The smart locker industry is rapidly evolving, driven by technological advancements and changing consumer needs. With increasing demand for contactless delivery, secure storage solutions, and the growth of e-commerce, smart lockers are gaining traction in various sectors such as logistics, retail, and even residential buildings. In this article, we will explore the key trends shaping the future of the smart locker industry, market growth projections, leading companies in the space, regional insights, opportunities, challenges, and industry segmentation.

Trends Shaping the Future of the Smart Locker Industry

- Rising Demand for Contactless Solutions The COVID-19 pandemic accelerated the demand for contactless solutions in both retail and logistics. Smart lockers offer a secure, touchless way to pick up deliveries, a trend that is expected to continue post-pandemic as consumers prioritize safety and convenience.

- Integration with Internet of Things (IoT) Smart lockers are becoming increasingly integrated with IoT, enabling real-time monitoring, improved security, and seamless communication between lockers, users, and service providers. This integration enhances efficiency and provides valuable data insights for companies managing these systems.

- Customization and Modular Designs As businesses across different sectors adopt smart lockers, there is a growing demand for customizable and modular locker designs. Companies can tailor smart locker systems to their specific needs, whether for parcel delivery, office supplies, or other applications.

- E-commerce and Last-Mile Delivery The explosion of e-commerce has significantly impacted the logistics industry, particularly in the area of last-mile delivery. Smart lockers provide a convenient solution for parcel drop-offs and pick-ups, reducing delivery times and enhancing customer satisfaction.

- Sustainability Focus With the increasing focus on environmental sustainability, smart lockers contribute to reducing carbon footprints by optimizing delivery routes, consolidating deliveries, and reducing the number of failed delivery attempts. This aligns with the global push toward more eco-friendly logistics solutions.

Smart Locker Market Growth Projection

The global Smart Locker Market Size was valued at USD 2.1 billion in 2023 and is estimated to reach USD 3.6 billion by 2028, growing at a CAGR of 11.6% during the forecast period. The key drivers behind this growth include the rise of e-commerce, demand for secure storage solutions in residential and commercial settings, and the ongoing trend toward contactless service options.

The retail and logistics sectors will continue to be major adopters of smart locker technology, but other industries, such as healthcare, education, and corporate offices, are also expected to fuel demand as they seek secure and efficient storage and delivery solutions.

Top Companies in the Smart Locker Industry

Several leading companies are driving innovation and adoption in the smart locker industry. Some of the top players include:

- Apex Supply Chain Technologies – Known for providing innovative locker solutions for logistics, retail, and manufacturing industries.

- Parcel Pending – A leader in the residential and commercial smart locker space, offering customizable locker systems for multifamily communities and corporate environments.

- TZ Limited – Specializing in smart locker solutions for mail and parcel management, TZ Limited is making strides in the logistics and e-commerce sectors.

- Quadient – A major player offering a wide range of smart parcel locker solutions, primarily focused on e-commerce and last-mile delivery.

- Smiota – Offering secure smart locker solutions for businesses and logistics companies, Smiota provides lockers designed to enhance last-mile efficiency and user convenience.

Regional Analysis of the Smart Locker Industry

The adoption of smart lockers is growing globally, with North America, Europe, and Asia-Pacific leading the way:

- North America: This region has seen significant adoption due to the expansion of e-commerce and the demand for more secure, contactless delivery methods. The U.S. is a major market for smart lockers, driven by the presence of leading e-commerce giants like Amazon.

- Europe: Europe is also experiencing strong growth, particularly in countries such as Germany, the U.K., and France. Government regulations promoting smart city initiatives and improved parcel delivery efficiency are driving demand for smart lockers.

- Asia-Pacific: The Asia-Pacific region is expected to witness the highest growth, largely due to the rapid expansion of e-commerce in China, India, and Japan. The growing middle class and increasing urbanization are key factors contributing to this surge.

Opportunities in the Smart Locker Industry

- Expansion into New Sectors: While the logistics and retail industries are well-established users of smart lockers, new opportunities are emerging in healthcare, education, and corporate offices. Smart lockers can be used to store sensitive medical supplies, student packages, and workplace equipment, offering new revenue streams for manufacturers and service providers.

- Growth of Smart Cities: As cities around the world implement smart city technologies, smart lockers are becoming an integral part of urban infrastructure. They can be installed in public spaces, transportation hubs, and residential complexes to streamline parcel management and reduce congestion in city centers.

- Partnerships with E-commerce and Logistics Providers: By partnering with major e-commerce platforms and logistics companies, smart locker providers can expand their market reach and capitalize on the growing demand for faster, more efficient last-mile delivery solutions.

