The RFID market is projected to reach USD 25.24 billion by 2033 from USD 12.61 billion in 2025 at a CAGR of 9.1% during the forecast period. Growing demand for real-time tracking and monitoring, increasing integration of RFID technology with industry 4.0 and smart manufacturing, adoption of RFID systems in toll collection, and expanding applications in healthcare management systems are the major factors contributing to the market growth.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=446

The high demand in various industries, including logistics & warehousing, healthcare, and retail, for real-time tracking and identification solutions pushes for the adoption of RFID technology. Demand for supply chain optimization and inventory management is increasingly high, driven by e-commerce and omnichannel retailing, hence driving the demand for RFID tags and readers. In healthcare, patient safety and operational efficiency will increase through real-time medical equipment and patient record tracking using RFID technology. RFID ensures seamless operations in the aerospace & defense sector by asset tracking and scheduling maintenance. For more efficient transportation systems in an urban area or smart city, RFID has a role to play in automating the collection of tolls and its waste management solutions. High upfront costs, interoperability problems, and data privacy have been the main hurdles encountered. With enhanced investment in RFID innovation along with the development of IoT and edge computing, these are promoting the application of RFID systems in novel applications.

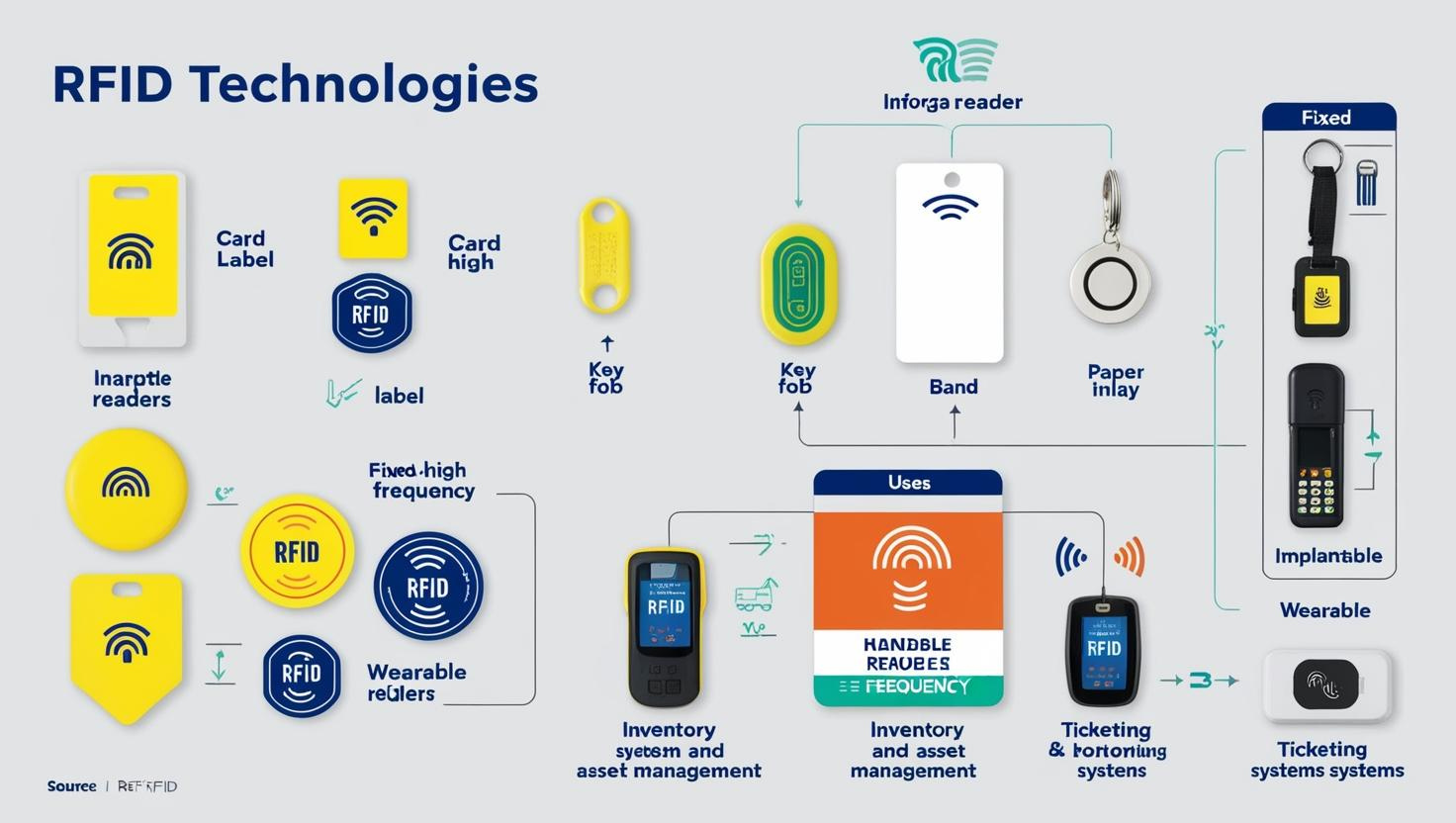

The segments of the RFID market based on offering include tags, readers, and softwares & services. The tag type segment mainly includes active and passive. The form factor segment includes card, label, key fob & token, band, paper & inlay, implantable, and other RFID tags. The frequency segment includes low frequency (LF), high frequency (HF), and ultra-high frequency (UHF). The material segment include plastic, glass, paper, and other materials. The wafer size segment mainly includes 8-inch, 12-inch, and other wafer sizes. The application segment includes inventory & asset management, accesss control & security, ticketing, and other applications. The vertical segment includes automotive, healthcare, agriculture, food, retail, transportation, animal tracking, aerospace & defense, entertainment, logistics & warehousing, and other verticals. Each of these segments requires precise RFID solutions and services against performance standards and regulations.

