The global industrial edge market is expected to increase from USD 21.19 billion in 2025 to USD 44.73 billion in 2030, at a CAGR of 16.1% during the forecast period.

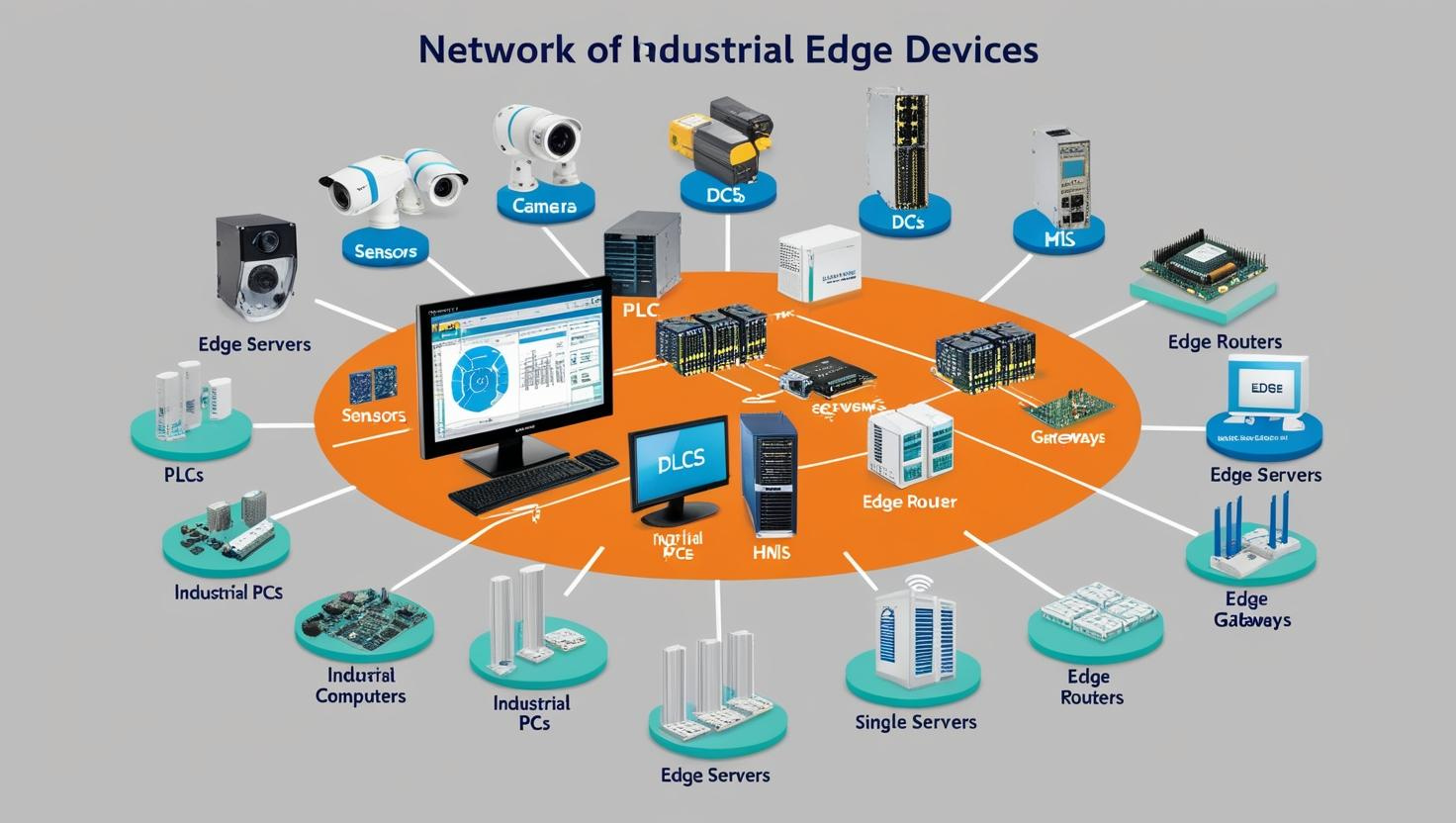

The industrial edge market is an ecosystem of technologies and solutions that enable data processing, analytics, and decision-making at the edge of industrial networks, at the site of data generation. This market comprises industrial edge software that allows real-time data processing, machine learning, and automation, as well as industrial edge devices including sensors, gateways, and controllers. The supervision of these devices and software is essential for industrial edge management, which guarantees the optimization, security, and seamless integration of edge operations. The industrial edge market is a pillar of Industry 4.0 and smart manufacturing initiatives, as it enables real-time insights, improves operational efficiency, and reduces latency by bringing computation and analytics closer to the source.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=195348761

