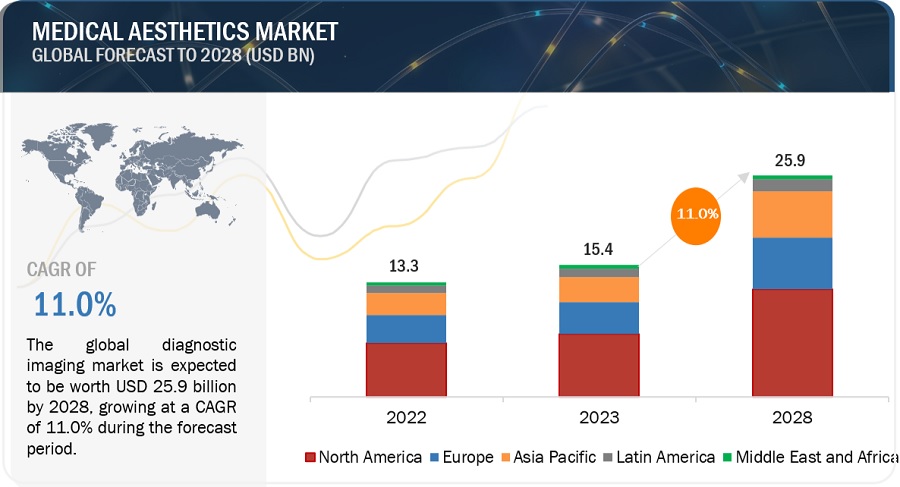

According to experts at MnM, the global medical aesthetics market is projected to grow from USD 15.4 billion in 2023 to USD 25.9 billion by 2028, at a compound annual growth rate (CAGR) of around 11.0%. Over the past decade, there has been a notable shift in the use of aesthetic techniques such as lasers and ultrasound. Traditionally used for anti-aging procedures, these technologies are now being adopted by emerging startups like Tria Beauty, Braun, Mismon, SmoothSkin, Ulike, Xsoul, Fallmist, and Meukpe. These companies are introducing at-home or self-use laser/light therapy devices priced under $500.

Key Market Drivers

The market’s overall revenue is significantly influenced by prominent leaders such as Cynosure, Galderma, Abbvie, and Alma Lasers. Key contributing factors include the rising acceptance of elective/aesthetic treatments by patients, the increasing installation of multi-modal/multi-use platforms, and the rapid growth of beauty clinics in developing countries. Additionally, supportive government regulations and reimbursements in mature markets, heightened patient awareness of the safety profiles of available technologies, and ongoing investments in development and innovation by companies are accelerating market trends.

Market Dynamics

Driver: Increasing popularity of minimally invasive and non-surgical aesthetic treatments.

Minimally invasive and non-surgical aesthetic treatments are gaining traction in cosmetic medicine as they offer a convenient and lower-risk alternative to traditional surgery. Treatments such as Botox, dermal fillers, laser therapy, chemical peels, and microdermabrasion provide natural-looking results with minimal downtime, making them appealing across various age groups. These treatments are accessible, customizable, and minimize scarring. It is essential, however, that qualified medical professionals perform these procedures to ensure safety and effectiveness.

Restraint: Stringent regulatory compliance and safety standards.

The medical aesthetics market faces challenges due to stringent regulatory compliance and safety standards. These regulations, while essential for patient safety and treatment efficacy, can hinder new entrants, delay product development and approvals, increase treatment costs, and require extensive oversight. Companies must navigate varying global standards, which adds complexity and necessitates ongoing education and training. Despite these challenges, these regulations foster industry trust and contribute to long-term market viability.

Opportunity: Growth potential in developing nations.

Emerging economies present significant opportunities in the medical aesthetics sector. Factors driving growth include an expanding middle class, increased disposable income, and the attraction of medical tourists seeking cost-effective yet high-quality procedures. Technological advancements and government support further enhance market prospects. Companies entering these markets must understand local preferences and navigate regulatory complexities, cultural differences, and economic fluctuations to succeed.

Challenge: Competition from alternative beauty and cosmetic products.

The medical aesthetics market faces competition from a wide range of over-the-counter beauty and cosmetic products. Providers must highlight the benefits of professional treatments to attract consumers who might opt for more economical and convenient alternatives. Robust marketing strategies, strong brand identities, and consumer education about the benefits and safety of professional treatments are crucial for providers to stand out. Emphasizing personalized care, lasting results, and expertise can help providers attract and retain clients in a saturated market.

Market Segmentation & Geographical Spread

By Product: In 2023, the facial aesthetic products segment held the largest market share. This segment is driven by the increasing adoption of advanced tools for precise diagnostics and the growing demand for improved sensitivity in aesthetic treatments.

By Procedure: The lipolysis segment within the non-surgical procedures market is expected to experience significant growth. This growth is attributed to the increasing utilization of innovative devices that enable precise targeting and real-time imaging.

By End User: In 2023, clinics, hospitals, and medical spas accounted for the largest market share. This segment’s dominance is due to the rising adoption of automated systems for early disease detection and the digitization of patient workflows in aesthetic practices.

By Region: North America, comprising the US and Canada, held the largest market share in 2023. Growth in this region is driven by expanding applications within the healthcare sector, favorable reimbursement policies, and the presence of key industry players. The elderly population and the establishment of aesthetic imaging centers also contribute to market growth.

Key Players and Recent Developments

As of 2023, notable players in the medical aesthetics market include AbbVie Inc. (US), Alma Lasers (Israel), Cynosure (US), and Galderma (Switzerland).

Recent Developments:

- March 2023: Galderma launched “FACE by Galderma,” an augmented reality (AR) tool allowing professionals and patients to preview injectable treatment results.

- August 2022: AbbVie Inc. introduced SkinMedica Firm & Tone Lotion for Body, the first product in their professional-grade skincare line.

- March 2021: Bausch Health Companies Inc. and Solta Medical launched the Clear + Brilliant Touch laser in the US, offering customized treatment protocols with two wavelengths for all skin types.

Market Scope:

- Market Revenue in 2023: $15.4 billion

- Estimated Value by 2028: $25.9 billion

- CAGR: 11.0%

- Key Driver: Increasing popularity of minimally invasive and non-surgical treatments

- Key Opportunity: Growth potential in developing nations

The report segments the medical aesthetics market to forecast revenue and analyze trends in the following submarkets:

By Product:

- Facial Aesthetic Products

- Cosmetic Implants

- Skin Aesthetic Devices

- Body Contouring Devices

- Physician-Dispensed Cosmeceuticals and Skin Lighteners

- Hair Removal Devices

- Tattoo Removal Devices

- Thread Lift Products

- Physician-Dispensed Eyelash Products

- Nail Treatment Laser Devices

By Procedure:

- Surgical Procedures (Breast Augmentation, Rhinoplasty, Facelift and Body Lift, Other Surgical Procedures)

- Non-Surgical Procedures (Anti-Aging and Skin Rejuvenation, Tattoo and Scar Removal, Hair Removal, Lipolysis, Other Non-Surgical Procedures)

By End User:

- Clinics, Hospitals, and Medical Spas

- Beauty Centers

- Home Care Settings

By Region:

- North America (US, Canada)

- Europe (Germany, France, UK, Spain, Italy, Rest of Europe)

- Asia Pacific (Japan, China, India, Australia, Thailand, South Korea, Indonesia, Rest of Asia Pacific)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa