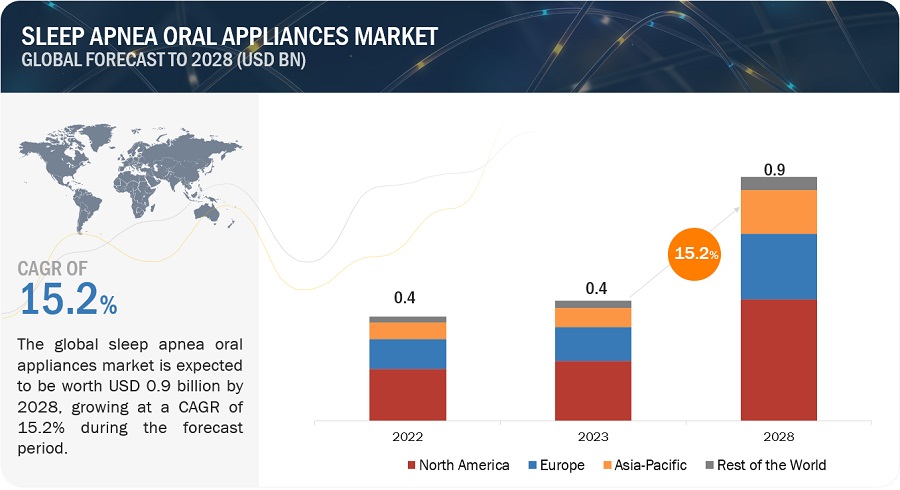

The global sleep apnea oral appliances market has witnessed significant growth in recent years. In 2023, the market was valued at approximately $0.4 billion and is projected to reach $0.9 billion by 2028, reflecting a robust compound annual growth rate (CAGR) of 15.2%. This article delves into the market dynamics, key drivers, challenges, and opportunities shaping this burgeoning industry.

Market Overview and Key Trends

The growth of the sleep apnea oral appliances market is largely driven by the increasing awareness and diagnosis of sleep apnea. As more people recognize the health risks associated with untreated sleep apnea, the demand for effective treatment solutions is on the rise. Oral appliances, particularly mandibular advancement devices, have emerged as a popular alternative to continuous positive airway pressure (CPAP) therapy, offering a less invasive and more comfortable option for many patients.

The new research study on this market includes an extensive analysis of industry trends, pricing strategies, patent filings, and insights from conferences and webinars. Additionally, the study explores the role of key stakeholders and examines the buying behavior of consumers in this market.

Market Dynamics

Driver: Large Pool of Undiagnosed Sleep Apnea Patients

Sleep apnea is a widespread sleep disorder affecting individuals of all ages. In 2022, the American Sleep Apnea Association (ASAA) estimated that obstructive sleep apnea affects between 10% and 30% of adults in the United States alone. The disorder is closely linked with various cardiovascular and metabolic conditions, exacerbated by rising obesity rates globally. This expanding pool of patients presents significant growth opportunities for the sleep apnea oral appliances market.

Restraint: Risks Associated with Oral Appliances

While oral appliances are generally considered safe, there are potential risks and side effects. Improperly fitted devices can lead to dental discomfort, jaw pain, or changes in bite alignment. Regular follow-ups and adjustments are essential to minimize these risks and ensure the effectiveness of the therapy.

Opportunity: Poor Compliance with CPAP Therapy

Despite its effectiveness, CPAP therapy suffers from poor patient compliance, with nonadherence often defined as less than four hours of use per night. This poor compliance presents a significant opportunity for oral appliances, which offer a more user-friendly alternative, potentially driving market growth.

Challenge: High Costs of Customized Oral Appliances

Customized oral appliances, designed to fit a patient’s specific oral anatomy, are more expensive than standard CPAP treatments. The customization process is time-intensive, involving accurate measurements and careful design. These factors make mass production challenging, potentially hindering market growth.

Market Segmentation

The global sleep apnea oral appliances market is segmented based on product type, purchase type, gender, age group, distribution channel, and region.

By Product:

- Mandibular Advancement Devices

- Tongue Retaining Devices

- Daytime Nighttime Appliance

By Purchase Type:

- Physician-prescribed/Customized Oral Appliances

- Online OTC Oral Appliances

By Gender:

- Male

- Female

By Age Group:

- Below 40 Years

- Age 40-60 Years

- Above 60 Years

By Distribution Channel:

- Online Pharmacies

- Retail Pharmacies

- Hospital Pharmacies and Dental Clinics

Regional Insights

In 2022, North America dominated the global sleep apnea oral appliances market, driven by rising obesity rates, ongoing technological advancements, and a favorable regulatory and reimbursement environment. The region’s dominance is expected to continue through 2028, with Europe and the Asia Pacific also showing significant growth potential.

Key Players and Competitive Landscape

Prominent companies in the sleep apnea oral appliances market include SomnoMed (Australia), ResMed (US), Whole You, Inc. (US), ProSomnus Sleep Technologies (US), and Vivos Therapeutic, Inc. (US). These companies have established themselves as leaders in the market, offering a diverse range of products and leveraging state-of-the-art technologies to meet the growing demand.

Recent Developments

- Vivos Therapeutics, Inc. (US) received 510(k) clearance from the U.S. Food & Drug Administration (FDA) in December 2022 for its DNA appliance, a Class II medical device for treating snoring and mild to moderate obstructive sleep apnea (OSA) in adults.

- ResMed (US) expanded its presence in the German market by acquiring MEDIFOX DAN, a provider of clinical, financial, and operational solutions.

- SomnoMed (Australia) held SomSUMMIT ’21, an event aimed at enhancing research, education, and awareness of oral appliance therapy as a primary solution for successful OSA treatment.

Conclusion

The sleep apnea oral appliances market is poised for substantial growth, driven by the rising prevalence of sleep apnea, increasing awareness of the disorder, and the limitations of traditional CPAP therapy. While challenges such as the high cost of customization persist, the market’s future looks promising, with significant opportunities for innovation and expansion.

As the industry evolves, key players will continue to innovate, improving patient outcomes and expanding the accessibility of these life-changing devices.