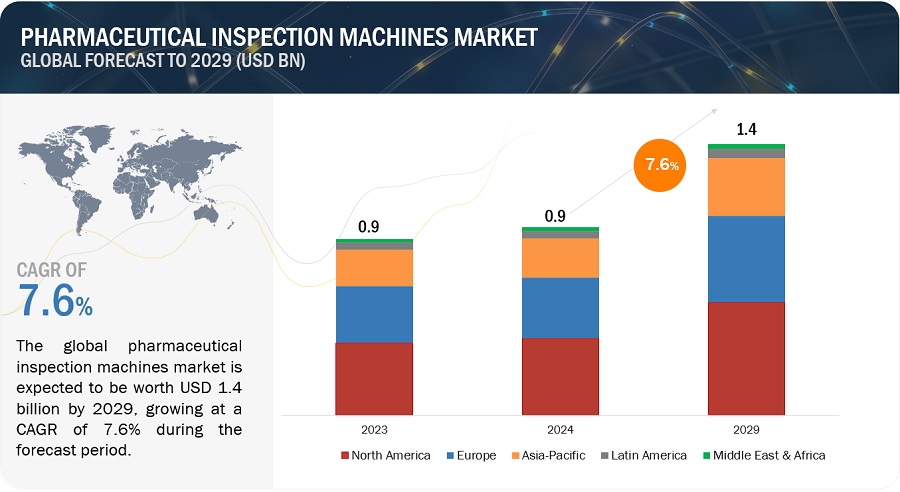

The report “Pharmaceutical Inspection Machines Market by Component ((Vision Inspection, X-Ray, Checkweigher, Metal Detector), Software), Type (Manual, Automatic), Packaging Type (Syringe, Blister, Bottle), Formulation (Parenteral, Oral) – Global Forecast to 2029“, is projected to reach USD 1.4 billion by 2029 from USD 0.9 billion in 2024, at a CAGR of 7.6% during the forecast period of 2024 to 2029.

Market Segmentation by Component

The market is categorized by component into inspection systems and software. The inspection systems segment includes vision inspection systems, X-ray inspection systems, leak detection systems, metal detectors, combination systems, checkweighers, and other types of inspection systems. In 2023, inspection systems held the largest market share and are expected to maintain this dominance through 2029, thanks to advancements in machine vision and AI, alongside the rising production of biologics, biosimilars, and pharmaceutical outsourcing.

Market Segmentation by Type

By type, the market is divided into fully automated inspection systems, semi-automated systems, and manual systems. The fully automated segment was the leading category in 2023, primarily due to higher throughput rates, improved inspection accuracy, increased detection capabilities, and compliance with strict regulatory standards.

Market Segmentation by Packaging Type

Regarding packaging types, the pharmaceutical inspection machines market is segmented into ampoules & vials, syringes, blister packaging, bottles, and other packaging formats. The ampoules & vials segment dominated in 2023 and is projected to see substantial growth during the forecast period, driven by a greater implementation of inspection machinery for these containers. Additionally, the rising demand for vaccines, biopharmaceuticals, and biologics is fueling production in this area.

Market Segmentation by Formulation

In terms of formulation, the market is categorized into oral, parenteral, and other formulations. The oral segment includes tablets & capsules, oral solutions, suspensions/syrups, and other types. The parenteral formulation segment led the market in 2023 and is expected to grow significantly, driven by increasing demand for injectable drugs and the growth of the pharmaceutical and biotechnology sectors.

Market Segmentation by End User

By end user, the market is segmented into pharmaceutical companies, biotechnology companies, and CROs & CDMOs. The pharmaceutical companies segment was the largest in 2023 and is anticipated to grow at a significant CAGR during the forecast period, reflecting the rising use of inspection machines for quality assurance and the urgent need to address counterfeit pharmaceuticals.

Regional Analysis

Geographically, the global pharmaceutical inspection machines market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2023, North America led the market due to factors such as advanced healthcare infrastructure, stringent regulatory requirements (including FDA regulations), significant investment in pharmaceutical R&D, and the presence of major pharmaceutical firms. The Asia Pacific region is expected to experience the highest CAGR from 2024 to 2029, supported by favorable government policies, growing contract manufacturing, increased production of generic drugs, and the rapid expansion of pharmaceutical and biotechnology companies.

Key Players in the Market

Key players in the pharmaceutical inspection machines market include Körber AG (Germany), Mettler-Toledo (Switzerland), Omron Corporation (Japan), Cognex Corporation (US), Stevanato Group (Italy), and Antares Vision S.P.A (Italy), among others. These companies are pursuing both organic and inorganic growth strategies, such as product launches and acquisitions, to maintain their leadership positions in the market.