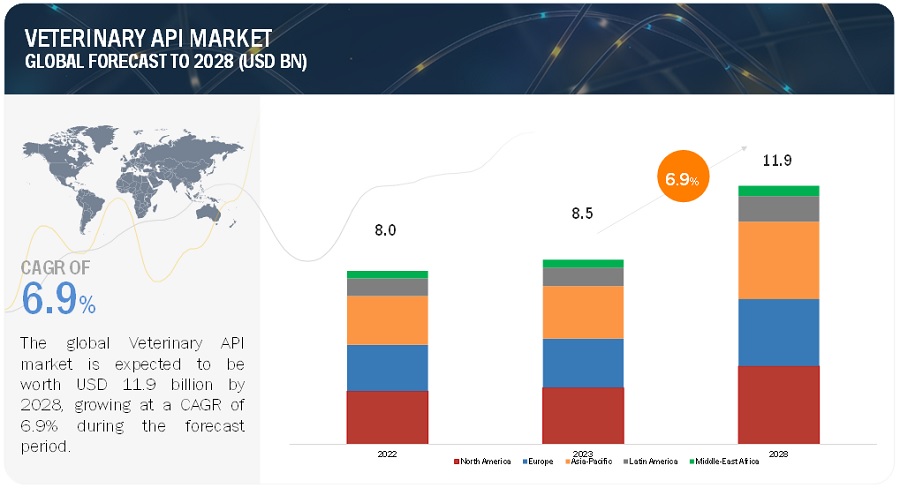

The global veterinary active pharmaceutical ingredient (API) market was valued at $8.5 billion. Projections indicate that this market will expand to $11.9 billion by 2028, growing at a compound annual growth rate (CAGR) of 6.9% over the forecast period. This growth is underpinned by a comprehensive analysis of industry trends, pricing, patent landscapes, and stakeholder behavior.

Market Dynamics

Drivers: Surge in Transboundary and Zoonotic Diseases

The rising incidence of transboundary and zoonotic diseases—such as avian influenza, rabies, and African swine fever—is a significant driver for the veterinary API market. These diseases can quickly cross borders and pose severe threats to both animal and human health. The demand for veterinary APIs is increasing as they are crucial for developing treatments and preventive measures. By effectively managing these diseases, veterinary APIs help in mitigating the risks of transmission to humans and support international disease control efforts.

Restraints: High Costs of Diagnostics and Treatments

A major challenge for the veterinary API market is the high cost associated with diagnostics and treatments. Veterinary care often requires advanced and costly equipment, specialized technology, and extensive maintenance, which contribute to elevated prices. The relatively smaller market size compared to human healthcare reduces economies of scale, leading to higher costs for veterinary diagnostics and treatments.

Opportunities: Growing Awareness of Animal Health

There is a growing awareness about animal health and welfare, driven by animal welfare organizations and public education. This increased awareness has led to a higher demand for veterinary services, including regular health check-ups and specialized treatments. This shift presents significant opportunities for the veterinary API market to expand and meet the evolving needs of pet owners and livestock farmers.

Challenges: Synthesis of Large Molecule APIs

The synthesis of large molecule APIs, such as proteins and peptides, presents unique challenges. These include high costs, extended production timelines, and the complexity of achieving high yields. The need for specialized expression systems and optimization techniques adds to the complexity and cost of producing these APIs.

Market Ecosystem

The veterinary API market comprises several key components including manufacturers involved in research and development, distributors, and third-party sellers. Notably, the parasiticides segment is anticipated to grow the fastest due to increased R&D investments in this area. Additionally, the companion animal segment is projected to experience the most rapid growth, driven by rising pet ownership and heightened awareness of animal health.

Regional Insights

North America led the veterinary API market in 2022, driven by robust R&D investments and government support for API manufacturing. The region is expected to continue leading in market share due to these factors.

Key Players

Leading companies in the veterinary API market include Phibro Animal Health Corporation (US), Fabbrica Italiana Sintetici S.p.A. (Italy), Sequent Scientific Ltd. (India), Excel Industries Ltd. (India), NGL Fine-Chem Ltd. (India), Insulnsud Pharma (Spain), Menadiona Sl (Spain), Rochem International Inc. (US), and Shaanxi Hanjiang Pharmaceutical Group Co. Ltd. (China).

Recent Developments

- 2021: Sequent Scientific Ltd. (India) received WHO-GENEVA approval for Praziquantel API under the prequalification program.

- 2020: Sequent Scientific Ltd. opened a state-of-the-art animal health R&D center in Mumbai, India.

Scope of the Veterinary API Market Report

The report offers a detailed forecast and trend analysis across various submarkets, including API types (e.g., parasiticides, vaccines, antimicrobials), synthesis types (e.g., chemical, biological), routes of administration (e.g., oral, injectable), and animal types (e.g., companion, livestock).