The next-generation memory market is undergoing significant growth as industries increasingly require faster, more efficient, and scalable memory solutions. From artificial intelligence (AI) and the Internet of Things (IoT) to advanced telecommunications like 5G, new memory technologies are poised to redefine how data is processed and stored. This article explores the current state of the next-generation memory market, highlighting its size, share, drivers, challenges, opportunities, and regional market trends.

Market Overview and Current Market Size

The next-generation memory market has seen rapid growth due to the increasing need for high-performance data storage and retrieval systems across diverse applications. As data generation surges globally, traditional memory systems such as DRAM and NAND flash have reached their performance limits. This has prompted a shift toward newer, more advanced memory technologies that offer faster speeds, lower latency, and improved energy efficiency.

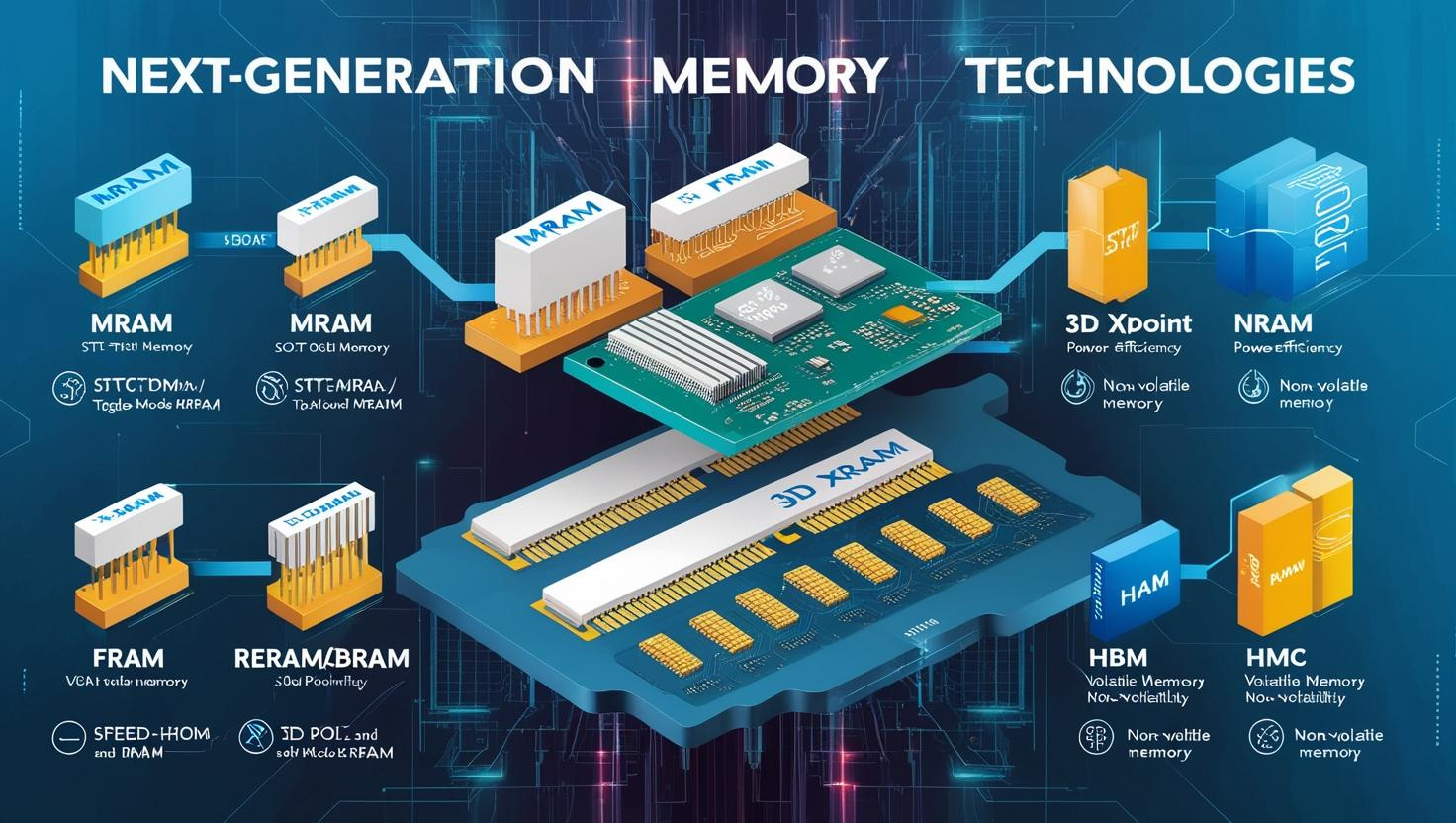

Currently, the next-generation memory market size was valued at USD 6.2 billion in 2023 and is estimated to reach USD 17.7 billion by 2028, growing at a CAGR of 23.2% between 2023 to 2028. Several factors, such as technological advancements in AI, IoT, and 5G, as well as the growing demand for data-intensive applications, are driving the need for next-generation memory solutions. For instance, products such as Memristors, ReRAM (Resistive RAM), Phase-Change Memory (PCM), and MRAM (Magnetoresistive RAM) are leading the charge in reshaping the memory landscape.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=632

