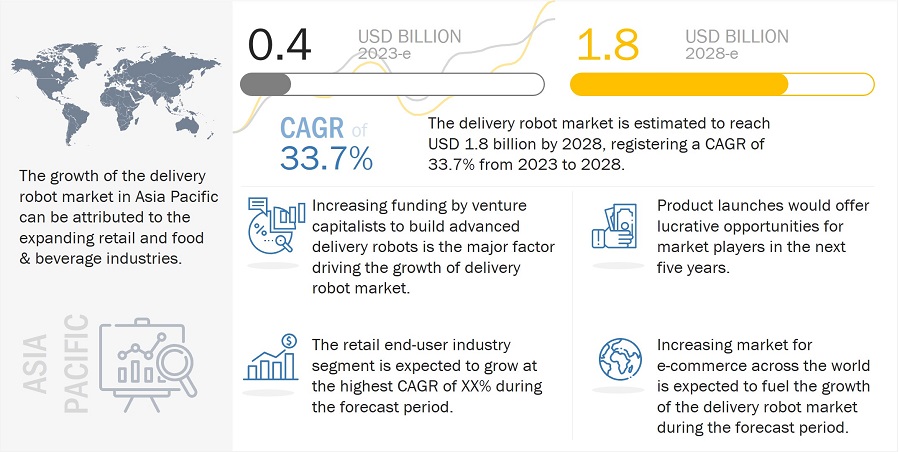

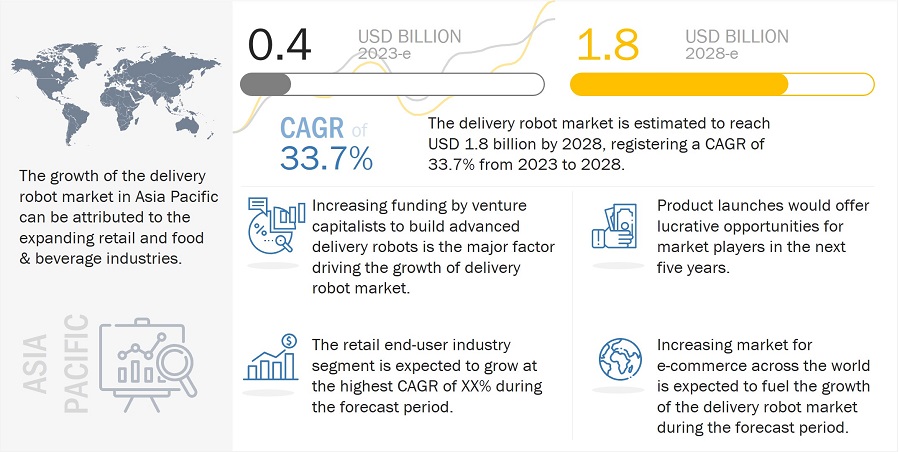

The Delivery Robots Market Size is projected to grow from USD 0.4 billion in 2023 to USD 1.8 billion by 2028, experiencing a robust CAGR of 33.7% during the forecast period. This substantial growth is driven by the rising demand for efficient and cost-effective last-mile delivery solutions, advancements in autonomous technology, and increasing e-commerce activities. Delivery robots offer numerous benefits, including reduced delivery times, lower labor costs, and enhanced operational efficiency. As urbanization and consumer expectations for fast and reliable delivery services continue to rise, the deployment of delivery robots in various sectors such as retail, food delivery, and logistics is set to expand significantly, contributing to the market’s rapid growth.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263997316

A rise in venture funding is expected to drive the growth of the delivery robots market in the coming years. The significant cost reductions achieved in last-mile delivery through the use of delivery robots have accelerated their development, further bolstering market growth. Autonomous delivery robots offer a substantial reduction in labor costs, constituting only 20–25% of the total delivery cost. This economic advantage is attracting substantial investment and innovation in the sector, as companies seek to optimize their delivery processes and enhance operational efficiency. The increasing deployment of these robots in various industries, including retail, food delivery, and logistics, highlights their potential to transform the delivery landscape, making it more cost-effective and efficient.

Delivery Robots Companies:

- Starship Technologies (US),

- JD.com, Inc. (China),

- Panasonic Holdings Corporation (Japan),

- Relay Robotics, Inc. (US), and

- Nuro, Inc. (US).

Delivery Robots Market Dynamics

Drivers: Increase in venture funding

Autonomous delivery robots are gaining traction in the food & beverage, retail, hospitality, and healthcare industries due to their high efficiency and energy-saving capabilities compared to traditional electric vehicles. The increasing adoption of these robots has attracted significant venture funding. For instance, in March 2022, Starship Technologies, a leading player in the autonomous delivery robots market, secured another round of funding just 30 days after its previous financial boost. The company raised USD 42 million in equity, elevating its total valuation to over USD 100 million. This Series B all-equity round was co-led by NordicNinja and Taavet+Sten, highlighting the strong investor confidence in the potential of delivery robots to revolutionize logistics and operational efficiency across multiple sectors.

