The global Sterility Testing Market by Product (Kits & Reagents, Instrument, Services), Test (Membrane Filtration, Direct Inoculation), Application (Pharma, Biological Manufacturing, Medical Device Manufacturing), End User (Pharma, Biotech) – Global Forecast to 2028″ global sterility testing market is expected to reach USD 1.9 billion in 2028 from USD 1.1 billion in 2023 at a CARG of 10.5%. Rising expansion of pharmaceutical & biopharmaceutical production capacities, increasing development of novel biopharmaceutical products, and rising investments in life science research are the key factors driving the growth of this market. However, the growing adoption of single-use technology is a major factor restraining the market growth.

Browse in-depth TOC on “Sterility Testing Market”

178 – Tables

35 – Figures

198 – Pages

Key Market Player

Prominent players operating in the biomarkers market are Charles River Laboratories, Inc. (US), Merck KGaA (Germany), bioMérieux SA (France), SGS SA (Switzerland), WuXi AppTec (China), Nelson Laboratories, LLC (US), Pacific BioLabs (US), Sartorius AG (Germany), Thermo Fisher Scientific Inc. (US), Samsung Biologics (South Korea). The study includes an in-depth competitive analysis of these key players in the modular data center market with their company profiles, recent developments, and key market strategies. The players in this market have embraced different strategies to expand their global presence and increase their market shares. New product launches and enhancements, partnerships, acquisitions, and collaborations have been the most dominating strategies adopted by the major players.

Drivers: Rising expansion of pharmaceutical & biopharmaceutical production capacities

In pharmaceutical and biopharmaceutical industries, sterility testing is conducted at all manufacturing stages to minimize the risk of product contamination. Subsequently, the growth of this end-use industry in the coming years will considerably boost the utilization of sterility testing.

The production capacity expansion of pharmaceuticals and biopharmaceuticals worldwide will augment the demand for sterility testing products and services. Sterility testing is mandatory during the production process of pharmaceuticals and biopharmaceuticals. Therefore, the rising production capacities of pharmaceutical & biopharmaceutical companies will drive the adoption of additional kits, reagents, and instruments for sterility tests.

Restraint: Growing adoption of single-use technology

Single-use technology substitutes the stainless-steel and hard-piped configurations used in aseptic processing and sterile manufacturing. Gamma-irradiated pre-assembled process systems are used under single-use technology. Such technology is used for aseptic filling as well as upstream & downstream processing. The main benefit of SUT is that time and money are not invested in labor-intensive and expensive cleaning, sterilization validation tests, or their recurring revalidation. Moreover, it eliminates system cleaning and sterilization requirement between batches. Adopting such technologies will hamper the demand for sterility testing products and services.

However, the chances of human error will continue, even if closed systems and single-use technology are used more frequently. Personnel continues to be the principal source of contamination for pharmaceutical & biopharmaceutical formulations that cannot be terminally sterilized. Thus, a thorough training program is essential. When adhering to GMP and quality standards, operator comprehension is a crucial factor.

Opportunities: Emerging markets

Emerging markets such as Brazil, India, and China are expected to present significant opportunities for the growth of the market. This can mainly be attributed to increased R&D funding for research in these countries. For instance, China’s current healthcare expenditure (% of GDP) went from 5.1% in 2017 to 5.4% in 2019. Similarly, for India, the healthcare expenditure rose from 2.9% in 2017 to 3.0% in 2019, while for Brazil, it was 9.5% in 2017 and increased to 9.6% in 2019.

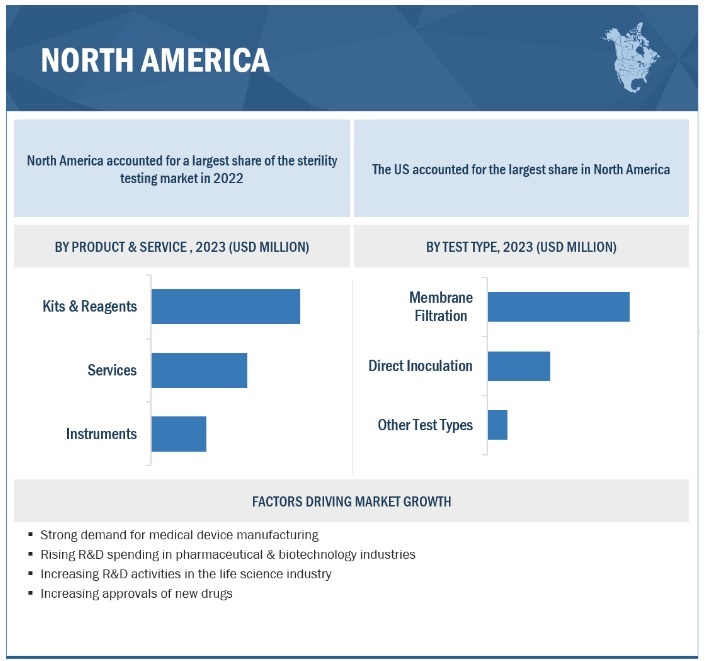

The kits & reagents segment accounted for the largest share of the product & service segment in 2022

On the basis of product & service, the sterility testing market is segmented into kits & reagents, instruments, and services. In 2022, the kits & reagents segment accounted for the largest market share in sterility testing. Kits & reagents are widely used in the pharmaceutical and biotechnology industries as it is easy to use. Moreover, the long shelf life of these products is contributing to their rising adoption in academic institutions and contract research organizations.

By test-type segment, membrane filtration accounted for the largest market share in 2022

Based on the test type, the sterility testing market is divided into membrane filtration, direct inoculation, and other tests. The membrane filtration segment accounted for the biggest share of the sterility testing market in 2022. Factors such as the growing demand for sterility testing of liquid dose formulations and the utility of such tests in samples containing preservatives and bacteriostatic & fungistatic compounds will boost segmental growth.

In 2022, the Asia region accounted as the fastest-growing region in the market

In 2022, the Asia region accounted for the fastest-growing region of the sterility testing market. Factors responsible for the growth of this region include the rising trend of outsourcing pharmaceutical activities to CROs and CDMOs coupled with growing demand from emerging markets such as China and India.Moreover, growing public and private investments in pharmaceutical and biopharmaceutical R&D activities in the region will also propel the growth of Asian sterility testing market over the forecast period.

Recent Development:

- In November 2022, Merck KGaA (Switzerland) invested USD 306.5 million in expanding its biosafety testing capacity at Rockville, Maryland, US. This site will provide biosafety testing and analytical development services in the US.

- In September 2022, Merck KGaA (Switzerland) opened its viral clearance (VC) laboratory as the first phase of the China Biologics Testing Center. This site is set to operate in China and will locally conduct viral clearance studies across pre-clinical development to commercialization.

- In June 2022, Charles River Laboratories, Inc. (US) opened a new facility of High Quality (HQ) Plasmid DNA Centre of Excellence at Bruntwood SciTech’s Alderley Park in Cheshire, UK. The 16,000 sq. ft facility will provide plasmid DNA manufacturing services.

- In May 2022, bioMerieux SA (France) acquired Specific Diagnostics (US). With this acquisition, bioMerieux will improve its presence in antimicrobial resistance while expanding its market-leading position globally in clinical microbiology.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/sterility-testing-market-208866931.html

https://www.marketsandmarkets.com/PressReleases/sterility-testing.asp