In the vertical segment, it is projected that the retail sector will hold the biggest share of the RFID market in the forecast period. The main reason for such growth is due to increased adoption of RFID technology in improving inventory management and supply chain operations to enhance the general customer experience. Retailers embed RFID tags within products for real-time accuracy and visibility in tracking levels of inventory. This automatically reduces the potential for stockouts and opportunities for overstocking. The technology also provides comfort through speedy checkout times, automatic reordering of goods, and increased loss prevention because of added security measures. Due to the rapid growth of omnichannel retail strategies such as buy-online-pickup-in-store, curbside pickup, etc., RFID solutions will gain demand to support the seamless fulfillment of orders. E-commerce and requirements for efficient warehouse management systems have made RFID the operational centerpiece for retailers who want to remain competitive and efficient, while further enhancing customer satisfaction. It is therefore anticipated that endless growth is expected in the adoption of RFID technology in the retail sector.

The passive tag segment of the tag type segment is likely to witness the highest CAGR in the RFID market during the forecast period. This growth is primarily because of the increasing adoption of passive RFID tags across industries such as retail, healthcare, logistics & warehousing. Passive RFID tags, which do not require an internal power source, are highly cost-effective and ideal for large-scale deployments. These tags are used highly in inventory tracking, asset management, and monitoring applications. Expanding implementation of RFID technologies in smart shelves, automated checkouts, and inventory management in retail is one major driver for this segment. Advancements in tag antenna design and manufacturing processes such as printed electronics also make it possible to produce smaller, more efficient passive RFID tags. Passive RFID tags are used for patient monitoring and medical equipment tracking in healthcare. They offer real-time data with a high degree of precision. Key drivers of the growth of the passive tag market are the growing penetration of IoT in industrial and consumer applications, demand for seamless supply chain management, and the need for cost-effective, scalable tagging solutions.

The key players in the RFID market Zebra Technologies Corp. (US), Avery Dennison Corporation (US), Honeywell International Inc. (US), HID Global Corporation (US), Datalogic S.p.A. (Italy), Impinj, Inc. (US), GAO RFID Inc. (Canada), Alien Technology LLC (US), CAEN RFID S.r.l. (Italy), and Xemelgo, Inc. (US). These players have adopted various organic and inorganic growth strategies such as product launches and expansions, partnerships, collaborations, and acquisitions to expand their presence globally and increase their share in the RFID market.