Inquire Before Buying @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=263997316

Opportunity: Advancements in features of autonomous delivery robots

Autonomous delivery robots are equipped with advanced electronics that ensure safe, reliable, and efficient operations. Significant technological advancements are occurring in delivery vehicles, particularly in power sources, data gathering, and processing technologies. While lithium-ion batteries are currently the predominant power source, hydrogen fuel cell batteries are anticipated to become more prevalent in autonomous delivery vehicles due to their excellent endurance and low weight. Additionally, manufacturers are striving to integrate sense and obstacle-avoidance systems into their delivery robots, further enhancing their operational capabilities and safety. These advancements are crucial for optimizing the performance and expanding the adoption of autonomous delivery robots across various industries.

Challenge: Safety issues associated with operations of delivery robots in populated areas

The escalating costs of traditional delivery methods, rapid technological advancements, and the increased adoption of artificial intelligence (AI) and integrated technology have significantly boosted the adoption of delivery robots. These robots are increasingly used for delivering groceries, food items, postal parcels, and medicines, as well as in the hospitality sector to provide room services and carry luggage, following users wherever they go. However, ensuring the safety of delivery robots for routine interactions with humans and smooth operations in high-density traffic areas remains a significant technological challenge. To enable safe and close interaction with humans, the hardware and software of delivery robots must be highly reliable, minimizing any potential risks of malfunction. Addressing these challenges is crucial for the widespread and safe integration of delivery robots into everyday operations.

By Number of Wheels Segments:

4-wheeled delivery robots are expected to hold the majority market share during the forecast period

The 4-wheeled robots will account for the majority share in the delivery robots industry in 2022. The design improvement of reducing the distance between the front and rear wheels results in better zero-radius turning, allowing 4-wheeled robots to rotate efficiently in place. Consequently, most robotics companies worldwide offer delivery robots with 4 wheels due to their superior maneuverability. For instance, Just Eat, a UK-based delivery firm, employs 4-wheeled robots to deliver food to customers even in snow and severe weather, as these robots can better navigate tough conditions compared to 6-wheeled models. Additionally, in May 2022, Uber Eats announced plans to launch two new test programs in Los Angeles, including four-wheeled delivery robots for short trips on sidewalks and self-driving cars for longer distances. These advancements highlight the increasing preference for 4-wheeled robots in the delivery sector, driven by their enhanced efficiency and adaptability.

Browse For More Details – https://www.marketsandmarkets.com/Market-Reports/delivery-robot-market-263997316.html

By End-user Industry:

Food & Beverage industry to boost market growth during the forecast period

Delivery robots have been extensively used in the food & beverage industry to deliver food items and beverages from restaurants. In terms of volume, the food & beverage industry constituted approximately 56% of the delivery robots market in 2022. This growth has been driven by ventures that offer food parcels from restaurants directly to consumers’ doorsteps. For instance, in December 2022, Uber Eats partnered with Cartken to deliver orders through autonomous, sidewalk-trotting robots in Miami. This new service alerts customers of their food order and instructs them to meet the remotely supervised robots on the sidewalk. Consumers seek low-cost, efficient delivery options, and delivery robots provide a cost-effective solution that optimizes delivery time. Companies like Starship Technologies and Segway Robotics are actively engaged in manufacturing and developing delivery robots tailored for the food & beverage industry, showcasing the industry’s move towards automation and efficiency in food delivery services.

By Regional Growth:

Delivery Robots market to witness the highest demand in the North American region

The market for delivery robots in North America was valued at USD 147.8 million in 2022 and is expected to reach USD 830.7 million by 2028, growing at a CAGR of 32.7% during the forecast period. North America, particularly the US, hosts numerous delivery robot manufacturing companies, such as Nuro Inc and BoxBot. The region’s sophisticated and adequate street infrastructure, with well-designed and sufficiently wide sidewalks and footpaths, facilitates the testing and operation of delivery robots. In recent years, ground delivery robot companies in the US have become increasingly commercialized. The US leads the robotics market, bolstered by substantial government support for innovative robotics research programs, including significant investments in defense-related projects. This robust ecosystem of infrastructure and governmental support is propelling the growth of the delivery robots market in North America.

News Covered:

https://www.prnewswire.com/news-releases/delivery-robots-market-worth-1-8-billion-by-2028—exclusive-report-by-marketsandmarkets-301763030.html