Challenges Facing the Smart Locker Industry

Despite its growth potential, the smart locker industry faces several challenges:

- High Initial Costs: The installation and maintenance of smart lockers can be costly, which may deter smaller businesses from adopting the technology. While larger enterprises can absorb these costs, the industry must find ways to reduce upfront expenses and offer more affordable solutions.

- Privacy and Security Concerns: As smart lockers become more connected through IoT, concerns about data privacy and security are rising. Companies must invest in secure systems that protect user information and ensure the safety of stored items.

- Logistical Challenges in Rural Areas: While urban centers are prime locations for smart lockers, rural areas with lower population densities may not see the same level of adoption. This poses a challenge for companies looking to expand into these regions and create an efficient logistics network.

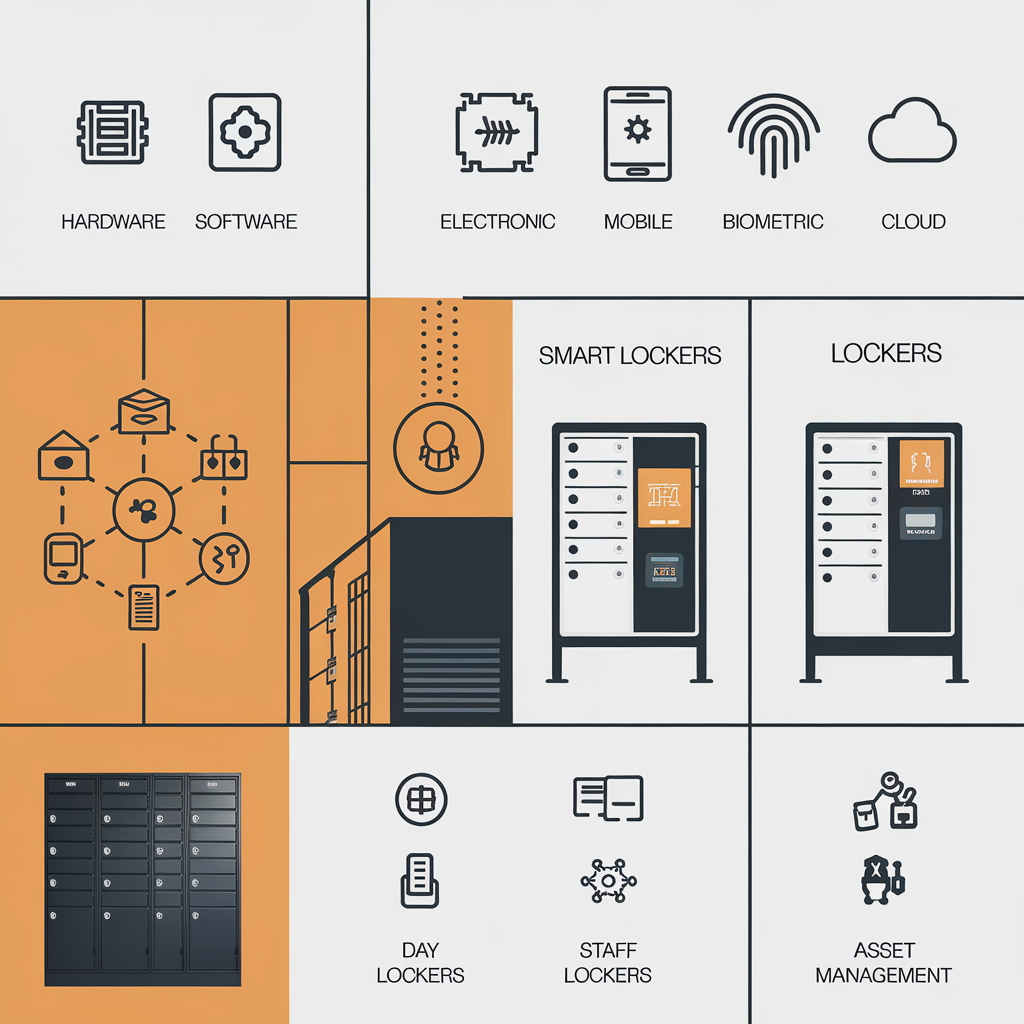

Smart Locker Industry Segmentation

The smart locker industry can be segmented based on the following criteria:

- By Type: Parcel lockers, asset lockers, refrigerated lockers (for perishable goods).

- By End User: Retail, logistics, corporate offices, residential complexes, educational institutions, healthcare facilities.

- By Deployment: Indoor and outdoor locker systems.

- By Region: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The smart locker industry is on a strong growth trajectory, with increasing adoption across various sectors driven by the rise of e-commerce, demand for secure and contactless delivery solutions, and technological advancements. However, to fully capitalize on the opportunities, companies must address the challenges of high costs, security concerns, and logistical limitations in rural areas. With continued innovation and strategic partnerships, the smart locker industry is set to play a crucial role in the future of logistics, retail, and smart cities.