Adoption of IoT (Internet of Things) and the need of distributed data processing in sectors like manufacturing, energy, and logistics fuel the expansion of the industrial edge markets. Designed to function under demanding conditions, industrial edge devices provide consistent connection and localised data processing capability. These devices are complemented by industrial edge software, which facilitates autonomous decision-making, predictive maintenance, and sophisticated analytics. Industrial edge management is responsible for the efficient deployment, monitoring, and maintenance of edge infrastructure. Collectively, these elements facilitate the industrial edge market’s status as a critical enabler of operational excellence and digital transformation in the contemporary industrial landscape, as they enable businesses to increase productivity, reduce outages, and achieve greater scalability.

Based on Component, the industrial edge market is anticipated to be dominated by the hardware segment during the forecast period, as a result of the growing popularity of edge computing devices, including gateways, edge servers, and embedded systems. The demand for high-performance computing infrastructure at the edge is on the rise as industries priorities real-time data processing, reduce latency, and enhance security. The expansion of industrial IoT, AI-driven automation, and remote monitoring applications intensifies the need for hardware solutions able to handle complex tasks. Moreover, the development of scalable architectures, ruggedised components, and edge processors allows companies to use edge computing in demanding industrial situations. Hardware is essentially driving the growth of industrial edge solutions as businesses like manufacturing, energy, and logistics engage in edge computing to maximise operations.

Based on Industry, it is anticipated that the automotive industry will maintain a significant share of the industrial edge market throughout the forecast period. The increasing adoption of edge computing solutions to support advanced manufacturing processes, autonomous vehicle development, and smart industrial initiatives is the driving force behind this. Automotive companies are also using industrial edge technologies to streamline supply chains, allow smart manufacturing, and maximize production lines. Growing acceptance of electric and connected cars drives need for edge computing in vehicle to anything (V2X) connectivity, so allowing flawless interactions between infrastructure, automobiles, and cloud systems. With the industry’s emphasis on digital transformation and data-driven decision-making, automotive is a major sector driving the growth of industrial edge technology.

Based on Region, North America is expected to dominate the industrial edge market during the forecast period, as a result of the widespread adoption of edge computing in sectors such as oil and gas, automotive, semiconductor and electronics, transportation, and energy and power. The United States is at the forefront of this transformation, employing industrial edge solutions to address scalability, security, operations efficiency, and real-time data processing enablement, as well as latency. By processing data closer to the source, industries get speedier decision-making, reduced dependence on clouds, and improved system performance. Key companies like AWS, Microsoft Azure, Google Cloud, Dell Technologies, and Cisco are increasing industrial edge use with advanced hardware, software, and services. While the semiconductor sector is optimising manufacturing methods, the automotive sector is adopting edge computing for real-time monitoring and predictive maintenance. The oil and gas sector is seeing similar increases in exploration and production efficiency; edge technologies are enabling the energy sector to better integrate renewable energy sources into grid management.

Government initiatives are additionally increasing market expansion. Under the Microelectronics Commons (ME Commons) initiative, the U.S. Department of Defence announced a USD 269 million investment in September 2024.This investment is aimed at enhancing national security, the semiconductor supply chain, and the development of leading technologies like artificial intelligence (AI) and secure edge computing. North America’s strong technical infrastructure, government incentives, and presence of leading-edge technology companies are a primary force behind industrial edge growth in this region. Exponential demand for industrial edge solutions will rise when businesses ramp up their digital transformation and adopt Industry 4.0. This path reflects the region’s focus on innovation, thus cementing its global leadership in industrial edge computing and forging new economic and industry opportunities.