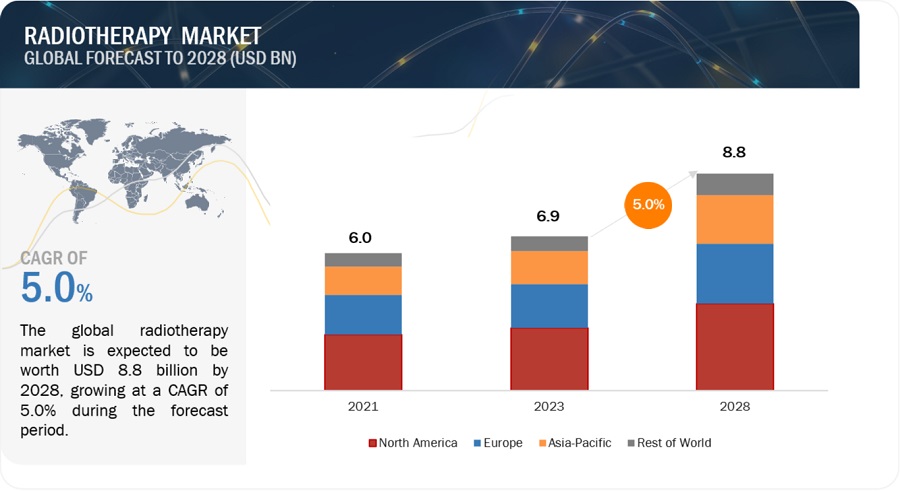

The global radiotherapy market, a critical sector in cancer treatment, was estimated to generate $6.9 billion in revenue in 2023. With ongoing technological advancements and increasing cancer incidence worldwide, the market is expected to reach $8.8 billion by 2028, growing at a compound annual growth rate (CAGR) of 5.0% during the forecast period.

Radiotherapy Market – Key Drivers of Market Growth

1. Technological Advancements

Radiotherapy is undergoing significant technological transformations. Innovations such as MRI linear accelerators, proton therapy, and treatment planning software that integrates imaging data have revolutionized cancer treatment, improving precision and outcomes. For instance, the development of intensity-modulated radiation therapy (IMRT) and stereotactic body radiation therapy (SBRT) allows for precise targeting of cancer cells, minimizing damage to surrounding healthy tissues.

In May 2022, Elekta introduced Elekta Esprit, a next-generation Gamma Knife designed for more personalized radiosurgery, while MagnetTx Oncology Solutions received FDA clearance for its Aurora-RT, a LINAC-MR technology. These advancements are expected to drive the adoption of new radiotherapy systems, particularly in developed markets.

2. Increasing Cancer Incidence

The rising global incidence of cancer is another significant driver of market growth. With the increasing availability of advanced radiotherapy treatments and a greater emphasis on early tumor detection, the demand for radiotherapy is expected to surge. Governments worldwide are also investing heavily in procuring advanced radiotherapy technologies and establishing new cancer treatment centers, particularly in developing nations.

Radiotherapy Market Challenges and Restraints

1. High Costs and Infrastructure Limitations

The high cost of radiotherapy devices and the lack of adequate healthcare infrastructure in emerging countries are significant barriers to market growth. Many developing nations struggle to allocate sufficient funds for healthcare, limiting the adoption of advanced radiotherapy technologies. Additionally, a shortage of qualified radiotherapists and oncologists poses a further challenge, especially in regions with underdeveloped healthcare systems.

2. Radiation Exposure Risks

The risk of radiation exposure to healthy tissues during treatment remains a concern, particularly with high-dose-rate brachytherapy and systemic radiotherapy. These risks, along with the complexities of radiotherapy treatment, could limit the widespread adoption of these technologies.

Radiotherapy Market Opportunities and Future Outlook

1. Rising Healthcare Expenditure in Developing Countries

Rapid economic growth in developing countries like China and India presents significant opportunities for the radiotherapy market. Increased per-capita healthcare expenditure and government initiatives to enhance healthcare facilities are expected to drive market growth in these regions. Manufacturers are increasingly partnering with healthcare providers in these countries to expand their market presence.

2. Expanding Global Collaborations

Growing collaborations and partnerships among industry players, cancer treatment centers, and oncology research institutes are contributing to the global expansion of radiotherapy services. This trend is expected to further boost market growth, as more advanced treatments become available to a broader patient population.

Radiotherapy Market Segmentation

1. By Type

- Products: Accounted for the largest market share in 2022, driven by the high installed base of radiotherapy devices and the increasing demand for comprehensive cancer care.

- Software & Services

2. By Technology

- External Beam Radiotherapy (EBRT): The largest segment, encompassing linear accelerators, particle therapy systems, and conventional cobalt-60 teletherapy units.

- Internal Beam Radiotherapy/Brachytherapy

- Systemic Radiotherapy

3. By Procedure

- Particle Therapy: Expected to register the highest growth rate within the external beam radiotherapy segment, driven by the adoption of proton therapy.

4. By Region

- North America: Expected to remain the largest market due to a high number of cancer patients, well-established healthcare facilities, favorable reimbursement policies, and the strong presence of key market players.

Conclusion

The global radiotherapy market is poised for steady growth, driven by technological advancements and the increasing global burden of cancer. However, challenges such as high costs and infrastructure limitations in developing countries could temper this growth. Nevertheless, rising healthcare expenditures and expanding global collaborations are expected to create significant opportunities for market players in the coming years.

Recent Developments in the Radiotherapy Market:

- October 2023: Accuray Incorporated received approval for the Tomo C radiation therapy system by the Chinese National Medical Products Administration (NMPA).

- July 2023: IBA partnered with Apollo Proton Cancer Centre (India) to provide training on proton beam therapy.

- April 2022: Elekta and GE Healthcare entered into a global collaboration agreement to offer comprehensive solutions in radiation oncology.