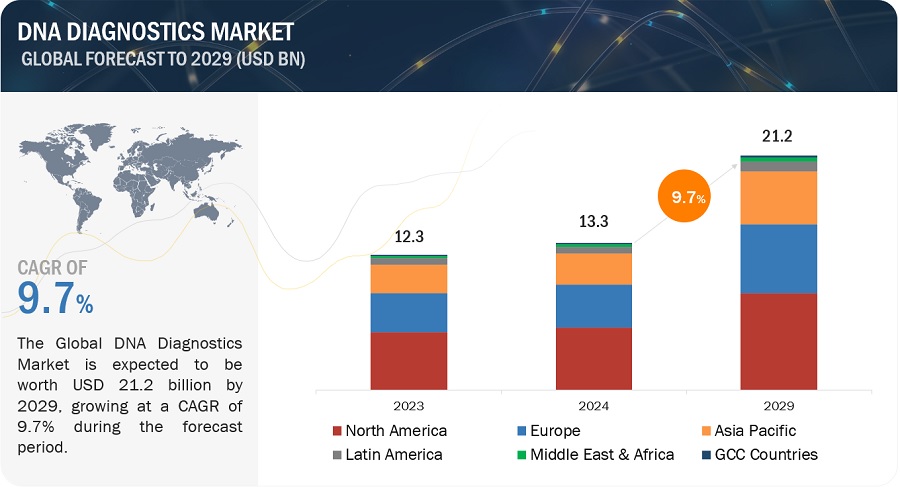

The global DNA Diagnostics Market is anticipated to increase from $13.3 billion in 2024 to $21.2 billion by 2029, growing at a CAGR of 9.7%. The primary drivers behind this expansion are continuous technological enhancements in DNA diagnostics and rising demand for personalized treatment and early diagnosis across developing regions. Moreover, healthcare companies’ investments are fueling market momentum.

Key players:

The major players in this market are Illumina, Inc. (US), Danaher Corporation (US), F. Hoffmann-La Roche Ltd. (Switzerland), BIOMÉRIEUX (France), Hologic, Inc. (US), QIAGEN (Germany), Thermo Fisher Scientific Inc. (US), Abbott Laboratories (US), Siemens Healthineers AG (Germany), Myriad Genetics, Inc. (US), and Revvity Inc. (US). These players’ market leadership is due to their comprehensive product portfolios and expansive global footprint. These dominant market players have several advantages, including strong research and development budgets, strong marketing and distribution networks, and well-established brand recognition.

DNA Diagnostics Market Dynamics

DRIVER: Rising focus on R&D and increased funding by healthcare-based companies

Government initiatives, schemes, or funding activities that support and promote innovation and development provide growth opportunities in the market. These financial incentives and support systems enable companies/institutes to invest in R&D, infrastructure, and the production of advanced diagnostic technologies. By facilitating access to funds, manufacturers can push the boundaries of DNA diagnostics, leading to breakthrough innovations in disease detection, monitoring, and personalized medicine. For instance:

Some of the leading players operating in the market are investing significantly in research and development. For instance, in 2023, Abbott invested USD 2.74 billion, and F. Hoffmann-La Roche Ltd. invested USD 2.20 billion.

Restraint: Ethical and privacy concerns associated with DNA diagnosis

The development of each new genetic test brings significant challenges for medicine, public health, and social policy. These challenges include determining the appropriate circumstances for the test’s use, the methods for its implementation, and the applications of its results. After undergoing genetic testing, individuals have the right to privacy, which includes the ability to decide for themselves whether and with whom to share genetic information such as insurers, employers, educational institutions, employers, spouses and other family members, researchers, and social organizations.

A number of ethical concerns have emerged with respect to the privacy of the health data generated—for example, the possibility that giant software companies engaged in NGS data management may sell genome data. Another area of resistance is R&D on genetically modified organisms—an application of NGS. This is due to the possibility of environmental hazards arising from such experiments, risks to the food web, and issues concerning the prevalence of diseases and allergies, as well as contamination in animal test subjects. Such ethical issues serve to challenge the growth of DNA diagnostic applications.

Opportunity: Advancements in bioinformatics and artificial intelligence in DNA diagnostics

Advancements in bioinformatics and artificial intelligence (AI) have significantly impacted DNA diagnostics, leading to more efficient, accurate, and accessible testing methods. A major use of bioinformatics is the identification of genes in large DNA sequences. Prior to the advent of bioinformatics, the only methods available for locating genes along a chromosome were either isolating the DNA and studying it in a test tube (in vitro) or studying the gene’s behavior in the organism (in vivo). By utilizing a computer to analyze sequence data, bioinformatics enables experts to make educated estimates regarding the location of genes (in silico). A cancer patient’s prognosis is enhanced by early detection; however, early diagnosis may be challenging to accept. Technology has evolved with the use of DNA microarrays and proteomics studies for large-scale gene expression research, which has increased the use of bioinformatics tools.

However, AI and genetic engineering have opened new avenues for biotechnology and personalized medicine. Machine learning algorithms can analyze large-scale genetic sequence datasets, which can then be used to steer the development of more accurate and effective genome editing technologies by predicting probable off-target consequences. This is one way that AI helps predict and optimize genome editing methods like CRISPR-Cas9. These advancements are revolutionizing the landscape of DNA diagnostics, enabling more precise, timely, and personalized healthcare solutions.

By offering, the reagents & kits segment of the DNA diagnostics industry is projected to register the highest CAGR in the forecasted period.

Based on offering, the DNA diagnostics market is segmented into reagents & kits, instruments, and services & software. DNA diagnostic test volume is steadily rising due to rising disease prevalence and the demand for prompt, accurate diagnosis. In order to accommodate this increase in test numbers, reagents and & kits are essential, assuring a continuous demand for this segment.

By application, the oncology testing segment of the DNA diagnostics industry is projected to register the highest CAGR in the forecasted period.

Based on application, the DNA diagnostics market is segmented into infectious disease diagnostics, oncology testing, prenatal, pre-implantation, myogenic disorders, and other applications. Oncology testing segment is expected to register the highest CAGR during the forecasted period. Growth in the oncology testing segment can be attributed to the rising prevalence of cancer and the increasing focus on personalized medicine.

By technology, sequencing technology segment of the DNA diagnostics industry is projected to register the highest CAGR in the forecasted period.

Based on technology, the DNA diagnostics market is segmented into polymerase chain reaction (PCR), microarrays, in situ hybridization, sequencing technology, mass spectroscopy, and other technologies. Sequencing technology segment is projected to register the highest CAGR in the market during the forecasted period. This can be attributed to factors such as the rising prevalence of infectious diseases, the emergence of newer pathogens, and the cost benefits of sequencing technologies.

Recent Developments of DNA Diagnostics Industry:

- In March 2024, F. Hoffmann-La Roche Ltd. (Switzerland) launched cobas Malaria test. The cobas Malaria test received approval from the US Food and Drug Administration (FDA) for use on the cobas 6800/8800 systems.

- In November 2023, Illumina Inc. (US) launched an assay, TruSight Oncology 500 ctDNA v2. This assay enables noninvasive comprehensive genomic profiling (CGP) of circulating tumor DNA (ctDNA) from blood when tissue testing is not available or to complement tissue-based testing.

- In December 2023, F. Hoffmann-La Roche Ltd. (Switzerland) partnered with Global Fund (Switzerland) to support low- and middle-income countries in strengthening critical diagnostics infrastructure.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/dna-diagnostics-market-145577831.html

https://www.marketsandmarkets.com/PressReleases/dna-diagnostics.asp