grants from governments and organizations. Additionally, hospitals are increasingly focused on expanding their endoscopic units and advancing endoscopic technologies. These trends are driving demand for minimally invasive procedures and contributing to market expansion.

However, the market faces challenges, particularly in emerging economies, where the high overhead costs of endoscopy procedures and limited reimbursement options may impede growth during the forecast period.

Industry Dynamics and Developments

Hospitals Invest in Advanced Endoscopy Instruments

Hospitals worldwide are prioritizing investments in advanced endoscopy instruments to enhance diagnostic accuracy and treatment outcomes. This focus is driven by the need to meet the growing demand for minimally invasive procedures. Notable developments in the field include:

- Mayo Clinic (October 2023): Significant investment in state-of-the-art endoscopy equipment to enhance diagnostic capabilities and expand endoscopy units.

- Johns Hopkins Hospital (March 2022): Expansion of its endoscopy unit with the latest advancements in endoscopic technology.

- Cleveland Clinic (June 2021): Upgraded endoscopy facilities, investing in advanced instruments to accommodate a higher volume of procedures.

Challenges in Developing Economies

In developing countries, the high costs associated with endoscopy procedures, including equipment procurement and maintenance, pose a significant challenge. Limited reimbursement rates exacerbate the financial burden on healthcare providers, leading to disparities in access to endoscopic services. Addressing these challenges requires sustainable reimbursement models, cost-effective equipment, and expanded access to affordable endoscopic services.

Opportunities and Challenges

Booming Healthcare Sector in Developing Economies

The healthcare sector in developing economies is experiencing rapid growth, driven by urbanization, an expanding middle class, and increasing healthcare awareness. Governments are investing in healthcare infrastructure and technology, creating opportunities for healthcare providers, investors, and medical technology companies.

Shortage of Trained Professionals

A significant challenge facing the endoscopy equipment market is the shortage of trained physicians and endoscopists. This shortage limits the optimal utilization of advanced endoscopy equipment and hinders the adoption of innovative technologies.

Key Market Segments

Visualization Systems Lead Market Share

The visualization systems segment holds a significant share of the global endoscopy equipment market, driven by the rising demand for high-definition displays and monitors. These technologies enhance diagnostic precision and treatment planning, contributing to improved patient outcomes.

Gastrointestinal Endoscopy Dominates by Application

The gastrointestinal endoscopy segment leads the market, driven by the rising incidence of gastrointestinal disorders and advancements in endoscopic technologies. The preference for minimally invasive procedures further amplifies this segment’s market share.

Hospitals as Key End Users

Hospitals dominate the endoscopy equipment market, driven by their capacity to conduct a large volume of medical procedures and invest in advanced technologies. Their robust infrastructure and resources enable seamless integration of cutting-edge endoscopy equipment, positioning hospitals as key players in the market.

North America as the Leading Region

North America leads the endoscopy equipment market, thanks to its advanced healthcare infrastructure, widespread adoption of medical technologies, and the growing incidence of gastrointestinal disorders. The region’s active approach to integrating advanced medical technologies further drives market growth.

Recent Industry Developments

- Olympus Corporation (November 2023): Launched the EVIS X1, an advanced endoscopy system.

- Stryker (September 2023): Introduced the 1788 minimally invasive surgical camera.

- Johnson & Johnson Medical Devices (January 2022): Collaborated with Microsoft to expand its digital surgery ecosystem.

This report segments the endoscopy equipment market by product, application, end users, and region, offering a detailed forecast and analysis of industry trends.

Content Source:

https://www.marketsandmarkets.com/PressReleases/endoscopy.asp

https://www.marketsandmarkets.com/ResearchInsight/endoscopy-devices-market.asp