Market Drivers and Opportunities

- Increasing Demand for Faster and More Efficient Data Processing

In today’s digital era, speed and efficiency are paramount. As AI, machine learning, and real-time analytics gain traction, there is an increasing demand for memory technologies capable of supporting these applications. Next-generation memory solutions, such as 3D XPoint and memristors, offer speed and energy efficiency that traditional memory systems cannot match. These innovations enable faster data access, more effective processing, and improved overall system performance, making them ideal for AI-based applications and large-scale data analytics.

- Growth in IoT Devices

The exponential growth of IoT devices is one of the key drivers of the next-generation memory market. With billions of devices expected to be connected in the coming years, each IoT device generates vast amounts of data that need to be processed and stored efficiently. Traditional memory systems struggle with the size, speed, and power demands of these devices, creating an opportunity for more advanced, energy-efficient memory solutions. Technologies such as ReRAM and MRAM are particularly well-suited for IoT devices because of their low power consumption and durability.

- Advancements in Telecommunications and 5G Networks

The rollout of 5G networks is further accelerating the demand for next-generation memory technologies. 5G networks promise to revolutionize connectivity by enabling faster speeds, lower latency, and more reliable communications. To support these capabilities, network infrastructure, mobile devices, and edge computing platforms require memory systems that can handle large volumes of data with minimal delays. Advanced memory solutions are critical in ensuring the efficiency of these networks and meeting the demands of high-speed data processing.

Challenges Facing the Next-Generation Memory Market

Despite the growing demand and promising prospects, the next-generation memory market faces several challenges:

- High Cost of Advanced Memory Solutions

One of the major barriers to widespread adoption of next-generation memory technologies is their high cost. While these technologies offer significant performance advantages, the cost of production is still higher than traditional memory options like DRAM and NAND flash. This cost factor can limit the affordability of these solutions for mass-market devices and applications, hindering broader implementation.

- Technical Limitations and Integration Issues

Many of the next-generation memory technologies, while promising, are still in the early stages of development. Some, like memristors, face challenges in scaling up for commercial production. Moreover, integrating these new memory systems into existing architectures and platforms can be complex, requiring significant adjustments to hardware and software systems.

- Data Security Concerns

As the volume of data grows, security becomes an increasingly important issue. Next-generation memory solutions will need to address vulnerabilities and provide robust data protection features. This requires continuous innovation and refinement of memory technologies to ensure that they meet the stringent security requirements of sectors such as healthcare, finance, and government.

Growth in IoT Devices

The rapid growth of IoT devices is one of the primary catalysts for the next-generation memory market. the next-generation memory market size is estimated to reach USD 17.7 billion by 2028, with each device producing and transmitting substantial amounts of data. This influx of data necessitates efficient memory systems capable of supporting real-time data processing while minimizing power consumption. Non-volatile memories, such as MRAM and ReRAM, are particularly well-suited to this environment due to their low power requirements and high endurance, making them ideal for IoT devices, wearables, and industrial applications.

Regional Market Analysis

- North America

North America dominates the next-generation memory market due to its strong presence in high-tech industries such as AI, cloud computing, and telecommunications. The region is home to major technology companies that are driving innovation in memory technologies. Additionally, the increasing adoption of 5G networks and IoT devices is fueling market growth in this region.

- Asia-Pacific

Asia-Pacific is expected to witness significant growth in the next-generation memory market due to the rising adoption of IoT devices, expanding 5G networks, and increasing investments in AI technologies. China, Japan, and South Korea are key players in the semiconductor industry, and their ongoing technological advancements are propelling the market forward. Furthermore, the region’s growing electronics manufacturing sector supports demand for advanced memory solutions.

- Europe

Europe is also a prominent player in the next-generation memory market, with strong investments in industrial IoT, automotive technology, and telecommunications infrastructure. The region’s push towards digital transformation and Industry 4.0 is expected to drive demand for memory technologies that support automation, real-time analytics, and edge computing.

- Latin America and Middle East & Africa

While still emerging, the Latin America and MEA regions are expected to see steady growth in the next-generation memory market, driven by increasing technological adoption and digitalization efforts. Growing sectors like automotive, healthcare, and telecommunications will spur demand for high-performance memory systems in these regions.

The next-generation memory market is poised for significant growth, driven by advancements in AI, IoT, and 5G technologies. While challenges such as cost, technical limitations, and integration issues remain, the opportunities presented by these emerging technologies are vast. As the demand for faster, more efficient, and scalable memory solutions continues to rise, the next-generation memory market will play a critical role in shaping the future of computing, connectivity, and data processing. With strong growth projected across various regions, the next-generation memory market is on track to become a cornerstone of the digital transformation era.